The key talking points are:

- Interest Rates

- Impact on housing market

- Unemployment outlook

- Resources and energy

- China reopening

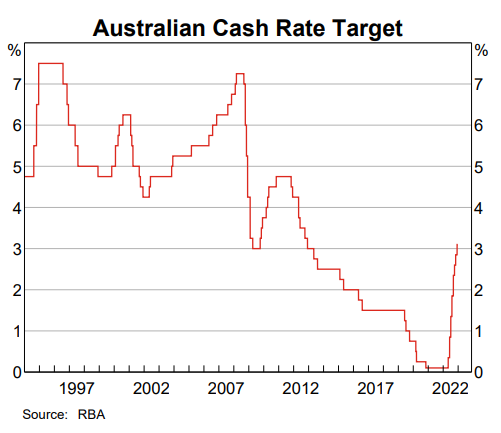

Interest Rates

Impact on Australian housing market

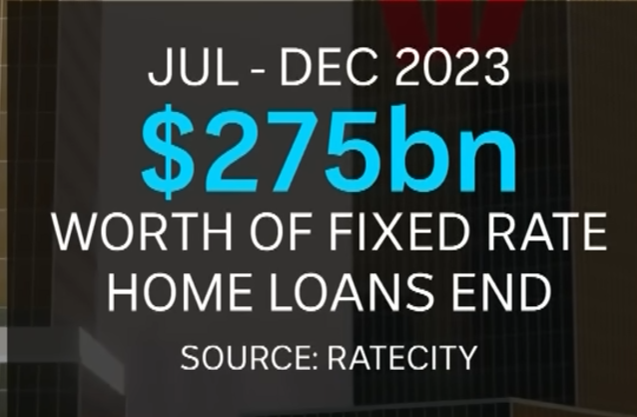

In Australia in 2020, 32.9% of household income was spent on servicing the mortgage. This is expected to increase further to 44.5% in July 2023 when in the second half of this year, $275 billion of fixed rate loans are refinanced at a higher rate.

In 2020 when Covid hit, on a salary of $100,000 a year, you could afford a mortgage of $747,500 at an interest rate of 2.69%. In 2023, to finance a $704,000 mortgage, you will need to earn $123,750 when the cash rate goes to 3.35%, according to Rate City analysts.

In Australia, around 35% of the population have a mortgage, 31% own their home outright and 34% rent.

The movement in interest rates will continue to impact the households with a mortgage. International student arrivals and the rebuilding of migration numbers will impact the already tight rental markets. The available rental market is a third less than what it was pre pandemic and is as tight as the early 2000’s.

For those Australians who own their home outright, they are going to benefit from increasing interest rates as they consider the benefits of downsizing and investing the extra amount from the sale of their home to supplement their retirement income as interest rates continue to increase.

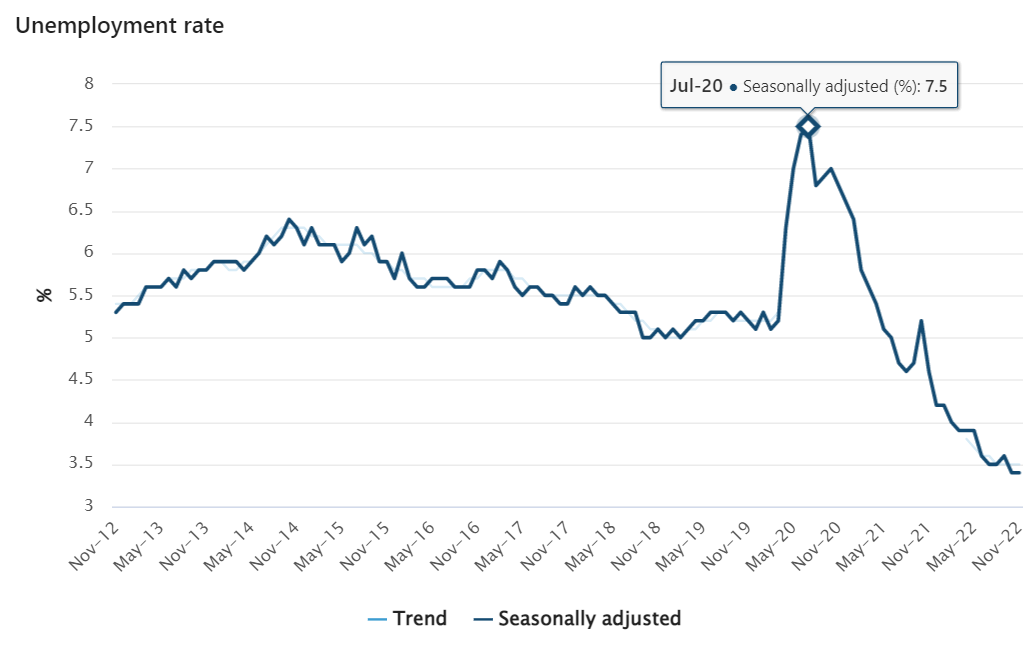

Unemployment rate

As the economy starts to contract, the jobless rate is expected to increase. As you can see, after a short term in July 2020 as a result of Covid, the number of unemployed Australians has continued to decrease and has contributed to inflation increases.

Resources and energy

The National Electricity Market (NEM) is the wholesale market through which generators sell, and retailers buy, electricity. Electricity generators submit bids into the NEM signaling how much electricity they are willing to supply and at what price; the generators that bid the lowest are then chosen to generate electricity to meet demand. The wholesale electricity price – or the ‘spot price’ – is the bid offered by the highest-bid generator that is chosen. The NEM operates across Queensland, New South Wales, the ACT, Victoria, South Australia and Tasmania. Western Australia and the Northern Territory each have separate electricity systems and regulatory arrangements.

According to the Reserve Bank of Australia, around 60 per cent of electricity generation in the NEM stems from coal-fired power. As such, disruptions in several large coal-fired power plants over recent months placed pressure on the supply of electricity. A number of plants have been offline in recent months, with some facing unplanned maintenance problems. Other plants produced less power than usual due to a combination of factors including difficulty accessing sufficient coal because of supply chain issues and illness-related staff absenteeism, and/or production at some coal mines being disrupted by rainfall and extraction difficulties. As a result, coal-fired electricity generation has been substantially lower in 2022 than in recent years.

China reopening

The faster-than-expected reopening of the Chinese economy after three years of stifling COVID-19 restrictions has triggered frantic bullish repositioning, lifting raw materials prices.

Strategists agree it is China’s re-emergence that has underwritten the large moves in commodity markets in the new year.

According to the AFR, copper prices, a bellwether of economic activity, reached $US9000 ($12,950) a tonne for the first time since June, and iron ore futures in Singapore gained a further 2.1 per cent on Friday to $US124.75 a tonne. Oil recorded its longest run of daily gains since February, and even gold briefly topped $US1900 an ounce for the first time since May. This lifted some of Australian mining stocks to within striking distance of an all-time high, with the S&P/ASX 200 Materials Index adding a further 0.2 per cent on Friday. The index sits about 2 per cent off its April 2022 record. Gains across the resources sector helped the Australian share market to a 0.7 per cent rise on Friday, ending the week at a six-week high of 7328.1 points. The benchmark index is now up 4.1 per cent this year and is about 4 per cent off its record high.

The Experts from K2 Asset Management George Boubouras

- China’s reopening is critical to the global economy delivering a positive growth rate in 2023.

- Market pricing in large earning downgrades this year

- Peaking US bond yields and lower than expected inflation to end 2022 has been positive

- Labour market data shows resilience which is at odds with a recession

- Australian conditions will benefit from resources (energy, bulk metals, agriculture)

- China engagement with G20 more positive going into 2023.

Chris Watling from Longview Economics

Chris Watling, CEO and Chief Market Strategist of Longview Economics, says most assets haven’t priced in the looming recession, and that the debate is now about what kind of slump is coming. The US unemployment rate could rise as high at 8% next year, and the Federal Reserve is tightening monetary policy “until something breaks”.

US (and global) equities remain in a cyclical bear market. Cyclical bear markets are driven by tight money, and the pricing in recessions and/or shocks. Currently, money is tightening up and a recession is yet to be fully priced. Consistent with that, key bull-bear models are generating a clear warning message.

The Australian housing market looks vulnerable but most of the excess has been cleaned out a few years ago.

IMPORTANT NOTICE: You are receiving this email because you have subscribed to our services in the past and you have agreed to the terms and conditions and the privacy statement on our web site. We protect and value your data and continue to send you information that is relevant and valuable. If you are interested in any product described in our newsletters then you need to read a copy of the PDS and determine for yourself if it is appropriate to your needs, circumstances and particular situation.

Anti hawking notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement

Target Market Determination

We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives.”

or terms and conditions, You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult our office to provide you with personal advice if you would like. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. To make an appointment please click on the link https://financialchoice.com.au/