3 Reasons why the Aussie Dollar drop in value will affect your hip pocket this Christmas

- Your Christmas presents will cost more from overseas

- Your overseas holiday becomes more expensive

- Your investment portfolio may go up

1. Online shopping

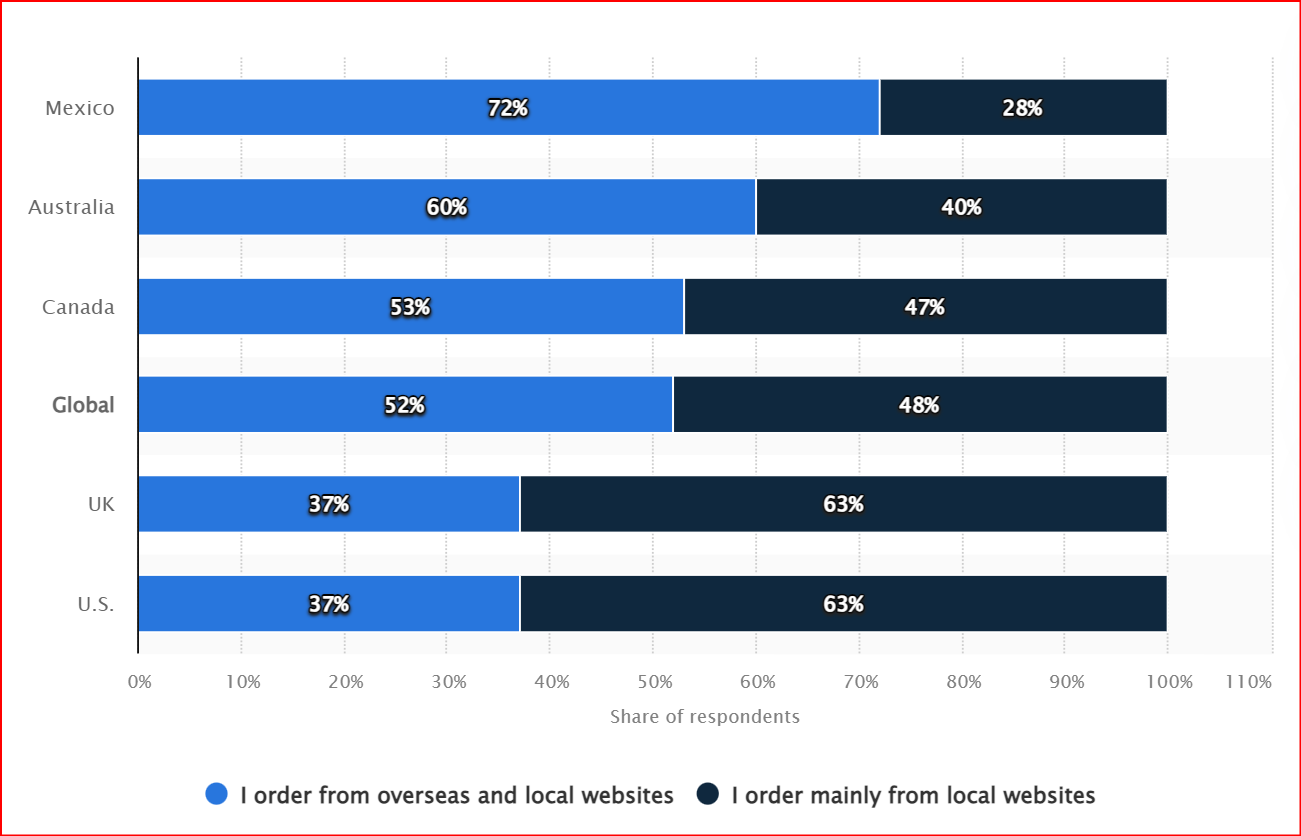

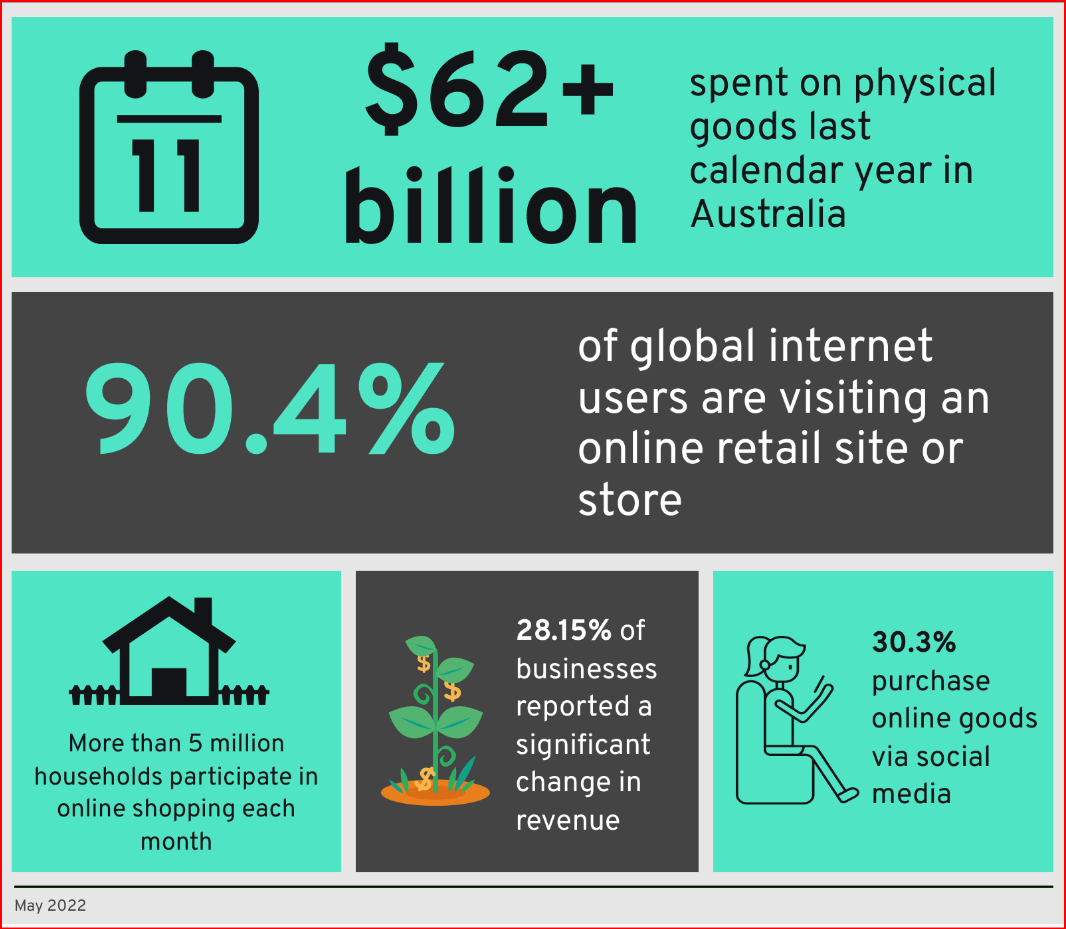

According to recent social media statistics, 90.4% of global internet users are visiting an online retail site or store. 81.5% are searching online for products or services and 76.8% are purchasing a product online. In 2021, 40% of online shoppers purchased goods from overseas – a falling Australian dollar made those purchases more expensive. Important to note though, experts say significant growth is still expected to come for the Australian market.

The market size of the online shopping industry has grown 19.6% on average over the last five years between 2017 and 2022. Last year, households in Australia made online purchases at least fortnightly – an increase of 112% from 2019, from 1.6 million to 3.4 million households. At the beginning of the pandemic, some of the biggest drivers for online shopping were retail restrictions and fear of catching Covid-19. Now, these primary reasons have sharply declined and been replaced by convenience, greater access to products and value for money.

In terms of online marketplaces, eBay had the most monthly visits by far, recording 61.7%. Amazon documented 28.5% visits, while Trade Me (17.7%), Catch.com.au (7.2%) and My Deal (3.5%) fell behind. Over the past 12 months, PayPal has been crowned the top payment service at 87%. BPAY (61%) and AfterPay (37%) are also popular, with GooglePlay coming in fourth at 21%.

2. Travel costs

A falling dollar increases the purchasing power of foreign tourists, making their money more ‘valuable’ than it was previously. That, in turn, influences their decisions on where they will travel which could make Australia a more attractive destination. The exchange rate really makes an impact for the North American market, which is the biggest segment of the inbound travel business. The flip side is that Australians heading overseas get less for their money.

3. Your investments

The CBA in June revised their year end outlook for the Aussie dollar with a forecast that the Aussie dollar would fall below $0.60 to the US dollar by the start of 2024. How wrong they were! NAB predicts that the Aussie will rise to 0.71c by June 2024 and Westpac predicts the Aussie will be worth around 0.68c by June 2024.

There are many reasons that may explain the weakening Aussie dollar, one of which is the interest rate differential between Australia and some other countries. The RBA cash rate is currently 4.35%. In the US the Fed Funds rate is 5.5%. Investor funds tend to flow to countries with higher interest rates and more security which increases demand for those currencies.

Why the devaluation of the Aussie dollar is so important for investors

A weakening Australian dollar is positive for local investors who own overseas investments via direct shares that trade on global exchanges and managed products like funds and ETFs. Returns from global investments have two components; the price movements of the underlying holdings, and changes in the exchange rate between the Australian dollar and the local currency of the investment.

We can also see the impact of currency movements on the returns of global investments by exploring the differences between hedged and un-hedged ETFs and funds. A hedged ETF and fund removes the impact of currency movements through the use of futures contracts. There are minimal fee differences between a hedged and unhedged ETF or fund which accounts for the costs of hedging. For instance, the iShares S&P 500 ETF (IVV) tracks the returns of the 500 largest companies in the US. The iShares S&P 500 ETF AUD hedged ETF (IHVV) tracks the same index but removes the impact of currency movements. Over the past 5 years IVV returned 14.25% annually while IHVV returned 9.37%.

Don’t try to predict the market

Before getting into how investors can respond to a fall in the Australian dollar, it is important to state that continually adjusting your portfolio based on market conditions is not a recipe for success. Constant adjustments to a portfolio lead to poor tax outcomes and increases transaction costs and that is assuming that the future predictions come to fruition. Both individuals and professional investors have poor track records of predicting short-term market movements. However, it is important to acknowledge that the Aussie dollar and the US dollar over the past 8 years have been trading in a bit of a pattern. The Aussie dollar has stayed in a range between around 80 cents at a high and around 60 cents at a low. If we go back over a 20 year period, the low end of the trading range was similar. The high end peaked with $1.10 Aussie to $1 US in 2011.

What is the impact on Australian business

The first impact is that exports may be more competitive given a weaker Australian dollar. If an export is priced in Australian dollars, a weaker currency means the product will be cheaper than alternatives in a foreign market. That can increase demand. However, may of Australia’s largest exports are commodities that are priced in US dollars. That is not all bad and it brings us to the next impact of a weakening currency. Profits made overseas are worth more in Australian dollar terms. That benefits any Australian company with international operations and the commodity producers selling in US dollars. Other companies face increasing costs from a weakening dollar. Companies that purchase inputs from overseas will see costs rise. It is a difficult environment to pass along these extra costs to consumers given the inflation we are already facing. Demand could also drop for companies that are selling global products in Australia. Consumers may search for cheaper alternatives.

What are the inflationary pressures

All things being equal, a weakening Australian dollar is inflationary as consumer and companies pay higher prices for imported items. The opposite occurs if the Aussie Dollar strengthens. This may prompt good news on the interest rate front in 2024 with possible cuts.

The final point- set and review with your adviser

Currency has one of the largest impacts for global investing. By continually reviewing the selection of ETF’s and hedging you can mitigate a possible disaster. It is always advisable to speak to your financial planner to ensure you are a “well informed” investor.

Anti Hawking Notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

Target Market Determination: We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives, or terms and conditions. You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits. All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.

General Advice Warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au.. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement. Please consult our office to provide you with personal advice if you would like. To make an appointment please click on the link financialchoice.com.au5 million Aussies in last 4 months have gone overseas. Should you invest overseas as well?