One third of Australians have a mortgage, one third pay rent and one third own their own home. Why is inflation so important to each group?

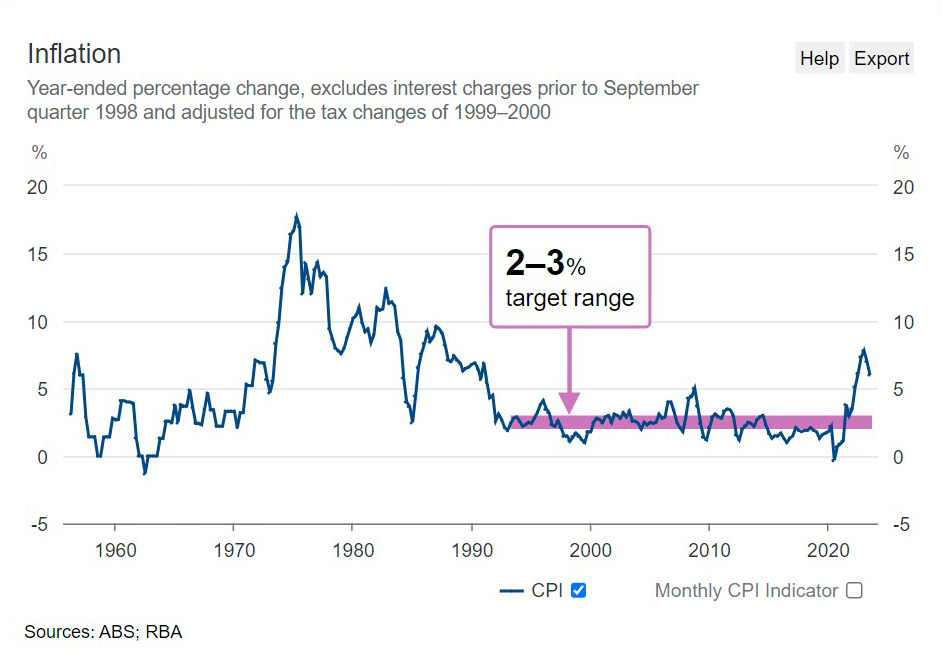

The trimmed mean measure of inflation was 5.6% in July, down from 6% in June. The RBA expects the 2-3% target range will be reached by the middle of 2025. Overall, the annual rate of goods inflation eased to 4.4% in July from 4.7% in June, CBA noted.

Group one – People with mortgages

When the Reserve Bank board meets next Tuesday, many Australians will be holding their breath in anticipation of interest rates increasing. Lower inflation may have saved us from yet another hike in interest rates.

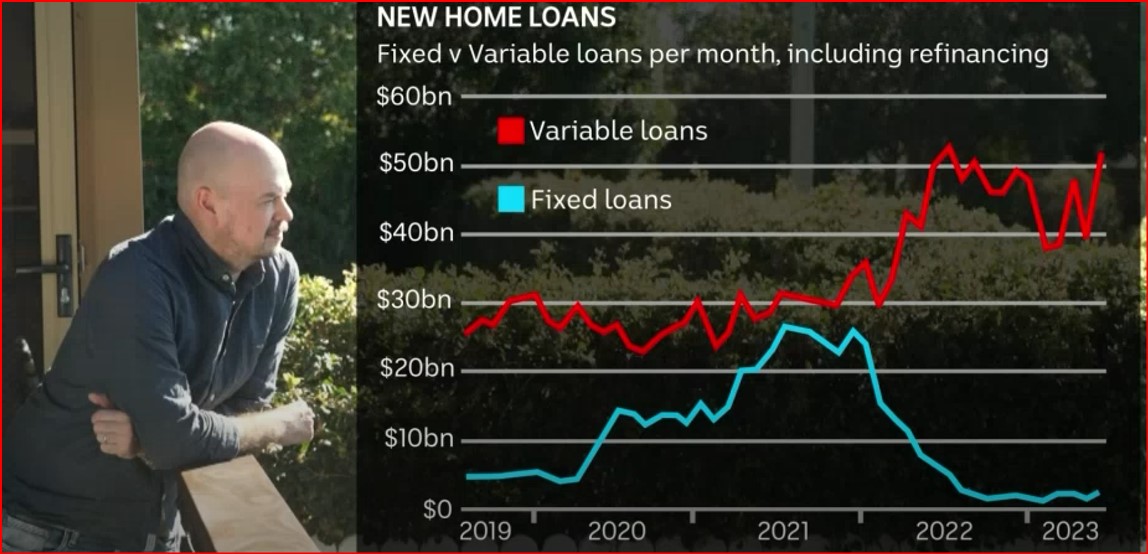

The biggest regret the retiring Reserve Bank of Australia Governor, Philip Lowe mentioned in his outgoing speech to journalists was his prediction that interest rates will stay low until 2024. Almost 880,000 Australian households will need to find hundreds, or even thousands, of dollars more each month when their fixed-rate periods expire this year and the rock-bottom interest rates they’ve enjoyed since the start of the pandemic become a thing of the past.

According to the Australian Financial Review, households servicing a $550,000 mortgage – the average size of a loan issued between 2020 and 2022 – will suffer an $891 increase in monthly repayments, with highly indebted households on the hook for an even larger increase. Someone with a $1 million mortgage would have to fork out an extra $1620 each month.

At their cheapest point in May 2021, the average new fixed rate loan for a term of three years or less was 1.95 per cent, compared with a new variable rate loan of 2.8 per cent. According to the RBA, about $350 billion – or half of all fixed rate credit – mortgages will expire this year. This is what is sometimes referred to as the “mortgage cliff”.

People will have to find potentially thousands of dollars more each month to service their home loans.

Is refinancing your loan the answer?

Financial Choice CEO Russell Medcraft CFP adds that people will have to find potentially thousands of dollars more each month to service their home loans or even move back home with their relatives. More properties have sold in June than any other month this year.

“Based on all the data provided by the Reserve Bank, I’m unconfident that a large percentage of those people that took out a mortgage in 2021 will be able to afford to refinance”.

Group two – Retirees on the pension

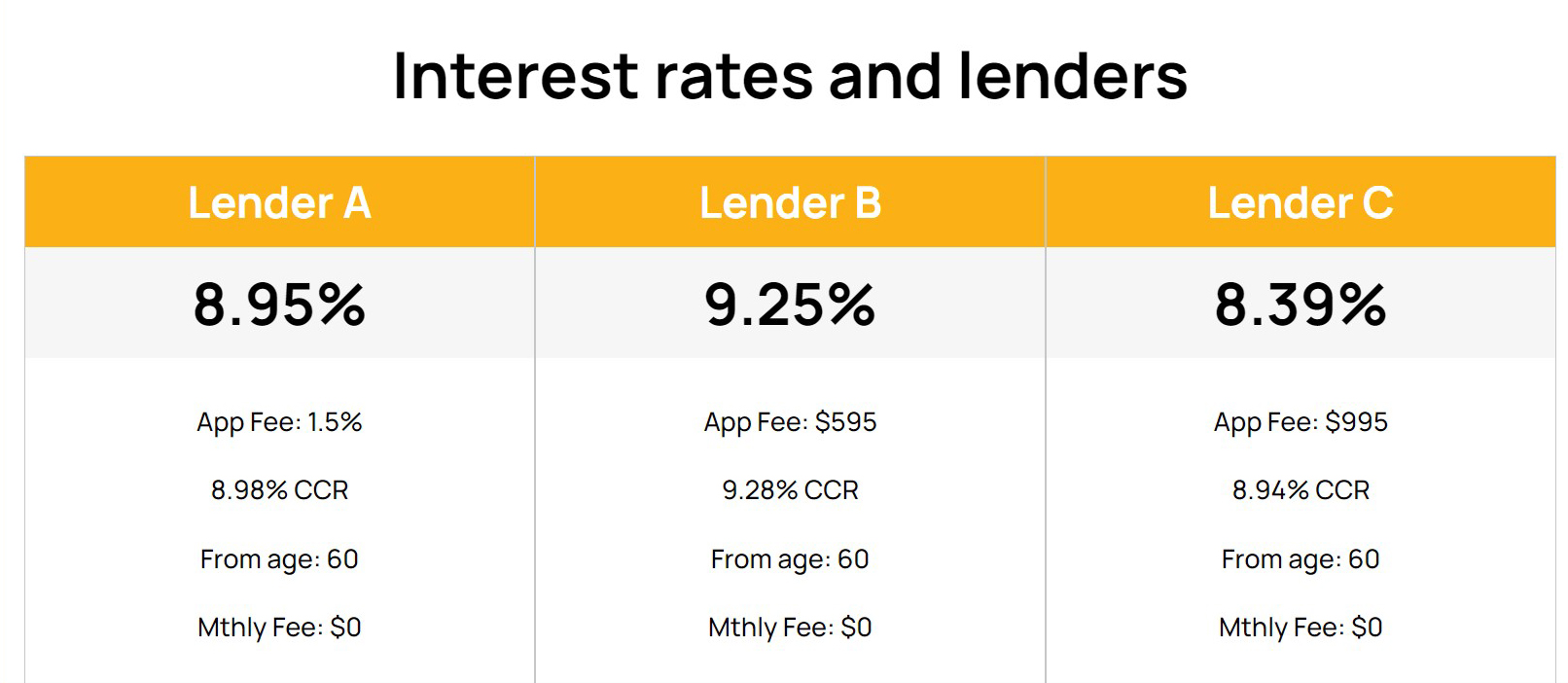

Self funded retirees have benefitted from the increasing interest rates for the last three years. Income from some fixed interest and term deposits have been steadily increasing and some investments are paying well over 6%. Retirees that own their own home but have a meagre amount in savings have chosen to opt-in to a reverse mortgage with very high rates. The below rates are considered excessive.

Reverse mortgage indicative interest rates

Source: Seniors first website 01/09/2023

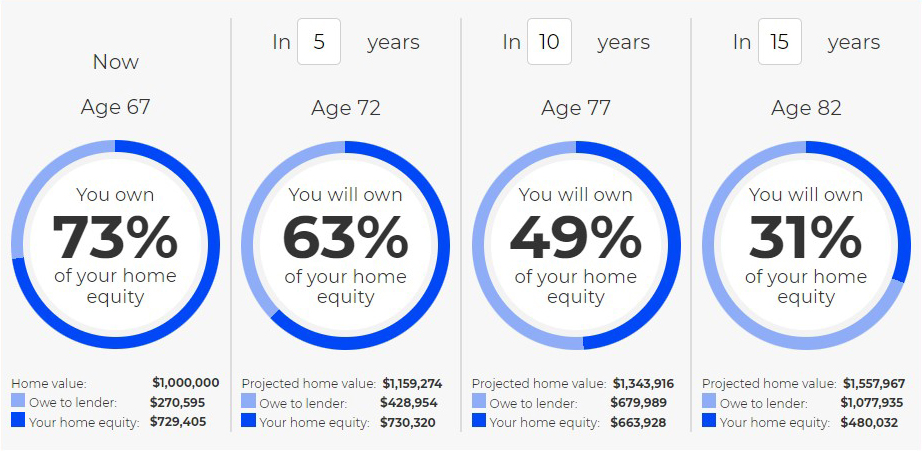

Using the rates from Lender B

As with standard home loans, a Reverse Mortgage is secured by the first registered mortgage over the borrower’s house. The interest is ‘capitalised’ i.e. charged back to the loan account, and will compound over time. For example, the loan balance will increase unless you make voluntary payments. The debt, including all interest and fees owed, is repaid to the lender when:

- You sell the property of your own accord, OR

- You move into aged care (not required with some lenders), OR

- The last surviving borrower dies (if you are a couple)

An alternative for extra income on top of the age pension without the high interest rate

The Government now offers a Home Equity Access Scheme which allows eligible older Australians to take a voluntary non-taxable fortnightly loan from the Government. You and your partner can use the loan to supplement your retirement income but you must repay the loan and all costs and accrued interest to the Government. NB: You can make repayments or stop your loan payments at any time.

Group three – Renters

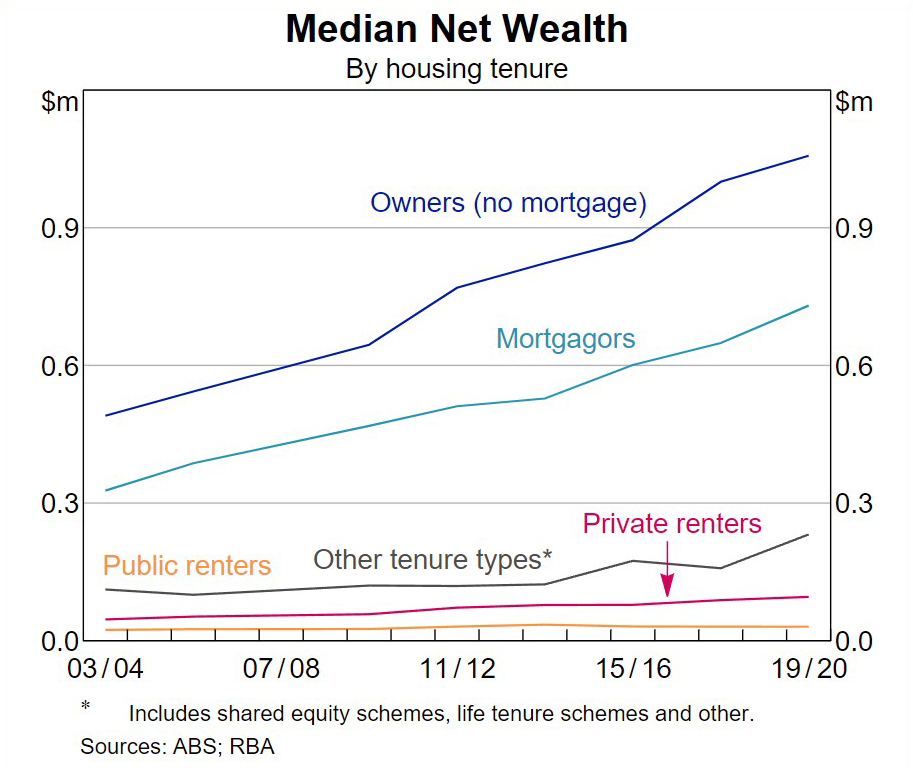

Renters also tend to have lower savings buffers. In combination, these factors can make renters more vulnerable to increases in the cost of living and make it more difficult for these households to accumulate wealth over time, compared with owner-occupiers.

The dollar gap between renters’ wealth and that of owner-occupiers has increased over the past two decades (see below chart). Rising housing prices have increased the net wealth of owner-occupier households, which is concentrated in housing. The wealth of renter households is concentrated in other types of assets, such as savings deposits, where returns have been lower.

The final point

Inflation rates impact everyone in different ways, that is why central banks went all out to curb inflation after Covid.

Anti Hawking Notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

Target Market Determination: We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives, or terms and conditions. You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits. All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.

General Advice Warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au.. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement. Please consult our office to provide you with personal advice if you would like. To make an appointment please click on the link financialchoice.com.au5 million Aussies in last 4 months have gone overseas. Should you invest overseas as well?