Meanwhile, the Australian Market keeps going up.

The S&P/ASX200 closed up Friday, gaining 25.50 points or 0.34% to 7,493.80 and setting a new 100-day high. The top performing stocks in this index were MEGAPORT LIMITED and LIONTOWN RESOURCES LIMITED, up 6.64% and 4.87% respectively. Over the last five days, the index has gained 0.56% and is currently 1.72% off of its 52-week high.

“I wish there were a completely painless way to restore price stability. There isn’t,” Powell said during the Fed’s December post-meeting press conference. “This is the best we can do.”

How far will interest rates go in 2023?

The Fed’s key benchmark borrowing rate is projected to rise another three-quarters of a percentage point in 2023, hitting a 17 year high of 5.25 percent from its current 4.25-4.5 percent level according to the Fed’s median projection from December.

ven if the Fed’s highest forecasts come to fruition, it shows that, at most, only 1.25 percentage points of rate hikes are on the table for 2023. That’s nowhere near the 4.25 percentage points of tightening Fed officials approved in 2022 alone. Where the Fed is heading — and where it’ll end up — depends on inflation and the labor market.

The labor market also still remains red-hot. Job creation is outstripping population growth, suggesting employers are adding more jobs than is sustainable, experts say. There are also about 1.7 job openings per every unemployed individual, Labor Department data shows, reflecting too few workers for too many vacant positions.

In Australia, the labour market is also showing signs that too few people for too many jobs.

Fed Chair Jerome Powell said the “can’t-be-tamed” labor market might be one of the key causes of inflation — and it could make inflation more stubborn, prompting the Fed to take rates even higher.

Companies desperate for workers often lift wages, but if they can’t find a way to eat those higher labor costs, they ultimately end up making the consumer bear the burden by increasing prices. Those higher costs are then reflected in the Department of Labor’s measure of services inflation, which is up 6.8 percent from last year, the sharpest burst since August 1982.

Interest rates, however, often take a while to filter through the economy, and the job market is one of the last places they end up affecting. Experts say it may take a year for the full effect of a rate hike to be realized in slower job growth and fewer job openings.

Useful tips to protect yourself going forward

What to do with your money when rates are expected to rise and recession risks are high.

Keep a long-term mindset: Remember, a diversified portfolio and a long-term mindset protects you through the most brutal of times in the stock market.

Pay down debt: Consumers with fixed-rate debt won’t feel any impact from a rate hike, but you are more fragile if you have a variable-rate loan, especially if it’s a high-interest credit card.

Boost your emergency savings and cash reserves: High inflation shouldn’t keep consumers from building up an emergency cushion of cash in case of emergencies or unplanned expenses and even look at drawing out two years of income instead of one and let your portfolio get a reprieve from market volatility.

Find the best place for your cash: Many accounts on the market are offering consumers who bank with them yields above 4 percent.

Think about recession-proofing your finances: it comes down to living within your means, identifying your risk tolerance and staying focused on the long haul if you’re an investor.

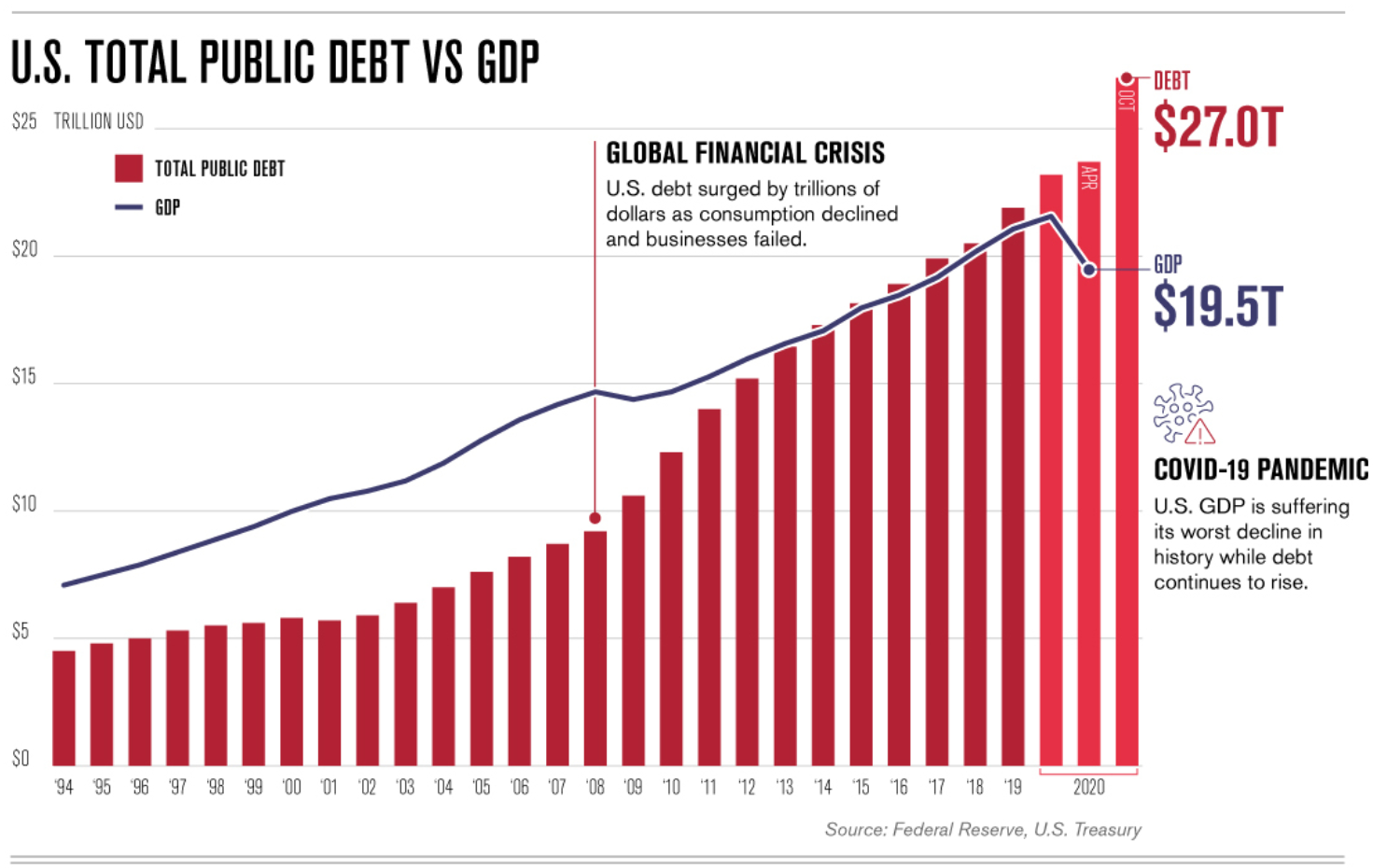

Will the US default on it’s debt

The debt ceiling was reached again on Jan. 19, 2023, when the national debt crept above $31.4 trillion. It was set back in December, 2021, when the debt ceiling was raised by $2.5 trillion. Until Congress increases the debt limit, the Treasury Department must rely on “extraordinary measures” to meet the government’s obligations. These measures cannot go on indefinitely, and the government will be at risk of default sometime later this year.

What is the debt ceiling?

The government has a self-imposed borrowing limit known as the debt ceiling, and over time, it has raised or suspended, that limit to help prevent the U.S. from defaulting on its debt.

- In modern history, the U.S. has never defaulted on its debt.

- The debt ceiling is the self-imposed limit on how much debt Congress allows the federal government to have.

- If Congress does not raise or suspend the debt ceiling, the U.S. could default on its debt, which would also impact financial markets and the economy.

If the ceiling hadn’t been raised or suspended, the Treasury Department would not have been be able to issue more Treasury bonds, which bring in revenue to help pay bills. The government would be forced to choose between paying federal employee salaries, Social Security benefits, or the interest on the national debt. If it doesn’t pay that interest, the country would default.

Has any country ever defaulted on it’s debt

Other nations have defaulted (or narrowly escaped default) on their debt, with serious consequences for their economies. Greece is working to repay its debt after the European Union helped it avoid default in 2010, and Iceland actually did default in 2009, and banks collapsed as a result.

What would happen to China if the US defaulted on its debt

Like many other countries and individual investors around the world, China owns U.S. Treasury debt. In late 2022, China held slightly less than $1 trillion in Treasury securities. If the U.S. were to default on its debt, China might not receive interest payments on those securities, and it could even lose its investment altogether.

IMPORTANT NOTICE: You are receiving this email because you have subscribed to our services in the past and you have agreed to the terms and conditions and the privacy statement on our web site. We protect and value your data and continue to send you information that is relevant and valuable. If you are interested in any product described in our newsletters then you need to read a copy of the PDS and determine for yourself if it is appropriate to your needs, circumstances and particular situation.

Anti Hawking Notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

Target Market Determination: We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives, or terms and conditions. You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits. All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.

General Advice Warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au.. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement. Please consult our office to provide you with personal advice if you would like. To make an appointment please click on the link financialchoice.com.au