Latest SMSF statistics: 1.1 million members with $869 billion in Super

About 44 per cent of savers starting an SMSF are aged under 45 years, with about one-third of new members aged between 35 and 45 years, according to the latest analysis by the Australian Taxation Office.

Regardless of your age, the advantages of an SMSF are often the same for many people – autonomy, control, flexibility, transparency, stronger investment options than the average superannuation fund, and the ability to be in control of your own financial future.

Younger for longer – almost one in three people opening a SMSF are under 45

“Since the Pandemic and a couple of years of strong investment returns many younger investors are seeing the merits of pooling the family wealth together and taking control of their wealth and investment choices”, says Russell Medcraft CEO and founder of Financial Choice and selfmanagedsuper.com.au . “We are seeing investors come to us and ask if they can invest in Gold, Silver or other exotic investments. The most common choice is the adoption of low cost index funds via Exchange Traded Funds (ETF’s) and then investment properties. Some clients are even investing in on site Caravans.”

What is the average SMSF balance in Australia?

In the 12 months from the 2021 to the 2022 financial year, SMSF assets grew by $25 billion, or 3%. At 30 June 2021: SMSFs had assets of almost $1.5 million on average, up 15% from the previous year and 25% from 2016–17.

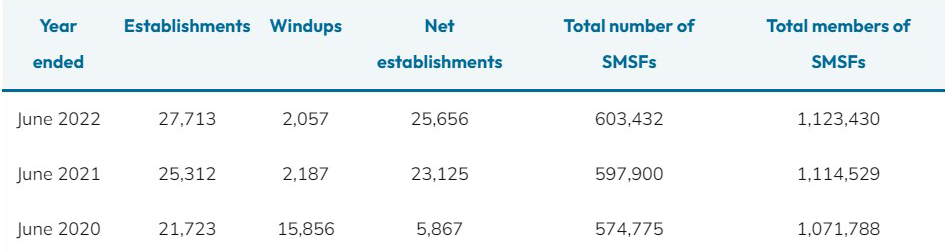

Total number of SMSF’s

The windup trend has reversed

As the above table illustrates the number of new SMSF’s being set up has steadily increased over the last three years but the number of closures or windups has reduced dramatically. The proceeds from windups were in most cases transferred to another superannuation or pension fund or paid out to the Estate. The reversal of this trend is further evidence that many trustees of SMSF’s are very happy with the flexibility, transparency and tax advantages of a SMSF when compared against other alternatives like Industry funds and retail super funds.

How much do I need to have in Super before I can set up my own SMSF

The vast majority (86%) of SMSFs in Australia had balances greater than $200,000 in June 2021, as indicated in the table below. This is consistent with the generally held view that it is not cost effective to set up and run an SMSF with less than $200,000.

As our superannuation system matures, the percentage of funds with less than $200,000 is declining. At the other end of the scale, the ATO has only recently started providing figures for funds with $10 million to $20 million in assets, $20 million to $50 million and $50 million-plus.

Anti Hawking Notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

Target Market Determination: We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives, or terms and conditions. You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits. All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.

General Advice Warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au.. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement. Please consult our office to provide you with personal advice if you would like. To make an appointment please click on the link financialchoice.com.au5 million Aussies in last 4 months have gone overseas. Should you invest overseas as well?