Yes, the cost of travel has been increasing since Covid. Despite economic uncertainty and dwindling household savings, the post-pandemic travel boom has led to high ticket prices, and there are no signs of it slowing down in the near future. For example, round-trip airline tickets to Europe are now about 20% more expensive than before the pandemic, and round-trip flights to Asia are approximately 60% pricier. It is expected that international travel costs will remain high until supply catches up with the pre-pandemic levels and jet fuel prices decline further.

What about the cost of Jet Fuel

The price of jet fuel has been subject to volatility and significant fluctuations in recent years. Between 2005 and 2016, fuel prices could vary between 20% and 35% of an airline’s operating expenses. Jet fuel prices in the 2010s stood at six times the level in the 1990s. While there was a decline in jet fuel prices during the onset of the Covid-19 pandemic, they bounced back sharply due to inflationary pressures and the war in Ukraine in early 2022.

Since the start of 2022, the price of jet fuel increased by approximately 90 percent and costs roughly 120 percent more, on average, than it did in 2021. This price increase presents a significant challenge for airlines as fuel is often the largest operating cost, accounting for around 25 percent of total costs depending on the year.

Although high fuel prices are painful for airlines in the short term, it is possible for airlines to remain profitable in times of high and low fuel prices, and they have done so in the past. Getting capacity deployment right is vitally important, particularly considering the increased push to be environmentally friendly and reduce emissions.

Higher interest rates and inflation will also create pressure as the cost of borrowing to support an unprofitable operation may compound into future earnings challenges.

What was the problem with Qantas

One major issue was the legal action brought against the airline by the Australian Competition and Consumer Commission (ACCC). The ACCC alleged that Qantas engaged in false and deceptive conduct by selling tickets to over 8,000 flights that had already been canceled, and in some cases, customers were not notified of the cancellations for up to 48 days. This could result in significant penalties for Qantas if found in breach of the law.

Qantas has also faced other legal battles, including an appeal against a court decision that found the airline illegally outsourced the jobs of ground handlers. Qantas is also facing a class-action lawsuit over its refund policy for flights canceled due to the pandemic. These legal challenges could potentially lead to substantial compensation payouts. Qantas has dropped off the list of Australia’s most trusted brands and is now ranked as one of the most distrusted brands in the country.

What if you invested in Qantas and Flight Centre post Covid

Airlines are notoriously unprofitable businesses. According to recent data, the airline industry’s operating margin in the second quarter of 2023 was reported at 12.73%, which is above the industry average operating margin.

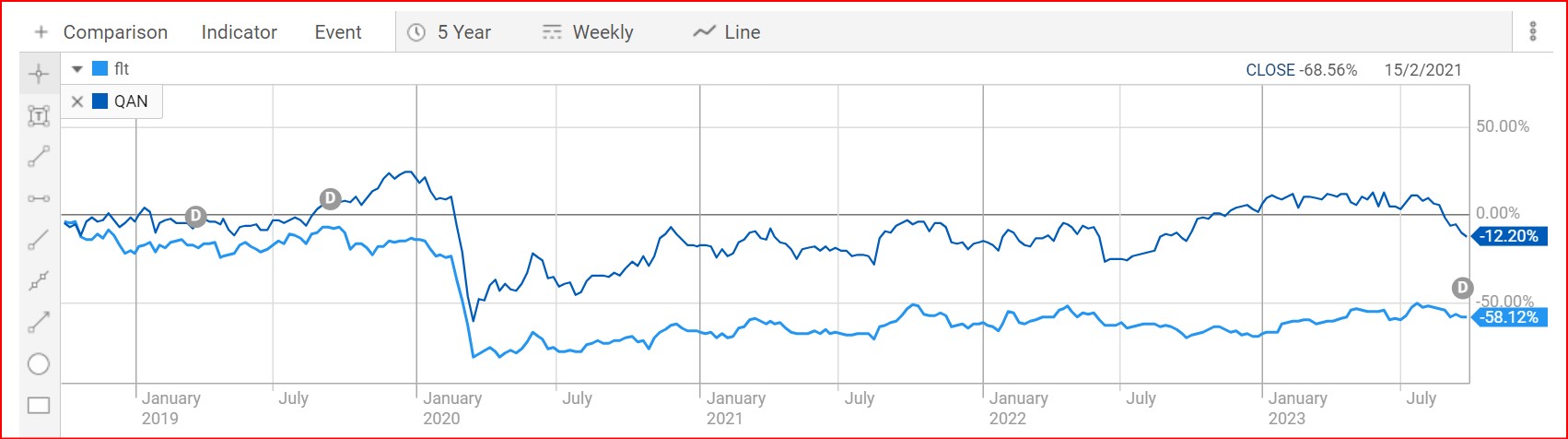

As you can see from the chart below, investing in travel, in an airline like Qantas or a Travel Agency, like Flight Centre is bad news. Qantas share price is still 12.20% below its pre pandemic value and Flight Centre is still 58.12% below January 2019. Over ten years Qantas is up 315.70% and Flight Centre is still languishing.

How you can save on travel

Creating a detailed travel plan and setting a budget can help you prioritize expenses and avoid overspending. Research and compare prices on flights, accommodation, transportation, and activities to find the most cost-effective options.

- Travel Off-Peak: Avoiding peak travel seasons and popular holidays can result in lower prices for flights, hotels, and attractions. Traveling during weekdays or shoulder seasons can offer significant savings.

- Be Flexible with Destinations: Consider exploring less popular destinations or alternative locations to save money. Opting for lesser-known cities or towns that offer similar experiences can often come with lower price tags.

- Use Travel Rewards and Loyalty Programs: Take advantage of travel rewards earned through credit cards, loyalty programs, and frequent flyer memberships. These rewards can be redeemed for flights, hotel stays, and other travel expenses, helping to offset costs.

- Cash in on Discounts and Deals: Stay on the lookout for discounts and special promotions offered by airlines, hotels, and travel agencies. Sign up for newsletters and follow social media accounts of your preferred travel providers to stay updated on the latest deals.

- Consider Vacation Rentals: Instead of traditional hotels, explore vacation rental platforms like Airbnb or Vrbo. These platforms often offer more affordable options, especially for families or groups traveling together, and come with the added benefit of access to kitchen facilities, which can save on dining expenses.

- Embrace Public Transportation: Opting for public transportation, such as buses or trains, can be a cost-effective way to get around in your destination. It can save you money on rental cars, parking fees, and fuel costs.

Anti Hawking Notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

Target Market Determination: We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives, or terms and conditions. You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits. All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.

General Advice Warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au.. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement. Please consult our office to provide you with personal advice if you would like. To make an appointment please click on the link financialchoice.com.au5 million Aussies in last 4 months have gone overseas. Should you invest overseas as well?