Australian Bureau of Statistics data covering the four months to the end of April shows more than 5 million Australians have travelled overseas so far this year.

Should your investment dollars head overseas as well? This week, we take a look at the benefits of investing in international markets.

In the investment world, being averse to investing offshore is a behavioural phenomenon known as “home bias”, and it’s not unique to Australia. Pick almost any country in the world and there’s bound to be a high degree of home bias there too.

Share investors naturally gravitate towards home-grown companies for a number of reasons. These companies are often corporate brands they interact with on a daily basis.

Home bias also can reflect fears that offshore investments can be riskier, more costly, are prone to exchange-rate volatility, and have different shareholder rights.

In the Australian context, there’s also a taxation explanation behind home bias. The tax benefits of dividend imputation encourages investing in Australian shares because of expectations of higher returns (from franking credits) relative to other sources of returns.

According to research by Vanguard

On an annualised basis, international equities outperformed Australian equities by 4.5% per year since 2010. This reverses when looking back to 2000, with Australia outperforming by 2.7%. This reverses yet again since 1970, with international outperforming by 0.8%.

In fact, looking at any one-year period since 1970, Australia has outperformed international equities just over 50% of the time, while having higher volatility almost 70% of the time.

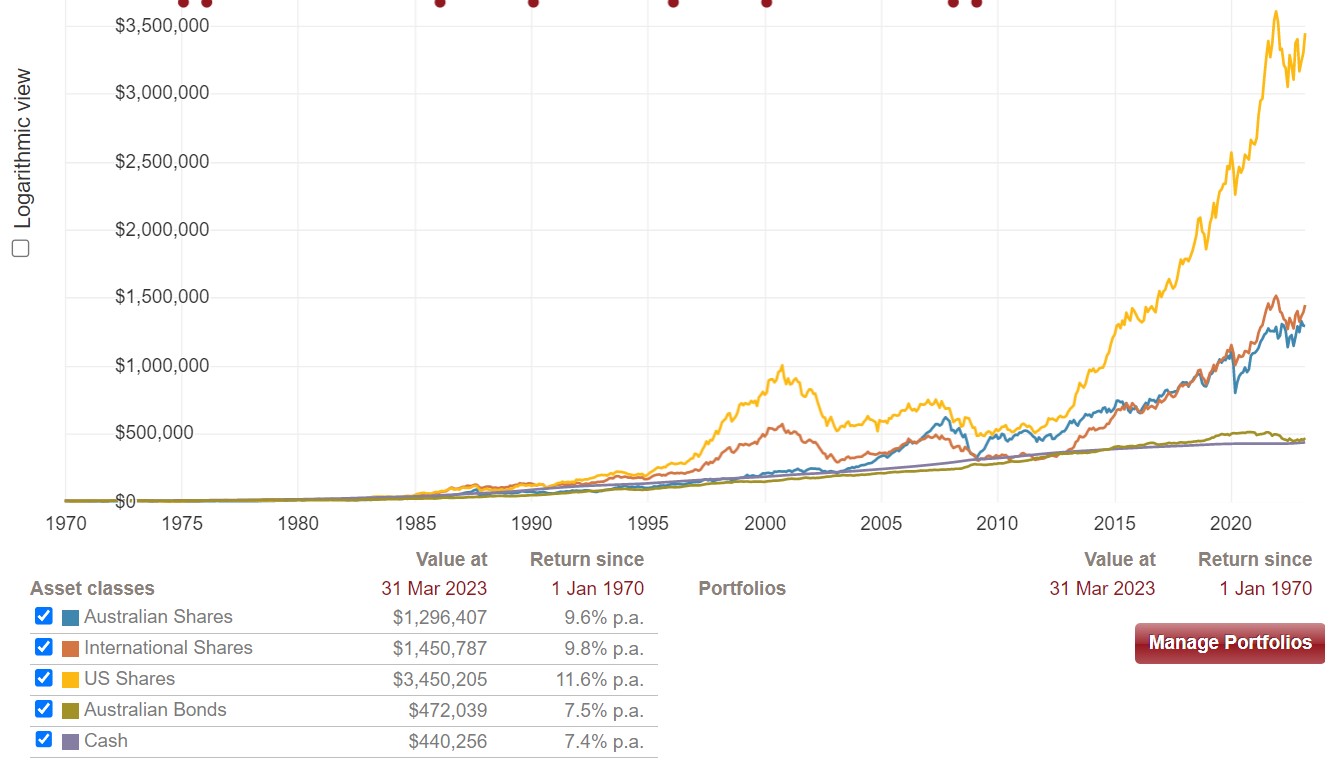

The power of compound returns over time 1970-2023

Take a close look at the chart above as provided by Vanguard. It shows the average returns for asset classes since 1970. If you had invested just $10,000 in each asset class on the 1st January, 1970 and sat back and watched it grow, you would have amassed $1,296,407 if you had chosen Australian shares by 31st March, 2023. This is a compound return of 9.60% each year.

If you had chosen US shares like the S&P 500 index, then your $10,000 would have grown to $3,450,205 by 31st March 2023. This is a compound return of 11.6% p.a.

On the other hand, if you had been a careful investor and left it in cash in an Australian bank, then you would have amassed $440,256 by 31st March 2023. This would have returned a compound return of 7.4% p.a. Remember, compounding returns means you leave your interest and capital to grow on it’s self.

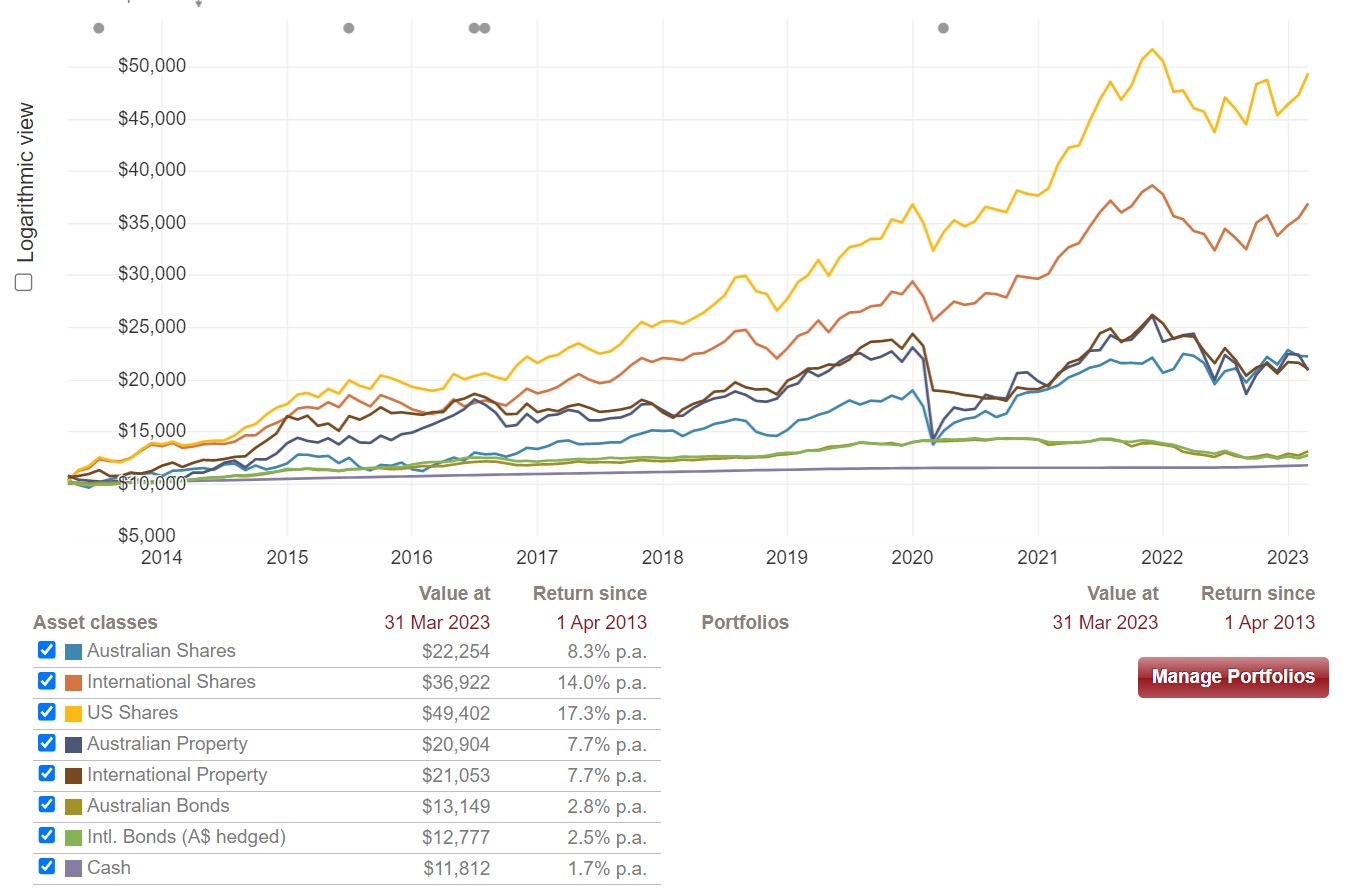

What about the last 10 years 2013-2023

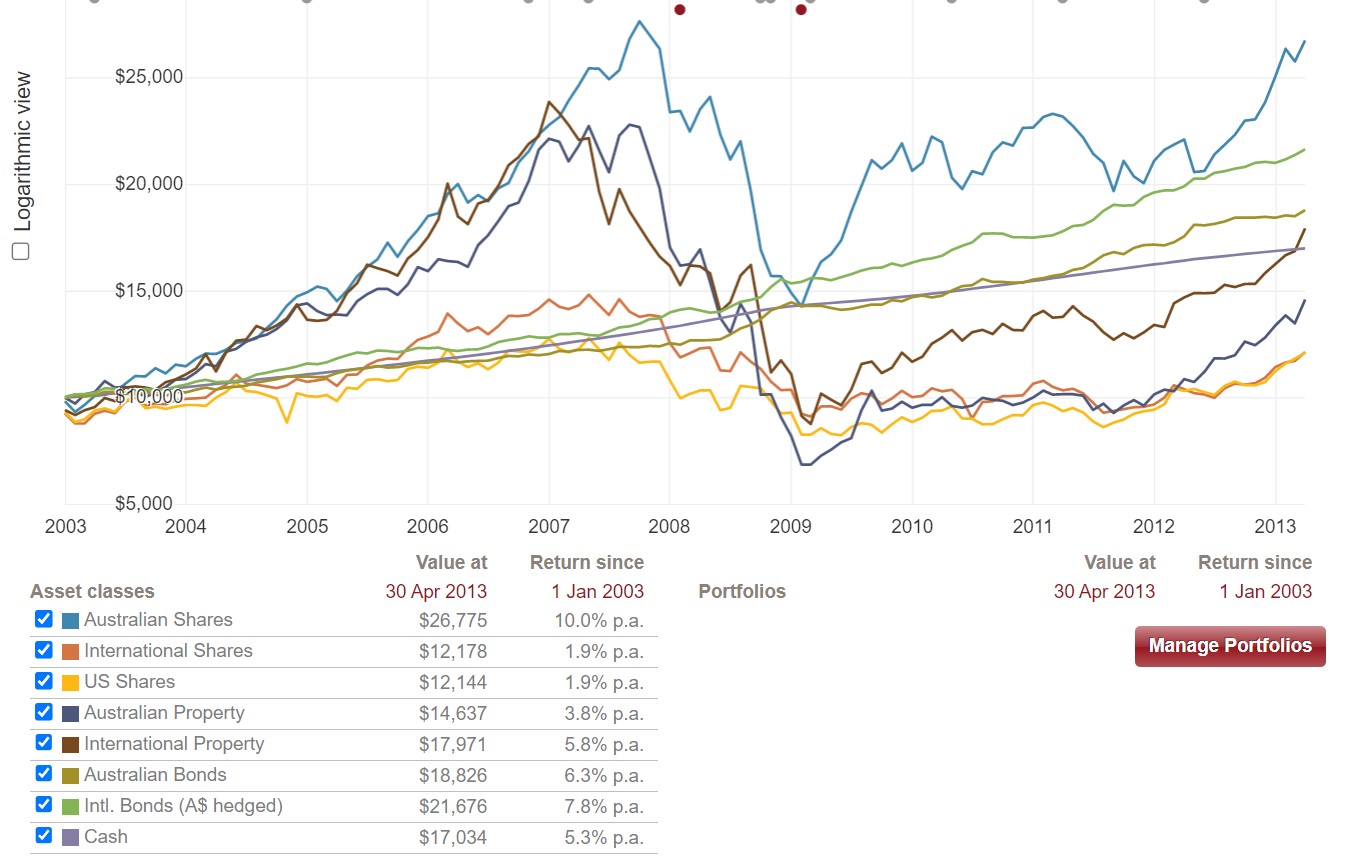

What about the previous 10 years 2003-2013

Look at the difference between Australian shares and US shares over the same time. 10.00% p.a. compound versus 1.90% compound.

What do these numbers tell us? Firstly, the respective investment returns have differed over time. But, more importantly, although the returns from different asset classes do change, the reduced risk associated with having a broadly diversified portfolio ultimately produces more stable returns.

The behavioural benefits of diversification can outsize the financial benefits, too. During volatile periods, investors with under-diversified investment portfolios often feel pressured to make rash decisions when their concentrated strategy produces poor results.

Good investing isn’t about earning the highest returns every year, because the highest returns tend to be one-offs that can’t be repeated. It’s about earning stable returns that you feel you can stick with and which can be repeated for the longest period of time.

The Nobel Prize laureate, economist Harry Markowitz, once reportedly said, “Diversification is the only free lunch” in investing. This assertion has been shown to have stood the test of time.

Investing in assets across geographies and currencies could reduce risk within your portfolio and enhance your returns over the long term. Let’s go get our free lunch Australia.

IMPORTANT NOTICE: You are receiving this email because you have subscribed to our services in the past and you have agreed to the terms and conditions and the privacy statement on our web site. We protect and value your data and continue to send you information that is relevant and valuable. If you are interested in any product described in our newsletters then you need to read a copy of the PDS and determine for yourself if it is appropriate to your needs, circumstances and particular situation.

Anti Hawking Notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

Target Market Determination: We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives, or terms and conditions. You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits. All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.

General Advice Warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au.. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement. Please consult our office to provide you with personal advice if you would like. To make an appointment please click on the link financialchoice.com.au5 million Aussies in last 4 months have gone overseas. Should you invest overseas as well?