At this time of the year we bring out the Crystal Ball and look toward the next twelve months and what we can expect from investment markets. Overall, 2023 has been a reasonable year for investors with our continued overweight position on US equities and in particular Tech stocks. Most Australian based Super funds probably experienced a reasonable year that tracked the long term average. If you are an active investor who followed our overweight recommendations, then you would be very happy. According to Super Ratings, the best performing long-term super fund in Australia for the 10 years ending June 30, 2023 was Telstra super with a performance of 6.9%, followed by Australian Super with a respectable 6.7%. (this is for funds with a growth allocation of between 60-76%)

Where should you be for the next 10 years?

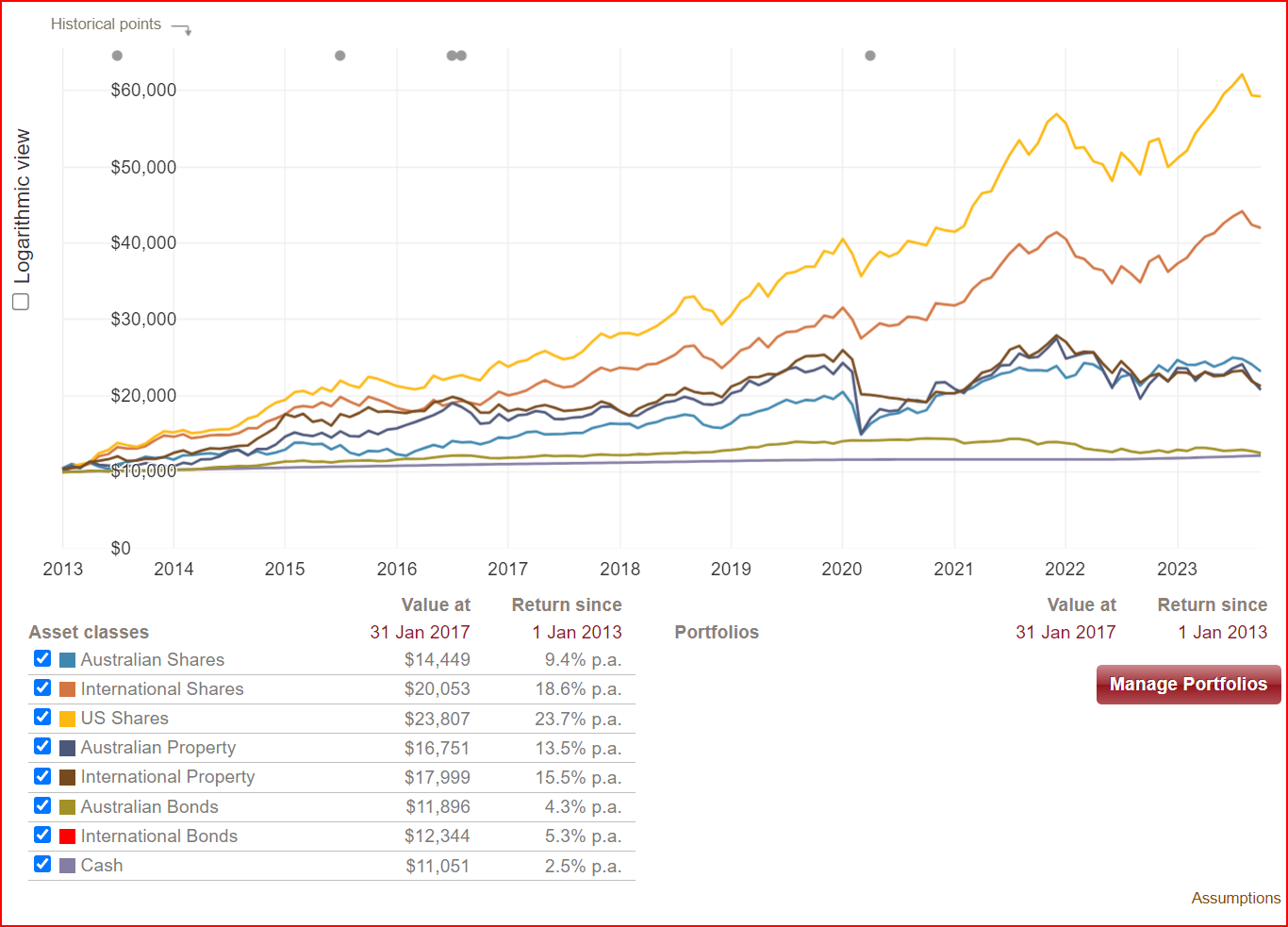

The last ten years have shown going overweight in US was the place to be.

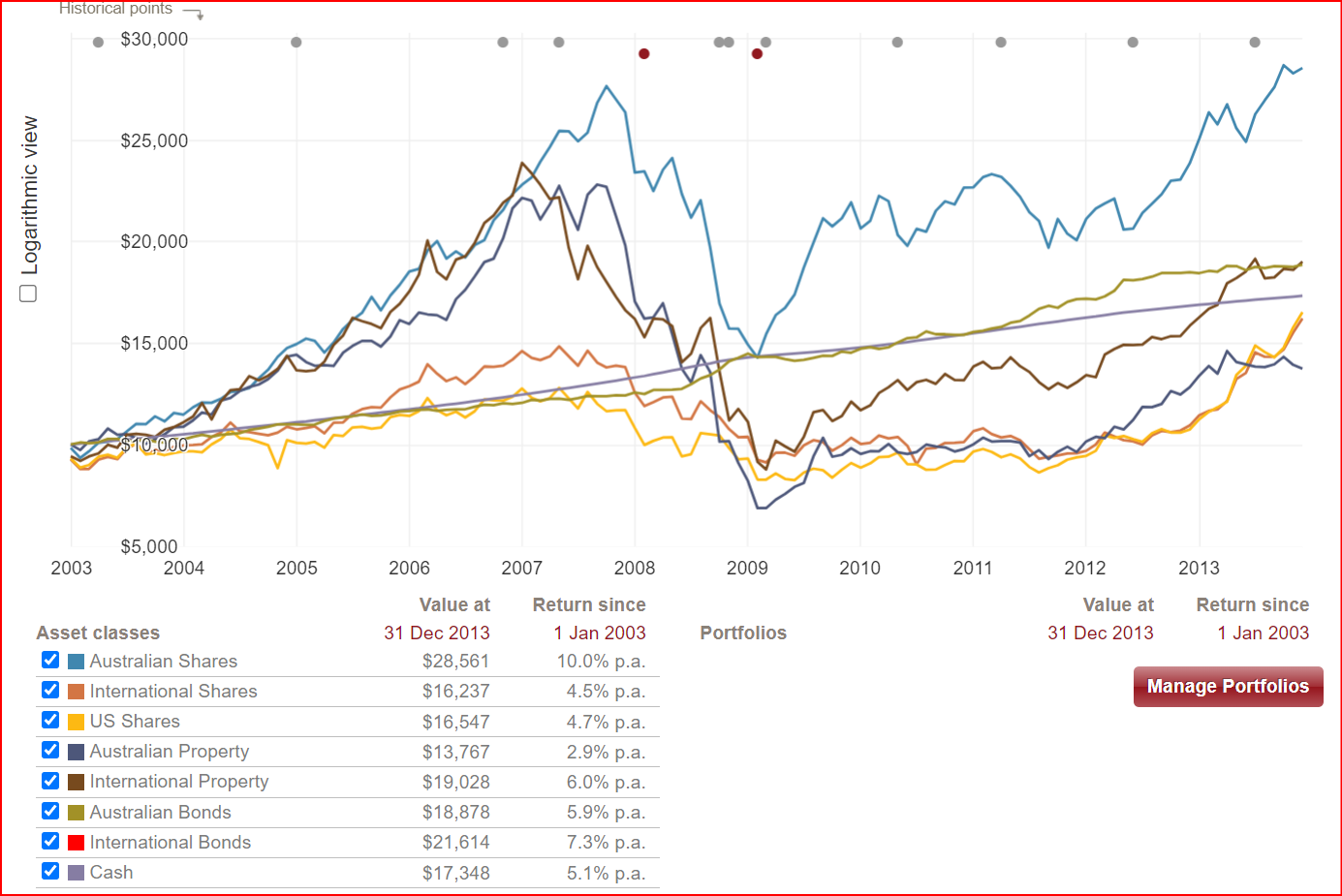

According to the index chart above provided by Vanguard, if you have invested in the US stock market then your wealth would have grown by a compounding 23.7%, compared to the Australian Stock market of 9.4%. The previous ten years showed almost the reverse trend. Australian shares delivered a return of 10% p.a. compound versus the US stock market delivering 4.7%

The previous 10 years delivered a different result.

Most Australian investors have a country bias

Australia represent around 2.5% of the global market cap. Yet, far too often, when I see a new client’s statement, or a takeover of an SMSF, it is 100% Aussie stocks. I understand the bias to a large degree; not only are these companies that you know, but the tax regime is such that if the company pays a dividend, there’s a good chance you’ll get that dividend tax-free. Worst case, you’ll pay a little tax.

This might also have something to do with the fact that access to international shares is sometimes difficult and prohibitive. The difference is currency risks may also be a concern. That has all changed with new Platforms coming into the market like Hub24 providing direct access to international markets with an adviser support allowing investors to have a lower cost access to individually managed portfolios. Imagine a portfolio of the leading artificial intelligence players and the returns they are expected to deliver over the next 10 years.

The final point – Review and update

Work with your adviser and get an understanding of the trends that lead to out performance and why changing the asset allocation each anniversary really makes a difference to the long term numbers.

Anti Hawking Notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

Target Market Determination: We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives, or terms and conditions. You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits. All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.

General Advice Warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement. Please consult our office to provide you with personal advice if you would like. To make an appointment please click on the link financialchoice.com.au5 million Aussies in last 4 months have gone overseas. Should you invest overseas as well?