Electric car sales and missing their targets and Elon Musk launches Cyber truck in U.S. What is the real cost of going green.

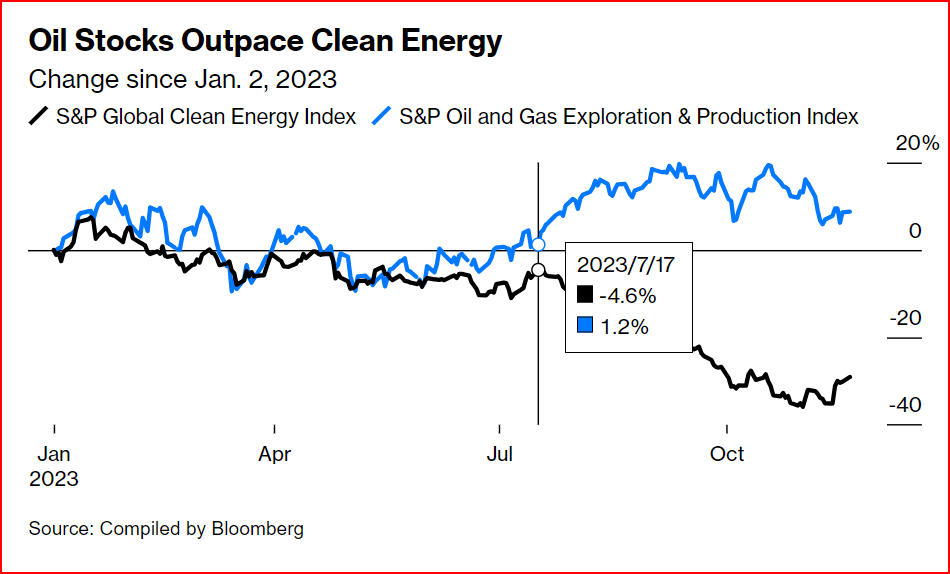

No one expected the transition from fossil fuels to be easy. But a year after President Joe Biden’s landmark climate law promised billions of dollars for America’s switch to clean energy, some of the nation’s most ambitious renewable power projects have been shelved, electric car sales are missing targets and investors are fleeing the sector in droves. Biden’s sweeping climate law offers at least $374 billion in tax credits and other incentives to spur the energy transition.

What about Elon’s cybertruck

There are now several fully electric trucks for sale, notably Ford’s F-150 Lightning and Rivian R1T. They’re electric on the inside, but on the outside look like OG gas-powered pickups. The Cybertruck —with its angular shape and polarizing design — headed in a wilder direction. That, plus the fact that electric sales growth is cooling, means the Cybertruck may find itself starting the race for market share well behind the bunch. Still, the market’s growing: EVs are expected to make up nearly 10% of all cars on US roads this year. Australia is on the back burner because of the requirement to convert to right hand drive. The cost to do so may eat into margins too much. A wait and see approach might be best.

Inflation and high interest rates are putting pressure on the green sector

According to Bloomberg reports The specter of bankruptcies now haunts the sector. Electric bus maker Proterra Inc. filed for Chapter 11 protection earlier this year, with solar financing firm Sunlight Financial Holdings Inc. following soon after. Deals are falling apart everywhere.

Green investing has to be based on economic realities. If the sector cannot service it’s costs and deliver returns then the green transition will be put back for decades.

The US is the biggest carbon emitter of all time, responsible for about a quarter of historical greenhouse gases, and today it holds the No. 2 spot for today’s levels behind China.

What is China doing?

China is taking several significant steps to address climate change. The country is the world’s largest emitter of greenhouse gases, but it has made commitments to reduce its carbon emissions. China aims to peak its carbon dioxide emissions by 2030 and achieve carbon neutrality by 2060. To achieve these goals, China is implementing various measures such as increasing renewable energy capacity, promoting electric vehicles, and enhancing energy efficiency. Additionally, China is investing in research and development of clean energy technologies and is involved in international climate initiatives, like the Paris Agreement. The country’s efforts towards climate change are crucial for global sustainability.

What is the impact on your investment portfolio. Back to Fossil fuels

The final point- rethinking uranium

Uranium and lithium are two different elements with distinct characteristics and applications.

Uranium is a radioactive metal primarily used as fuel in nuclear power plants. It is an efficient energy source and produces a significant amount of electricity. However, uranium mining and nuclear waste disposal pose environmental challenges and safety concerns.

On the other hand, lithium is a lightweight metal widely used in batteries, particularly for electric vehicles and portable electronics. Lithium-ion batteries have a high energy density and long lifespan, making them ideal for powering electric vehicles and storing renewable energy.

In terms of availability, uranium is relatively abundant and widely distributed around the world, while lithium reserves are more limited and concentrated in a few countries.

From an investment perspective, uranium has experienced fluctuations due to shifts in global energy policies and concerns about nuclear accidents. On the other hand, lithium has seen significant growth due to the increasing demand for electric vehicles and renewable energy storage.

Anti Hawking Notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

Target Market Determination: We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives, or terms and conditions. You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits. All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.

General Advice Warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au.. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement. Please consult our office to provide you with personal advice if you would like. To make an appointment please click on the link financialchoice.com.au5 million Aussies in last 4 months have gone overseas. Should you invest overseas as well?