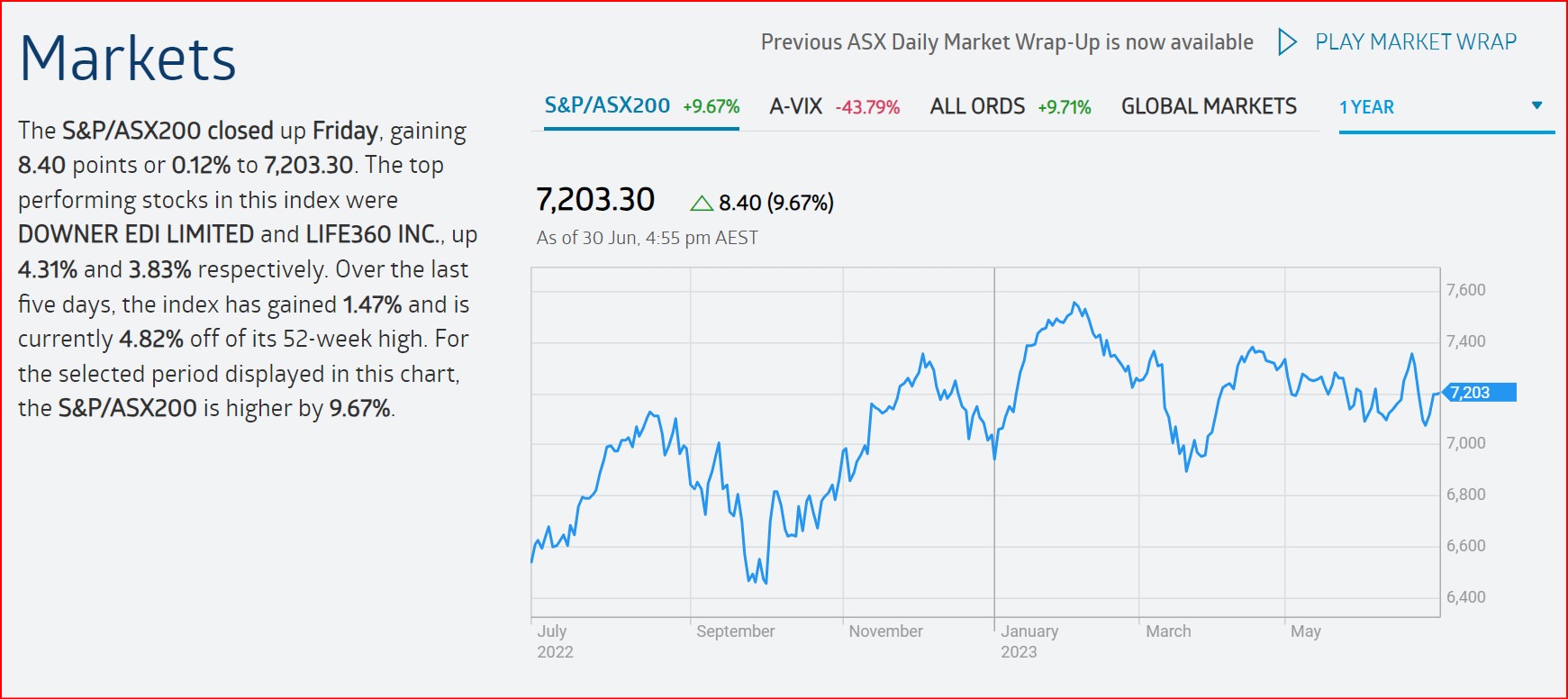

The Australian share market rebounds

The Australian sharemarket as measured by the S&P ASX200 delivered a 12 month return for investors of 9.67%. On the other side of the planet, the S&P500 has delivered a return excluding the June 30 results of 18.12% return over the same period.

What are some of the goals you need to set for the next 12 months?

1. Save 10% of your income

You might have heard the saying “pay yourself first.” But really, you should pay yourself first if you want to meet your financial goals. What that means, is that instead of setting aside money for bills and other expenses first, you will flip the script. You will save FIRST, then pay your bills. Set your goal to save 10 percent of your gross income this year. So if you make $3,000 per month before taxes are deducted, that means you need to save $300 per month.

Depending on where you are at, this can seem tough at first. But look at your unnecessary expenses and see which ones need to be up on the chopping block in order to meet your financial goal. If you’re already meeting this goal, double or triple it. The key to getting started is through automatic withdrawals, that way you don’t have to think about it. You can schedule it so that money just transfers from your checking to your savings after every pay day.

2. Max out your retirement savings

Planning for the future is not something to sleep on! Maxing out your retirement contributions is a great way to prepare for the future, but it shouldn’t be done at the expense of other, shorter-term goals. If you have already hit your emergency fund goals, repaid your consumer debts, and are regularly contributing to your medium term goals, then you can up your game by contributing extra money to your retirement.

3. Increase and measure your net worth

For 2023-2024, your goal could be to increase your net worth by a certain amount. Let’s take $12,000 for example. Say what? That might seem crazy, but it’s actually more achievable than you may think.

First, a crash course in what ‘net worth’ actually means. Your net worth is your total financial value — assets minus liabilities. So you would take the sum of your cash accounts, investments, retirement, etc. and subtract your debts (credit cards, car loans, mortgages, student loans, etc.) That’s your net worth.

Increasing your net worth by $12,000 doesn’t necessarily have to come just from saving more cash. It can be paying down debt, or earning interest on your investments too. Let’s say you paid down $6,000 in debt, added $3,000 to cash savings and $3,000 to retirement, that would make for a $12,000 increase in your net worth!

4. Commit to one “no spend day” each week

Spending is where all of our financial goals can go haywire. Too many unexpected seamless orders, and too many spontaneous online shopping orders often cause us to borrow from savings and/or miss an automated transfer here and there. But, hey, it happens! Don’t beat yourself up about it. The key for the new financial year is to become more mindful of your spending habits – make a plan to commit to one “no spend days” per week.

5. Track your expenses every day

You have set up your new financial year budget and committed to saving your tax refund (right!) You’ve committed to a “no spend day” each week and to saving 10 percent of your income. You’re all set right? Wrong! You need to track your expenses. Use a financial App and categorize your spending into categories (talk to us – we have one that’s sure to help you map out your plan to a better financial position).

Anti Hawking Notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

Target Market Determination: We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives, or terms and conditions. You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits. All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.

General Advice Warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au.. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement. Please consult our office to provide you with personal advice if you would like. To make an appointment please click on the link financialchoice.com.au5 million Aussies in last 4 months have gone overseas. Should you invest overseas as well?