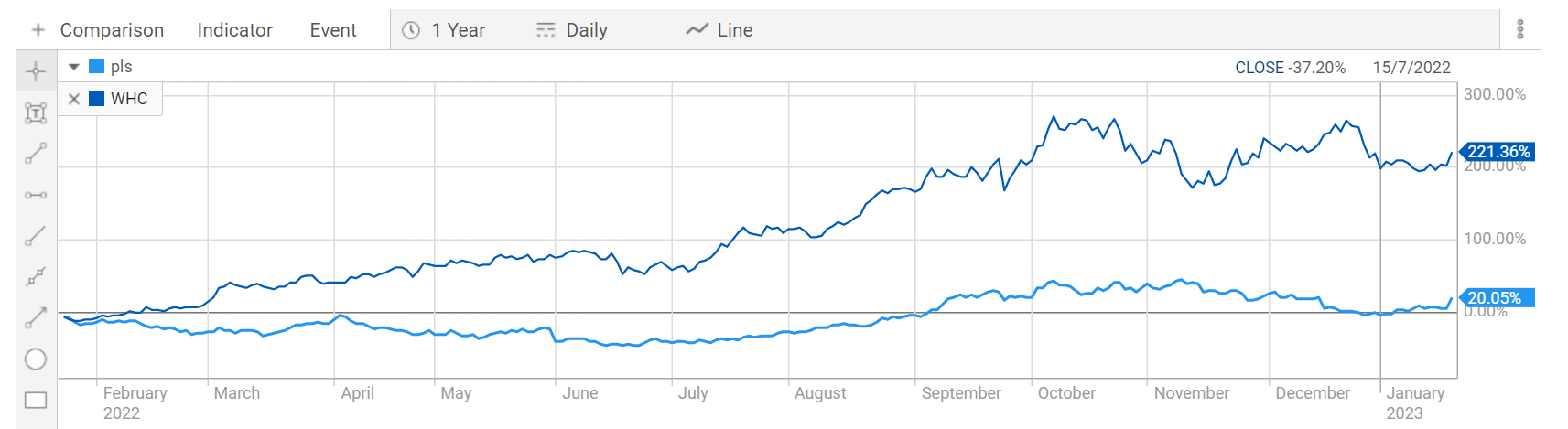

The top performing stocks in this index were PILBARA MINERALS LIMITED and WHITEHAVEN COAL LIMITED, up 13.18% and 6.16% respectively.

The top performing stocks in this index were PILBARA MINERALS LIMITED and WHITEHAVEN COAL LIMITED, up 13.18% and 6.16% respectively.

Over the last 12 months, Pilbara Minerals has increased its share price by 20.05% and Whitehaven Coal Limited has increased its share price by a staggering 221.36%

In last weeks newsletter I mentioned that Australia still generates more than 60% of its energy requirements from Coal fired power.

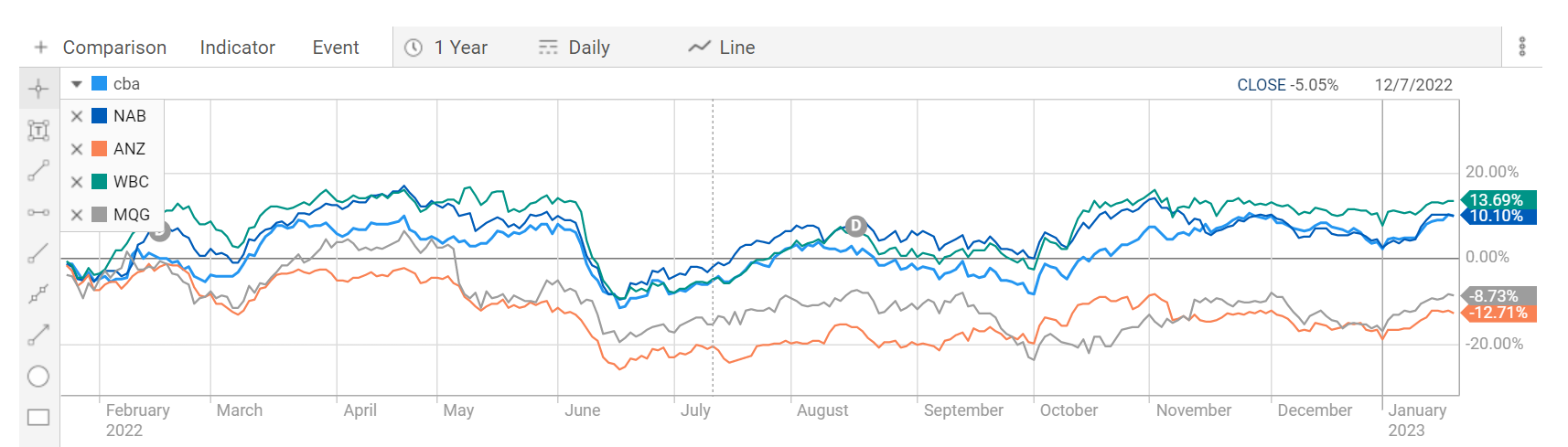

What about the big banks

The big four banks are forecast to rake in record combined profits of more than $33 billion this financial year, even as investors remain wary about the risk of rising bad debts caused by a weakening economy.

Australia’s four largest lenders last year notched up their highest combined profits since 2018, as higher interest rates gave margins a boost in the second half. Analysts expect the trend will continue into this year, driving earnings higher. The best performer over the last 12 months has been Westpac, followed by CBA. ANZ and Macquarie are the poor performers in the recent past.

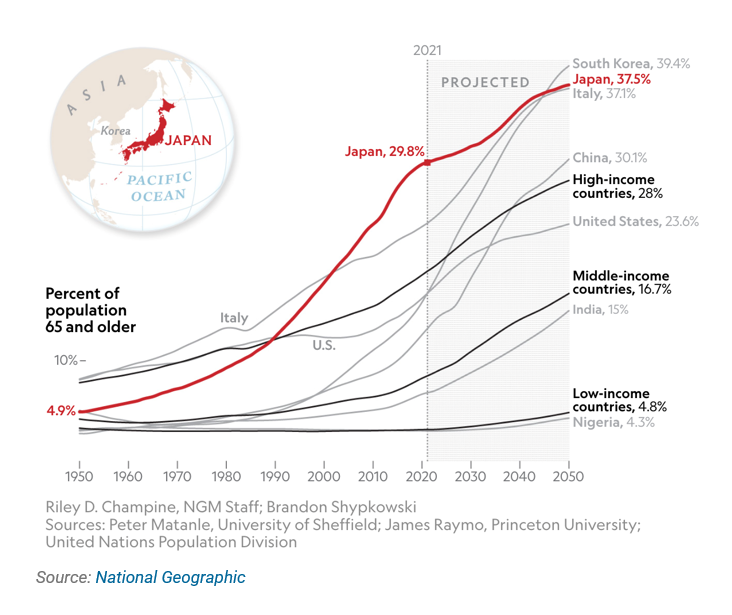

The World is getting older; China’s population declined for the first time in decades

37.5% of Japan’s population is projected to be 65+ by 2050. Currently, it has the second-oldest population in the world (behind Monaco). Other countries are also watching their populations age rapidly. China will also have 30.1% of its population over 65 by 2050, but the big surprise is India. By 2050 they will have only 15% of their population over the age of 65. China and Japan will have a squeeze on their health care and pensions well into their future.

Population decline doesn’t stop China’s share market from a strong rebound

Mining giant BHP believes the reopening of China’s economy following the end of its long-running zero-COVID policy will prop up demand for some of Australia’s largest commodity exports even as many other nations across the world suffer slowdowns this year.

China’s equity benchmark is closing in on a bull market as foreign investors rush to buy local shares on bets that the nation’s economic reopening and supportive policies will accelerate the markets bound in the short term.

IMPORTANT NOTICE: You are receiving this email because you have subscribed to our services in the past and you have agreed to the terms and conditions and the privacy statement on our web site. We protect and value your data and continue to send you information that is relevant and valuable. If you are interested in any product described in our newsletters then you need to read a copy of the PDS and determine for yourself if it is appropriate to your needs, circumstances and particular situation.

Anti Hawking Notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

Target Market Determination: We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives, or terms and conditions. You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits. All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.

General Advice Warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au.. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement. Please consult our office to provide you with personal advice if you would like. To make an appointment please click on the link financialchoice.com.au