Australian Resources continue to deliver outstanding returns for investors.

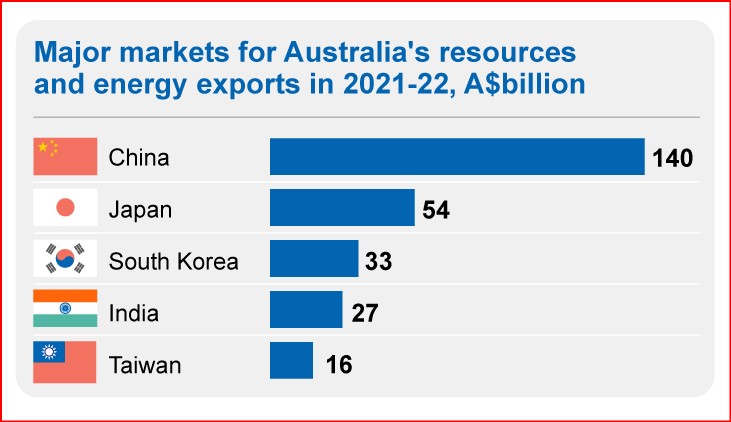

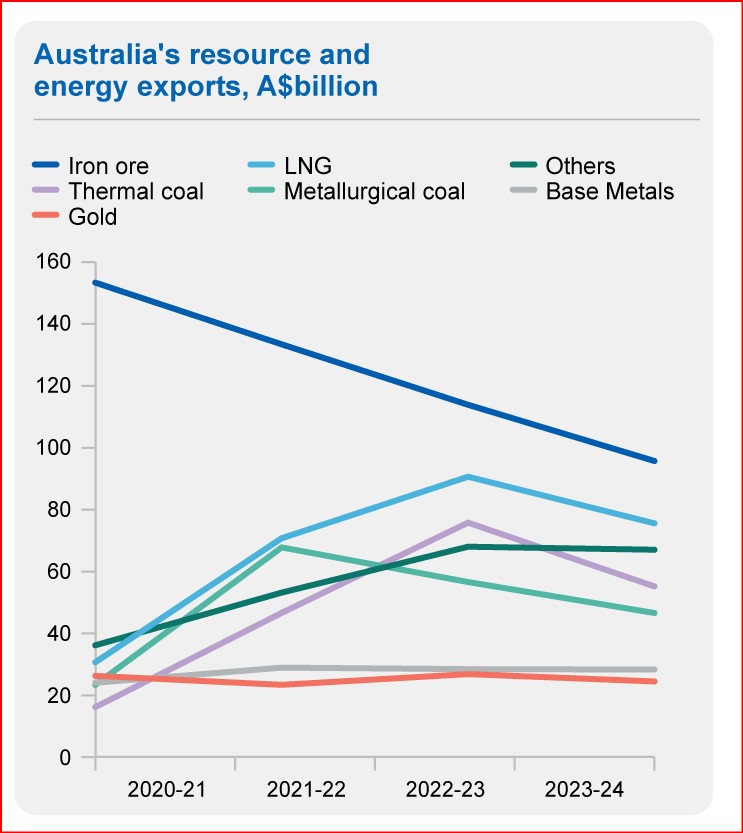

Despite a sharp slowing in world economic growth during 2022, Australia’s resource and energy export earnings are forecast to set a new record of $459 billion in 2022–23. But earnings are forecast to fall to $391 billion in 2023–24 (still the third highest level of earnings on record), as tepid world demand and an easing in supply disruptions reduce commodity prices. Energy commodity prices have declined but generally remain above levels reached just prior to the Russian invasion of Ukraine. Markets have become less concerned about a drop in exports of gas, coal and oil by Russia, one of the world’s largest energy exporters: Northern Hemisphere nations have been successful in building up energy stockpiles for winter. Weak Chinese energy demand (largely due to COVID lockdowns) has made it easier for Western European countries to fill gas storage.

What’s the best way to invest in Resources

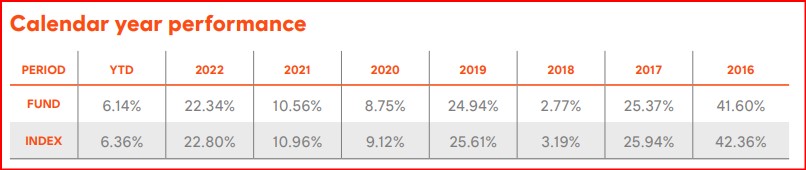

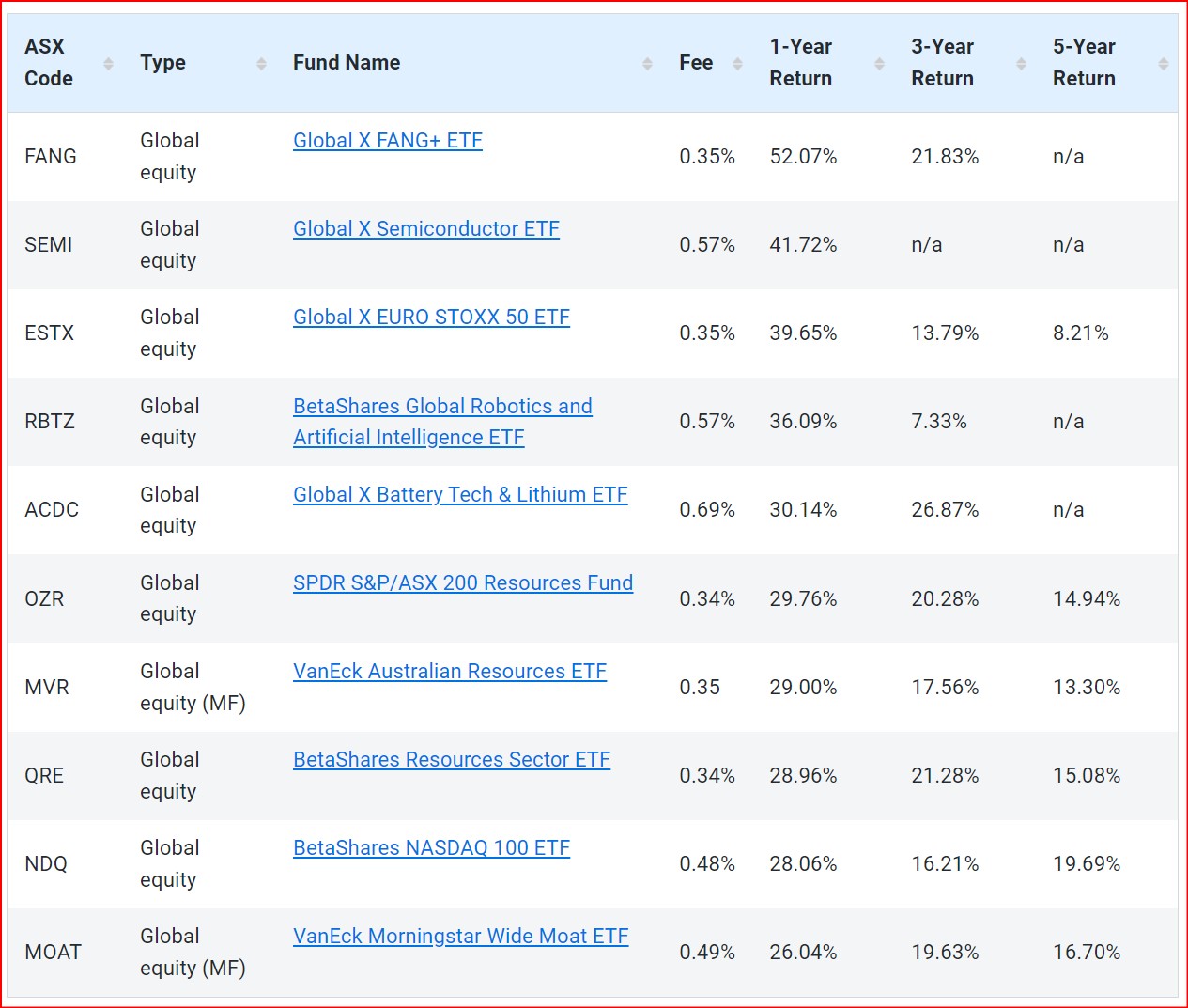

In a difficult investment year for Australian investors, the Australian resources sector stood tall and delivered exceptional returns against the Technology stocks and Financials. The easiest and cheapest way to get access to this sector is via an exchange traded fund (ETF) and the Australian Resources Sector QRE-ASX is a good start as it offers exposure to the largest ASX-listed companies in the resources sector, including BHP, Rio Tinto, Woodside Petroleum and more.

Betashares QRE ETF

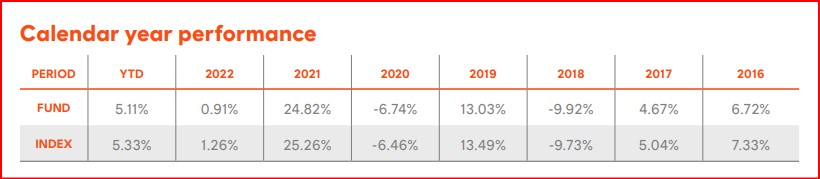

Compare the performance against the Financials Betashares QFN ETF

Our top performing ETF’s

When you invest, you don’t have to bet everything on one team; instead, the best policy is to divide your money among different types of assets. This is what we call asset allocation — done right as it safeguards your money and maximizes its growth potential, regardless of which team is winning in markets.

With asset allocation, you divide your investments among shares or listed investments like ETF’s, bonds and cash. The relative proportion of each depends on your time horizon—how long before you need the money — and risk tolerance — or how well you can tolerate the idea of losing money in the short term for the prospect of greater gains over the long term.

The Next Step is to talk to us

Anti Hawking Notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

Target Market Determination: We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives, or terms and conditions. You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits. All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.

General Advice Warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au.. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement. Please consult our office to provide you with personal advice if you would like. To make an appointment please click on the link financialchoice.com.au5 million Aussies in last 4 months have gone overseas. Should you invest overseas as well?