We had to wait for the latest numbers to drop into our inbox to help forecast the rest of 2022.

We paused our Friday newsletter on purpose so that we could deliver the real numbers on inflation, growth of the global economy and the tensions in The Ukraine so that we can help you can make some great investment decisions in this slump.

The S&P/ASX200 closed up Monday, gaining 11.90 points or 0.16% to 7,233.60. Over the last five days, the index is virtually unchanged, but is down 2.83% for the last year to date. (not much to be upbeat about). So where are we in this cycle? Is Russia going to invade? Is the Pandemic now an Endemic and what difference does it matter to the way we live and getting business back to full capacity. Read below to get some sense of the latest numbers that are important to you.

Its all about Ukraine turning blue

Is Russia likely to Invade Ukraine?

The crisis on the Russian-Ukraine border continues to simmer. The French President, Emmanuel Macron has stepped in to play the diplomatic card and it seems as though this may have eased tensions. The map above gives you some sense of how important this territory is to Russia and why The Ukraine want to join NATO to get some additional backup protection. Imagine if the blue color in this map spread and edged onto green?

Is this Pandemic now an Endemic?

A disease outbreak is endemic when it is consistently present but limited to a particular region. This makes the disease spread and rates predictable. A pandemic when a disease’s growth is exponential. This means the growth rate skyrockets, and each day cases grow more than the day prior. California has announced it is moving to declaring the Pandemic an Endemic and this will change how Covid-19 ill be managed. We expect Australian states to adopt a similar strategy.

After two exhausting years of living in a pandemic, grabbing a mask (or two) on the way out the door has become a routine part of our mental checklist.

Even if COVID-19 transitions from a pandemic to an endemic disease—where infections occur in seasonal or predictable cycles, like the flu—that does not necessarily mean we’ll be mask-free or that vaccinations will no longer be needed.

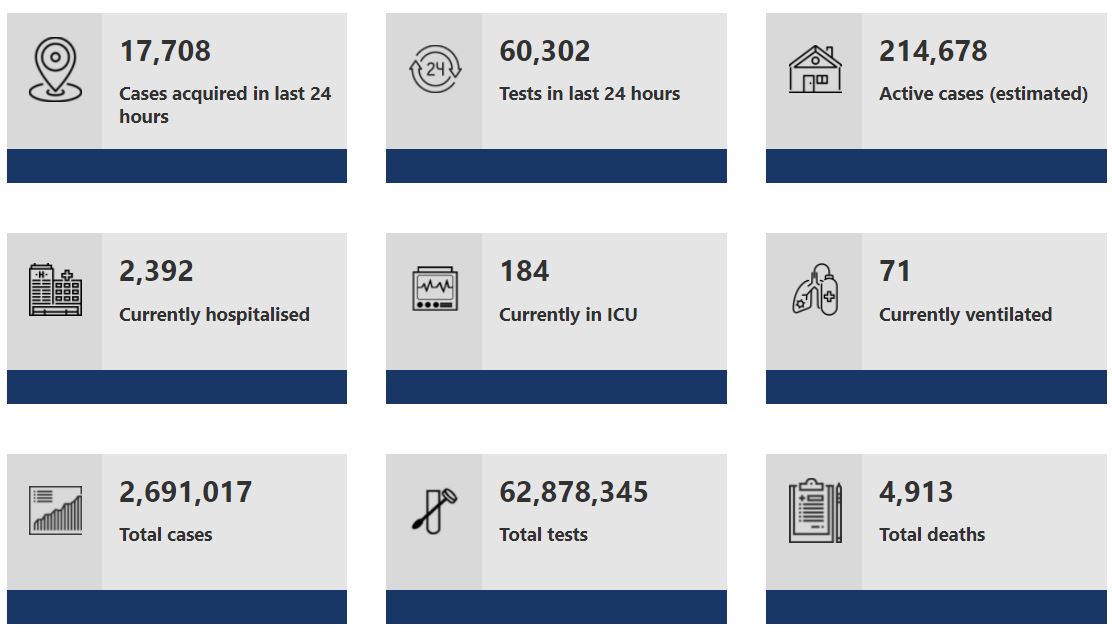

What are the Australian numbers telling us today?

Are we heading for a recession?

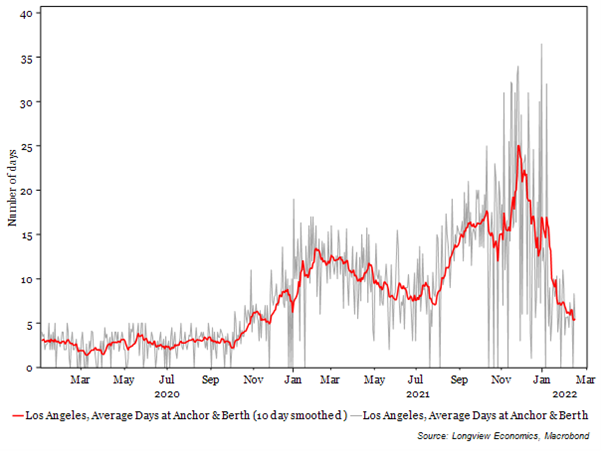

The pressures on the supply chain are reducing. Days in Port.

Investors are currently grappling with two major macro questions.

(Longview Economics) London

First: How permanent is the current high inflation rate, and for how long will it persist? Is there still a case that it’s transitory? Or should market participants view the ‘inflation landscape’ as changed (relative to the prior decade)?

And, linked to that, is the US & global economy rolling over into recession, pinched by high prices and impeded by a slowing fiscal and monetary impulse (i.e. slowing stimulus); Or is this simply a mid-cycle (or more accurately, early cycle) slowdown?

Forecasting inflation remains challenging. Wall Street, central bankers, and economists, until recently, have majored on an expectation that high inflation is transitory.

Various manufacturing indicators have rolled over, highlighting an easing of supply chain tensions. These include supplier delivery days, the backlog of orders, as well as measures of congestion at ports.

Durable and non-durables goods inflation, which has peaked, should get easier going forward.

All of the above should ease immediate pressure on the Fed and create a strong set up for equities to rally over coming months. Consistent with that, Longview economics market timing models are close to generating major BUY signals.

On the second question, the collapse in consumer sentiment and the squeeze on real incomes. Meanwhile, if you ask consumers how they feel about their income levels relative to five years ago, they remain reasonably upbeat because interest rate reductions has eased some of that concern.

Added to those factors above, the structural balance sheet backdrop of Western economies is healthy. Households have deleveraged; new US housing equity is $17 trillion higher than it was a decade ago, UK is higher and Australian home prices have boomed in the last couple of years to be at record highs. Consumer credit levels (i.e. those directly linked to day to day consumer spending, and excluding student debt) are still below 2008 peak levels, suggesting considerable potential for leveraging up (and spending); while commercial banks’ capital ratios are high; household and corporate bank accounts are flush with cash; and house prices remain strong. All of which supports an enduring recovery.

Anti hawking notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L