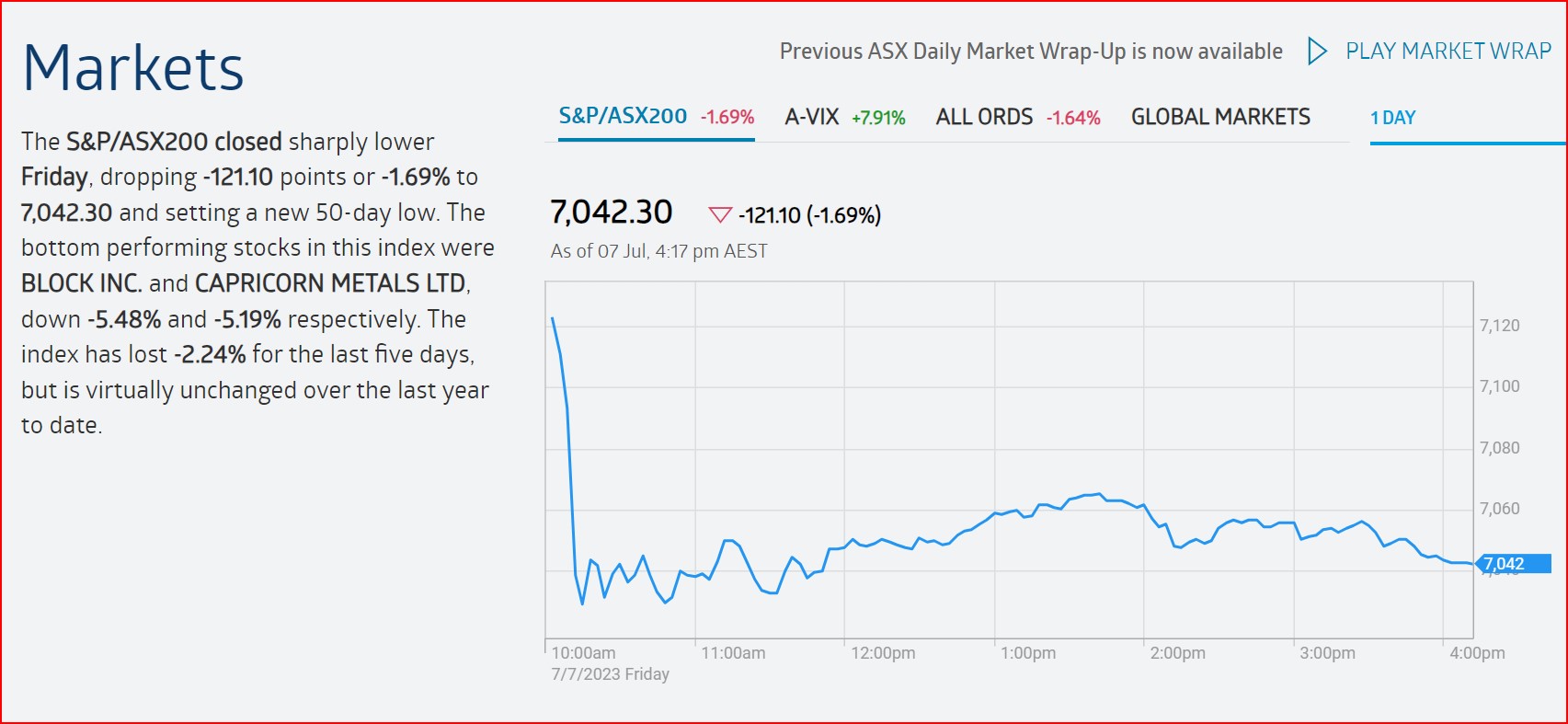

This week the Australian Share market retreated, giving up some of the gains that were made in June. Experts are predicting that the interest rate pause may be a little too late and that the economy will further contract in the coming months. Let’s wait and see.

It’s a very different story overseas.

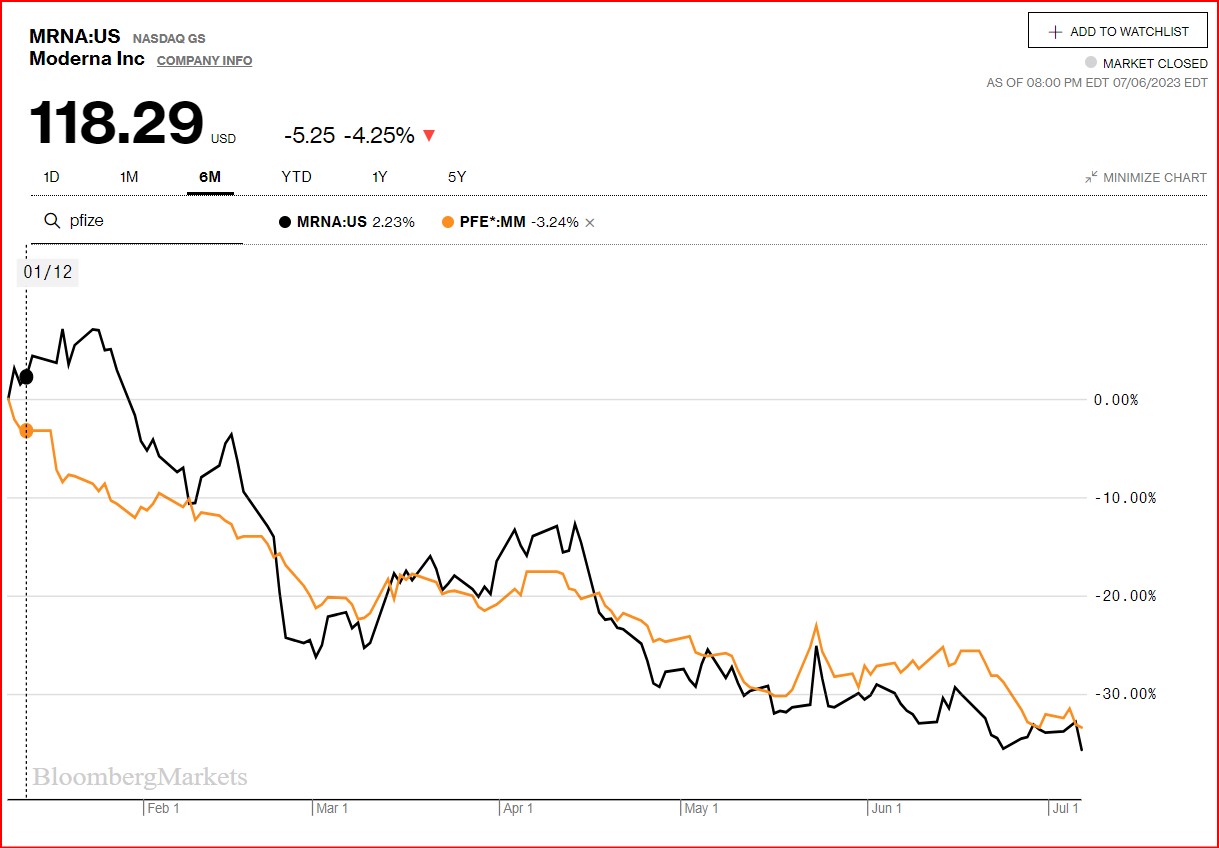

“Compare the Pair” Tech stocks surge while Vaccine makers plunge

Tech stocks surge: Technology stocks have been on a strong rally today, driven by positive earnings reports and increased demand for digital services. Companies like Apple, Microsoft, and Amazon have experienced significant gains, attracting investor attention.

The latest on the Vaccine front

Pharmaceutical companies working on COVID-19 vaccines have seen their stocks stage a small recovery as positive trial results continue to emerge. Investors are hopeful about the potential for these vaccines to bring an end to the pandemic, leading to a surge in stock prices for companies like Moderna and Pfizer.

Renewables boom

The renewable energy sector is witnessing a surge in investments as governments and businesses focus on sustainability. Companies involved in solar, wind, and other clean energy solutions are attracting significant capital, driven by the increasing demand for green alternatives and favorable regulatory policies.

The IPO frenzy

The IPO market remains active, with several high-profile companies going public. Investors are closely watching the performance of companies like Airbnb, DoorDash, and Snowflake, which have recently debuted on the stock market. These IPOs have generated significant excitement and raised questions about their valuations.

The Cryptocurrency surge

Bitcoin and other cryptocurrencies have experienced a strong rally, with Bitcoin hitting an all-time high recently. Investors are increasingly viewing cryptocurrencies as a store of value and a hedge against inflation, driving increased interest and investment in the digital currency market.

IMPORTANT NOTICE: You are receiving this email because you have subscribed to our services in the past and you have agreed to the terms and conditions and the privacy statement on our web site. We protect and value your data and continue to send you information that is relevant and valuable. If you are interested in any product described in our newsletters then you need to read a copy of the PDS and determine for yourself if it is appropriate to your needs, circumstances and particular situation.

Anti Hawking Notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

Target Market Determination: We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives, or terms and conditions. You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits. All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.

General Advice Warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au.. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement. Please consult our office to provide you with personal advice if you would like. To make an appointment please click on the link financialchoice.com.au5 million Aussies in last 4 months have gone overseas. Should you invest overseas as well?