In late January 2020, the smoke was still clearing from the intense bushfires that had ravaged the country. The east coast had been battered by intense hailstorms and flash flooding. And an obscure and as-yet unnamed disease came to Australia.

The first case of Novel Coronavirus in Australia (nCoV-19) was reported in Victoria on 25 January 2020, with an additional three cases confirmed in New South Wales later that day. The name for the disease caused by nCoV-19, coronavirus disease (COVID-19), was announced by the World Health Organization (WHO) on 11 February 2020. The first person to die from COVID-19 in Australia was a man from Western Australia who died in Sir Charles Gairdner Hospital on 1 March 2020.

We could only imagine what the next three years would be like

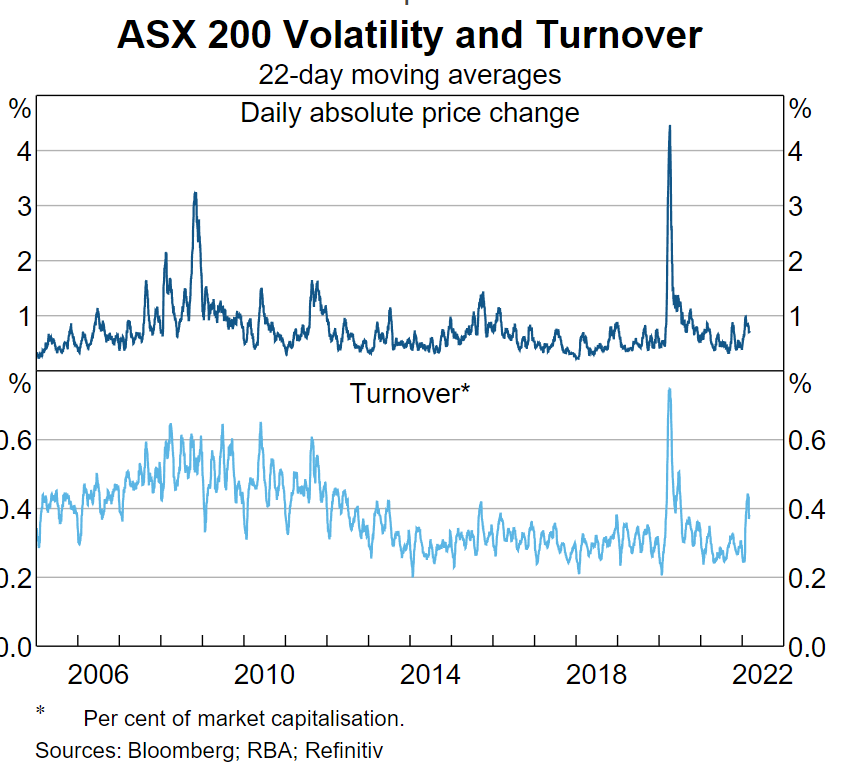

As a result of Covid 19, prices in Australian securities markets declined sharply, while volatility in equity markets increased substantially for a time. However, the period of volatility was brief, particularly when compared with the disruption experienced during the global financial crisis of 2007–2009.

Throughout much of February 2020, securities markets were relatively unaffected as market participants were cautiously optimistic about the expected economic effects of the virus. However, with rising case numbers both here and abroad, it became apparent that the virus was highly transmissible and that economic activity would be severely disrupted by measures necessary to contain it. On 11 March, the World Health Organization declared COVID-19 a pandemic.

On 16 March, the ASX 200 fell by 9.7 per cent – the largest one-day fall in over 30 years. By 23 March, the ASX 200 was 35 per cent below its 20 February peak. By this time, prices were very volatile and changing in either direction by an average of nearly 4.5 per cent each day. Meanwhile, the average share of securities that were bought and sold each day more than doubled.

August 7, 2020 was one of the most dramatic days of the pandemic in Australia. All non-essential businesses in Melbourne were closed as full lockdown kicked off in the city. Meanwhile, thousands of people streamed across the border from NSW to Queensland after a border closure was announced. The closure was announced following the diagnosis of 12 COVID-19 cases in NSW. People returning to the ACT from Victoria were told they could not drive through NSW to get home, and Australia’s Chief Medical Officer warned there was no guarantee a COVID-19 vaccine would ever be developed.

As Australia was exiting coronavirus conditions, the virus was spreading rampantly in the United States. But change was in the air. Donald Trump had lost the election two weeks earlier, partly on the back of America’s botched handling of the pandemic. Days earlier, Pfizer had announced its COVID-19 vaccine was 90 per cent effective.

Meanwhile, NSW Premier Gladys Berejiklian announced she would no longer be holding daily press conferences on the pandemic.

Meanwhile, NSW Premier Gladys Berejiklian announced she would no longer be holding daily press conferences on the pandemic.

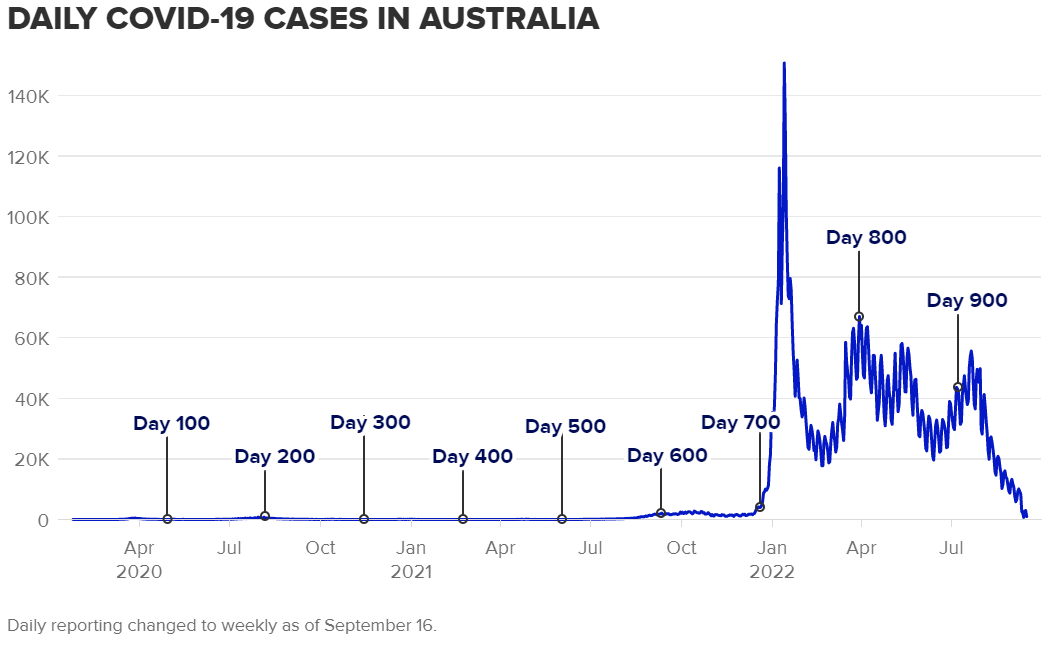

On December 20, 2021, Omicron was beginning to spread rapidly around the country. The Omicron surge overwhelmed PCR testing capacity around the country.

By March 30, 2022, tens of thousands of Australians were catching COVID-19 every day.

But by then, the public mood had shifted away from concern over the disease. Instead, the eyes of the nation were on northern NSW, which was being overwhelmed with flooding.

In South Australia, the government announced that unvaccinated teachers would be allowed to return to classrooms.

The impact of testing-daily to weekly

In the 1000 days since the first Covid case was recorded, 15,487 Australians have died from the disease, and more than 10 million cases have been reported.

IMPORTANT NOTICE: You are receiving this email because you have subscribed to our services in the past and you have agreed to the terms and conditions and the privacy statement on our web site. We protect and value your data and continue to send you information that is relevant and valuable. If you are interested in any product described in our newsletters then you need to read a copy of the PDS and determine for yourself if it is appropriate to your needs, circumstances and particular situation.

Anti Hawking Notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

Target Market Determination: We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives, or terms and conditions. You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits. All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.

General Advice Warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au.. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement. Please consult our office to provide you with personal advice if you would like. To make an appointment please click on the link financialchoice.com.au