“We have just renewed the fixed interest part of our portfolio for six months”

A term deposit and a bond both fall under the category of fixed incomes. They are relatively risk-free investments that you can use to diversify and strengthen your portfolio. And like all investment options, they both come with their fair share of pros and cons. To maximise your returns, you need to first understand how investment bonds and term deposits function in a real-world environment.

In 2022, Bonds took a leave of absence in providing security for investors. The S&P U.S. Aggregate Bond Index, which tracks the performance of publicly issues U.S. debt, returned -12.03%. This left a lot of investors scratching their heads thinking bonds were as safe as houses!

So how do bonds really work and is now the time to rethink them as part of your portfolio.

Term deposit rates are going higher and risk-free. So why own bonds?

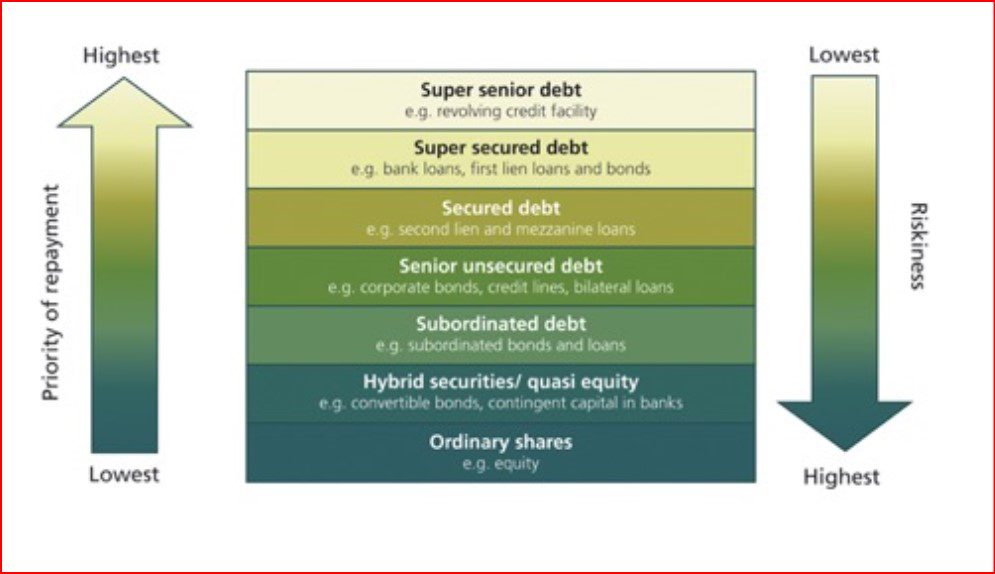

A term deposit functions like a high-interest savings account. You put your money into a term deposit and it will achieve higher returns than a regular bank account. An investment bond is a way of lending money to a government or a corporation. Because the entity owes you money, you can collect regular interest on the bond. When the bond has fully matured, the government or corporation must repay the original sum of the loan. Both are considered safe places to store your money, but term deposits are generally considered even safer than bonds.

Both term deposits and bonds can be important parts of a strong portfolio because they provide consistent returns. In the case of a term deposit or a government bond, the investor is virtually guaranteed a payout up to $250,000.

For a term deposit, it’s the interest rate that matters most when determining the yield. Term deposits generally lock in that interest rate at the very start, making it easy for investors to plan ahead. However, term deposits are an illiquid investment strategy. Once the money is locked away, an investor will have a difficult time cutting the term short. Bonds generally give investors the option to sell prior to maturation, making them more flexible and ultimately giving some investors more peace of mind if they run across an emergency situation.

However if interest rates rise you can be caught short holding longer duration bonds.

What is the outlook for rates?

To understand how fixed income assets will behave from here, one needs to understand the outlook for rates. Here are the key points to consider:

- What is the recession risk? This recession risk is starting to diminish as more positive economic date emerges. Longview economics latest view is that US rally in the past six months, stock market sentiment has switched (from maximum bearish to bullish) and industrial production has expanded (for the past 5 months, i.e. since December), perhaps brought about by the sudden reopening of China (and reinforced by $400 billion of extra liquidity during the March banking panic). With that, our ‘bull-bear’ models for the stock market (which we use as a sanity check) have started to signal a new cyclical bull market.

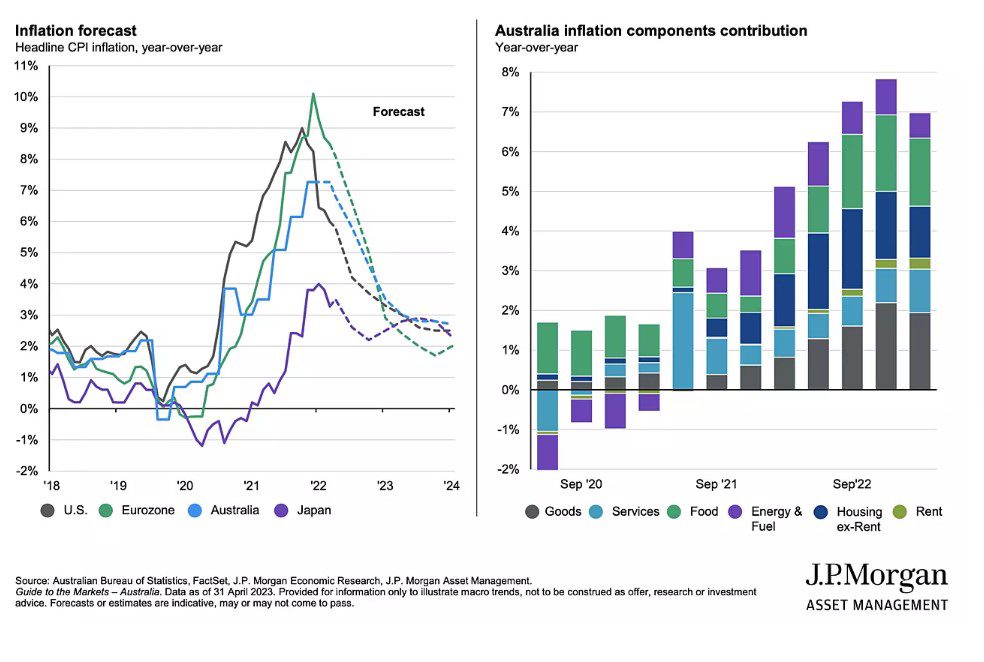

- Inflation rates forecast. If interest rates have increased sufficiently to curb inflation then a pause in increasing rates seems more likely which then means we may start to see rate cuts early in 2024. However Central banks including the Fed and the RBA cannot start declaring victory on inflation. The US is in better shape at the moment because they went hard and early on interest rates.

What is the forecast for inflation

- Banking crisis and liquidity. In simple terms, monetary tightening via rate hikes and quantitative tightening (shrinking the Federal Reserve’s balance sheet) is an exercise in pulling liquidity from the market. The reduction in liquidity sloshing around the market crimps growth and thus eases pressure on the Fed to maintain rates at a restrictive level.

“With the outlook for inflation coming down, it supports the argument that you’re going to get diversification for investing in bonds.”

Risk-free term deposits are currently paying out upwards of 4.5% in Australia. That still equates to a negative real return of a few percentage points given Aussie CPI is running at 7%, but it’s nonetheless attractive in a volatile market.

What do the big 4 banks think interest rate will go

Big four bank’s cash rate forecasts:

- CBA: Peak of 4.35% by August 2023, then dropping to 3.35% by November 2024

- Westpac: Peak of 4.60% by August 2023, then dropping to “below 3%” by end of 2025

- NAB: Peak of 4.60% by August 2023, then dropping to 3.10% by November 2024

- ANZ: Peak of 4.60% by August 2023, then dropping to 4.10% by end of 2024

Source: Rate City 2023

Anti Hawking Notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

Target Market Determination: We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives, or terms and conditions. You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits. All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.

General Advice Warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au.. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement. Please consult our office to provide you with personal advice if you would like. To make an appointment please click on the link financialchoice.com.au5 million Aussies in last 4 months have gone overseas. Should you invest overseas as well?