The ranks of Australians receiving the Age Pension are increasing. It’s important to understand who is eligible and the role it plays in retirement planning.

“Nearly half of Australians aged 65 years and older receive most of their income from the Age Pension (47.8% or 2,029,000 persons)”.

The Department of Social Services (DSS) data shows 2,565,870 people were receiving the Age Pension at the end of last year. This included 1,783,980 people receiving full pension payments, 393,365 people receiving part pensions as a result of the “income test”, and a further 385,525 people receiving part pensions as a result of the “assets test”.

Under the income test, individuals can earn a maximum of $190 in income per fortnight (and couples $336 per fortnight) from other sources before their pension is reduced by 50 cents for every dollar above the respective allowable limits.

Under the assets test, individuals and couples are assessed on whether they do or don’t own a home. They can hold up to a certain value of financial and other assets before their pension is incrementally reduced for every dollar above the respective allowable limits.

Singles and Couples Pension Amounts

SINGLES

Single homeowners can have up to $280,000 in assets (excluding family home) and non-homeowners up to $504,500, before their full Age Pension starts to reduce. The Age Pension cuts out completely once singles reach maximum asset limits of $634,750 (homeowners) and $859,250 (non-homeowners), with higher cut off points for singles who receive rent assistance. Figures exclude family homes.

COUPLES

The same rules apply to couples receiving the Age Pension, but the limits are higher.

Couple homeowners can have up to $419,000 in assets, and non-homeowners up to $643,500, before their full Age Pension starts to reduce. The Age Pension cuts out completely once couples reach maximum asset limits of $954,000 (homeowners) and $1,178,500 (non-homeowners).

The age pension, an inflation proof safety net

The DSS’s demographics data shows that there are just under 400,000 Australians aged 66 to 69 that were receiving a full of part pension as of December 2022 – roughly about 15% of the total Age Pension population.

Keep in mind that this is the youngest Age Pension cohort, as individuals can potentially qualify to receive a full or part Age Pension from the age of 65 years and six months, depending on the year they were born.

The largest cohort of pension recipients (about 51%) was aged 70 to 79.

For most Australian retirees, the Age Pension forms a meaningful portion of their retirement income, and for all retirees it should be considered as part of the retirement planning process.

Two key features of the Age Pension – it is payable until one’s death, and it adjusts for inflation over time – which makes the Age Pension a very valuable benefit as well.

Given this, a thorough understanding of how the Age Pension works, what benefits should be expected, and its role in planning for retirement is critical.

For retirees who meet the eligibility criteria, the Age Pension can act like an inflation-protected, lifetime-income safety net.

$60,000 A YEAR How much do you need to have in super to give you $60,000 a year

The widely reported ASFA (Australian Super Funds Association) Retirement standards suggests couples can enjoy a ‘comfortable lifestyle’ on around $70,000 a year and singles on around $49,000. It stands to reason then that a single person should be able to live more than comfortably on $60,000 while a couple would live reasonably well, if not lavishly.

If $60,000 a year sounds like your kind of retirement, the next step is to work out how much super you will need to fund it.

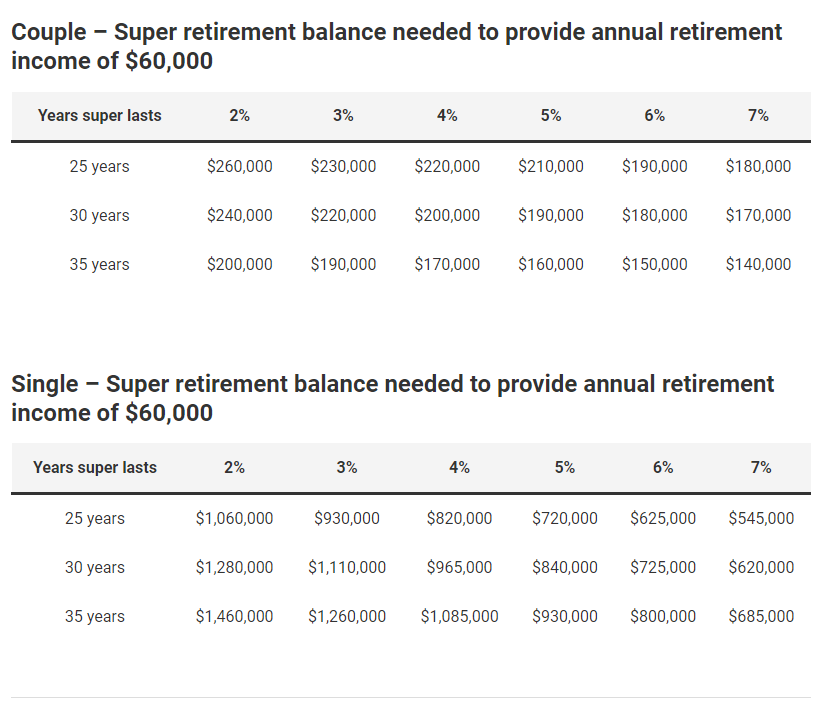

The tables below show the super balance required to provide a couple or a single person with annual income of $60,000.

Using ASIC MoneySmart’s Retirement Planner we’ve calculated various scenarios, depending on how long you want your money to last and the average annual return on your super investments, net of all fees.

For simplicity, we have not counted savings and investments held outside super. If you have significant outside savings, you will need less super. We also assume you own your home.

You will notice that the balances required for couples and singles are materially different, with couples needing significantly less super between them to generate an annual income of $60,000, relative to an individual. This is due to the lower age pension paid to a single and the additional lump sum required to get to $60,000 p.a. In reality a single person can live very comfortably on $45,000 in retirement.

IMPORTANT NOTICE: You are receiving this email because you have subscribed to our services in the past and you have agreed to the terms and conditions and the privacy statement on our web site. We protect and value your data and continue to send you information that is relevant and valuable. If you are interested in any product described in our newsletters then you need to read a copy of the PDS and determine for yourself if it is appropriate to your needs, circumstances and particular situation.

Anti Hawking Notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

Target Market Determination: We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives, or terms and conditions. You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits. All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.

General Advice Warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au.. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement. Please consult our office to provide you with personal advice if you would like. To make an appointment please click on the link financialchoice.com.au