In our economic briefing on Wednesday evening, (Australian time), with Chris Watling from Longview Economics in London, few observations are now ringing true. Chris predicted that the technology sector was in for a shock as investors started to “take some money off the table and sit on the sidelines for a while”. He said he expects investors to jump back into the market during the second half of 2022. Chris still thinks that this year will be a very positive year for shares markets.

Chris Watling predicted this correction in this interview on CNBS.

Facebook committed the most basic marketing mistake; they changed their name which affected brand recognition!

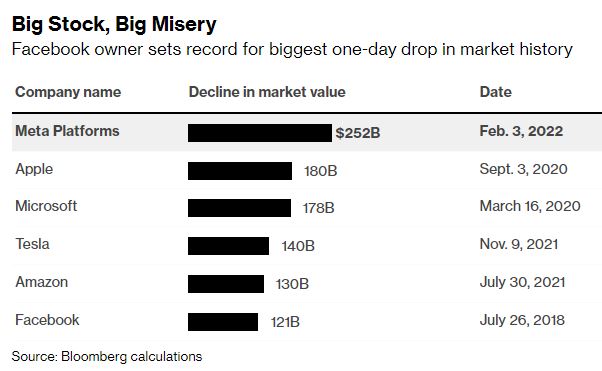

Meta Platforms Inc.’s one-day crash now ranks as the worst in stock-market history. The Facebook parent plunged 26% on the back of woeful earnings results, and erased about $251.3 billion in market value. That’s the biggest wipeout in market value for any U.S. company ever.

FACEBOOK HAS BEEN “ON THE NOSE” FOR A FEW YEARS BUT WE HAVEN’T NOTICED.

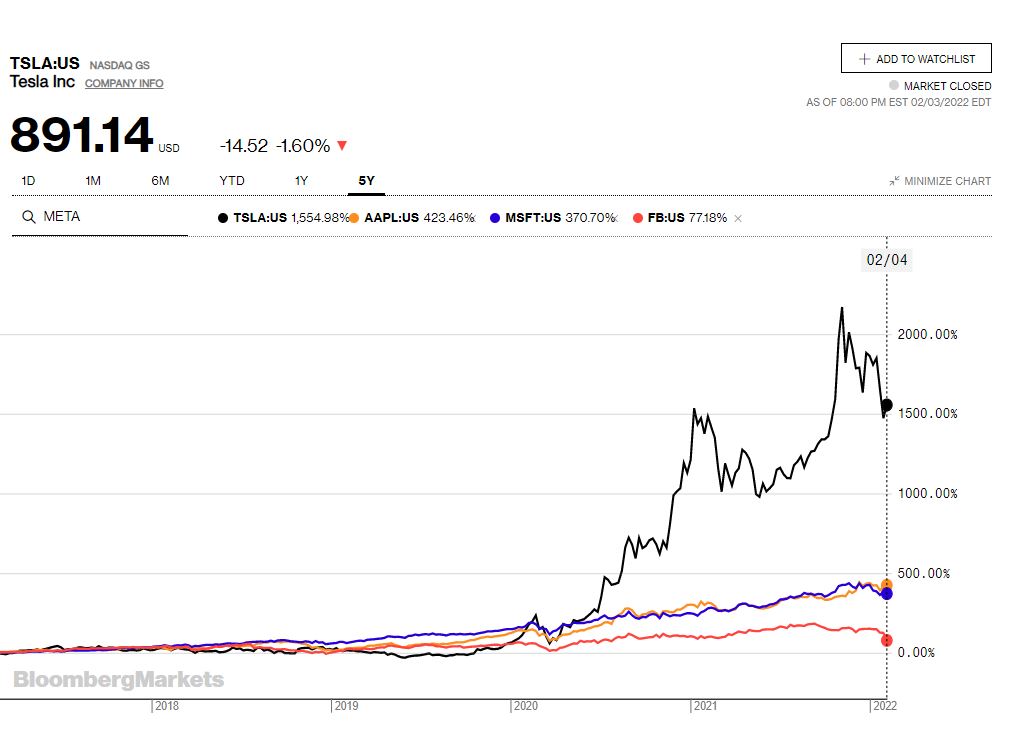

Compare the performance of Meta (Facebook) against Tesla, Microsoft and Apple over the last 5 years.

What does this mean for our investor clients?

In our model portfolios, the allocation to the Nasdaq index ETF is up to 10% of the overall portfolio allocation and within the index only 4.8% of the portfolio was allocated to Facebook as at the end of December 2021. For most investors, the impact on their portfolio will be moderate. However, this market shock reveals a growing trend in global asset allocation towards value companies that have consistent and predicable earnings. Some very famous technology companies are trading on 30 times earnings and given how developed their businesses are, and what a massive market share they have, it’s going to be really, really challenging for those companies to continue to grow profits at a rate that justifies the multiple. We expect a move back to value stocks and a reallocation away from the U.S over the remainder of 2022.

Take a look at some other big tech brands who have also had major slumps

Most of these companies have recovered quite well after the slump and provided investors with handsome returns.

The mantra of asset allocation has never been more evident that this week. In the Nasdaq NDQ ETF that forms a part of our portfolios, Facebook has an allocation of only 4.8% of the total portfolio.

Anti hawking notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L