Many market commentators and investors continue to forecast a soft landing for the US economy.

Recently, they have pointed to resilient consumer spending as one of the key reasons for that soft landing. Retail sales, for example, have been growing reasonably rapidly since March, while last Friday’s real personal spending data was better than expected (albeit only modestly).

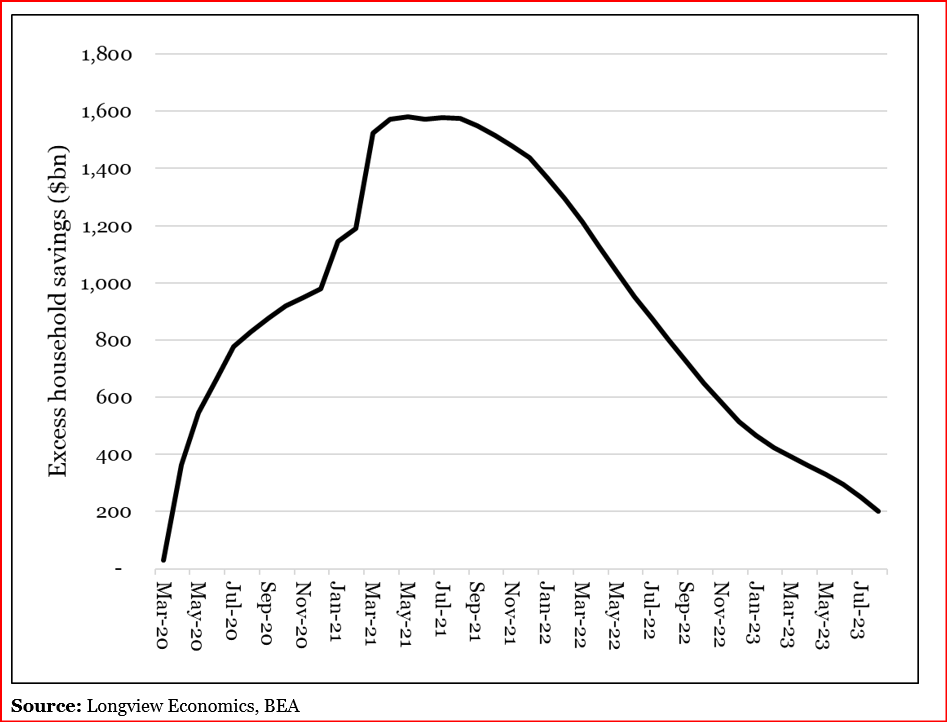

As such, the key question is: What will happen to the US consumer once the excess savings (cash buffer) has been run down? Can the consumer still drive US growth once that’s happened (i.e. such that the recession is ‘cancelled’)? Or is the consumption thrust of recent quarters now running out of steam, with the implication that the recession has been merely ‘delayed’?

Household savings drop

Broadly speaking, that analysis is consistent with the level of ‘core’ deposits, in household bank accounts, which have been run down to around pre-pandemic levels. This includes short term cash accounts(specifically time and sight deposits), and strips out other savings, like money market funds (i.e. often savings where the money is not readily available for day to day transactions). In other words, on this measure, household spending firepower is significantly depleted.

That (depleted) level of ‘spare cash’ is mostly distributed amongst the higher income groups, which have the lowest marginal propensity to spend.

What about student loans in the US?

Student loan repayments start this month (October). At the margin, that will somewhat squeeze household cashflow. The consensus is that it will cost households about $70 billion per year. This has not been factored into our cashflow model or our forecast for ‘spare cash’. All else being equal, though, it reduces our year end ‘spare cash’ forecast modestly, from+$14 billion in December to -$9 billion.

Student loans in the United States are a form of financial aid aimed at assisting students in accessing higher education. Over the past two decades, student debt has more than doubled, with about 44 million borrowers owing a total of more than $1.6 trillion as of March 2023.

These loans play a significant role in enabling students to pursue their educational goals. In 2018, around 70% of higher education graduates had student loan debt. However, the impact of increasing student debt on the U.S. economy is a topic of concern.

While student loans allow students to pursue higher education and enhance their career prospects, the rising burden of debt can have adverse effects. High student debt levels can limit individuals’ ability to invest and make major purchases, such as buying a house or starting a business. This can hinder economic growth and restrict overall consumer spending.

The view of the next quarter

The Fourth-Quarter 2023 Stock Market Outlook’s Key Takeaways (Morningstar)

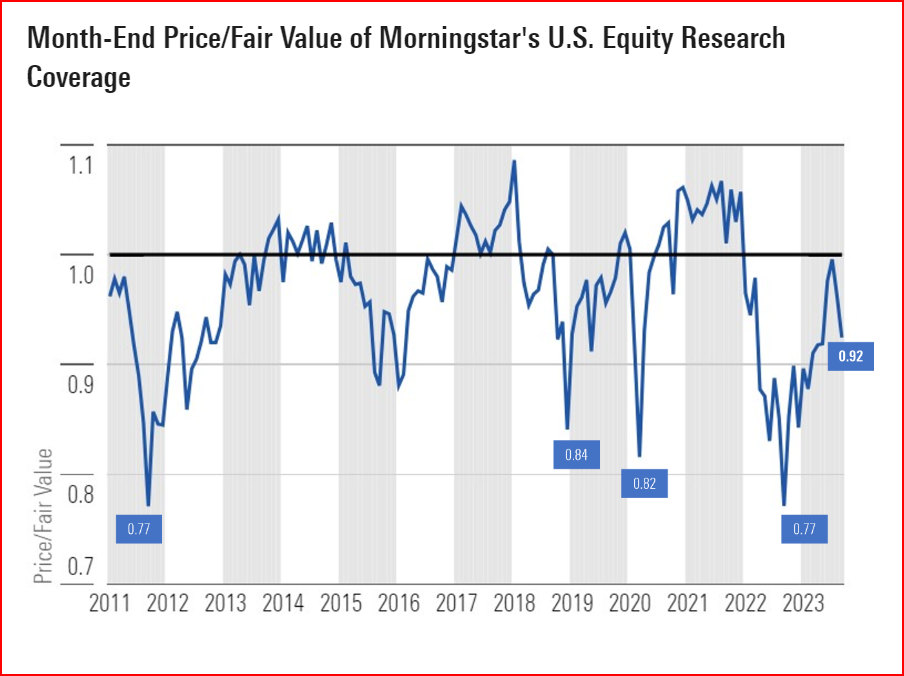

- Following the pullback, the U.S. stock market is trading at an attractive discount to our fair value.

- Growth stocks have fallen enough to move to market weight from underweight.

- Real estate overtakes communication services as the most undervalued sector.

- Utilities have been hit too hard this year and have now dropped to undervalued from overvalued.

- Interest rates higher for longer? No. expect cuts in 2024.

In the wake of this pullback, we see several opportunities for investors to adjust their portfolios. Although we continue to advocate for an overweight position in the value category and an underweight position in core, the growth category has dropped enough that it is now trading in line with the broad market discount.

What are the sector tilts that offer value?

Technology

The pullback across tech stocks in conjunction with raising the fair value estimate on Nvidia NVDA has brought the sector’s price/fair value down to 0.98. As such, now is a good time to move back to a market-weight position.

While the excitement surrounding the potential for artificial intelligence has boosted those stocks directly tied to AI, we think some of the more attractive undervalued opportunities are those that are derivative plays on AI. For example, most companies do not have the expertise or resources to build and maintain their own AI platforms. That’s where an IT consulting company comes in with its technical capabilities in AI services.

Communication Services

The Morningstar US Communication Services Index rose 3% in the third quarter through Sept. 25 and almost 39% thus far this year, yet at a price/fair value of 0.81, it still remains one of the more undervalued sectors. The bulk of this performance was driven by gains in Alphabet GOOGL and Meta Platforms META and bolstered by 4-star rated cable companies Comcast CMCSA and Charter Communications CHTR. The Morningstar US Communication Services Index rose 3% in the third quarter through Sept. 25 and almost 39% thus far this year, yet at a price/fair value of 0.81, it still remains one of the more undervalued sectors. The bulk of this performance was driven by gains in Alphabet GOOGL and Meta Platforms META and bolstered by 4-star rated cable companies Comcast CMCSA and Charter Communications CHTR.

Energy

Surging oil prices have led to a broad rally across the energy sector. However, while the price per barrel of oil surged 27% during the third quarter, the Morningstar US Energy Index only rose 12%. According to our valuations, we think returns were held back as the sector was only trading at a slight discount to fair value coming into the quarter. For the most part, the only values we see in the energy sector are among the pipelines.

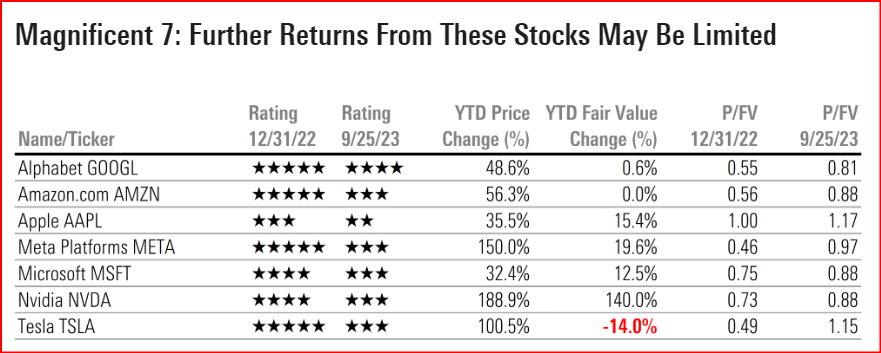

The Magnificent Seven

We noted that only a handful of stocks were responsible for the preponderance of the entire market gains. Of the aptly named “magnificent seven,″ six were significantly undervalued and rated 4 or 5 stars at the beginning of the year. However, following immense gains, only Alphabet remains undervalued, four are now fairly valued, and two are overvalued.

Based on our valuations, we think the tailwind that these stocks provided to drive the market higher is behind us. As we noted over the past few months, for the rally to continue, it will need to broaden out into value stocks and down in capitalization into mid- and small-cap stocks

The next three quarters

Over the next three quarters, Morningstar forecast that the combination of tight monetary policy and declining credit availability will take its toll on the economy. While they do not project a recession, we expect the rate of economic growth will slow sequentially over the next three quarters. The slowing economy will pressure earnings growth, which in turn will test the markets. In their view, investors should look past this potential short-term volatility and, where their risk tolerance allows, use pullbacks to move from market-weight positions back into overweight positions.

Anti Hawking Notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

Target Market Determination: We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives, or terms and conditions. You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits. All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.

General Advice Warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au.. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement. Please consult our office to provide you with personal advice if you would like. To make an appointment please click on the link financialchoice.com.au5 million Aussies in last 4 months have gone overseas. Should you invest overseas as well?