Independent research has just been released to show the strong link between advice and retirement confidence

Seeking professional advice could lead to greater confidence in being financially prepared for retirement. But when should you retire?

If you had your time over again, would you still retire at age 65?

The employment rates of those aged 65-69, 70-74, and 75+ have been increasing for the past 20 years, especially for the 65-69 year-olds. While in 2021, over 9 per cent of the working population was aged 60 and over, the figure was only 4.5 per cent 20 years ago.

It’s not uncommon for baby boomers to continue to work well into their 60s, 70s or even 80s. Some people decide to continue working because they need the money, while others love what they do and can’t imagine not doing it anymore or just need to stay busy. With continued improvements in health care and life expectancy, people can spend as long in retirement as they spent working.

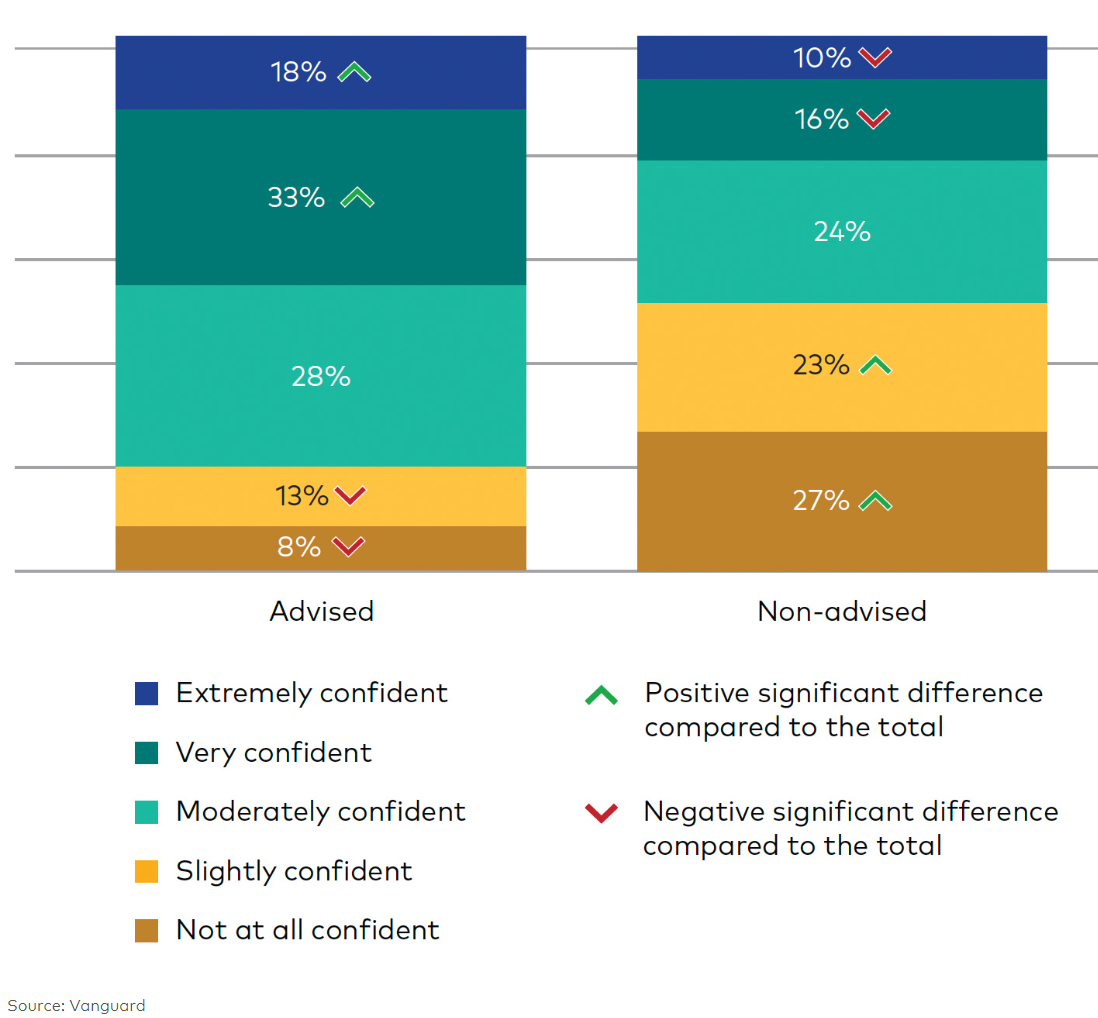

Vanguard’s inaugural How Australia Retires study has found a strong correlation between the use of a professional financial adviser and retirement confidence.

Our survey of more than 1,800 working and retired Australians aged 18 years and older found that, of the people participants who received professional financial advice, 44% indicated they were extremely confident, or very confident, in funding their retirement.

These people were also twice as likely to have a clearer, more detailed retirement plan.

But the study also found that almost 2 in 3 working-age Australians (those who did not identify as retired) have never engaged a financial adviser to help map out their retirement strategy.

And, of the Australians who have never sought any professional advice, only 25% indicated they were extremely confident, or very confident, in being able to fund their retirement.

51% of advised people are more confident

Furthermore, those who had not sought professional advice or sought only the assistance of family and friends tended to have less comprehensive retirement plans.

There were some other interesting findings from our study in terms of where some people are getting advice from.

Working-age Australians, particularly those with low retirement confidence, are much more likely to seek information from digital sources including podcasts, blogs, and social influencers.

That contrasts with retired Australians and those with high retirement confidence, who predominantly consult professional sources of guidance, such as financial advisers or their superannuation fund. Vanguard Australia’s Managing Director, Daniel Shrimski, says the study highlights both the opportunities and challenges facing Australians on their journey towards retirement.

Look, these are my priorities.

Working-age Australians who did not seek professional advice and developed their own financial plan are relatively likely to have prioritised budgeting and regular savings.

In contrast, people who have a more detailed plan from an adviser have typically taken more purposeful action to prepare for retirement, particularly in debt management and budgeting. They are more likely to make additional superannuation contributions and invest in securities and property, the study found.

In fact, contributing regularly to superannuation is a key trait of Australians who presented as having high confidence about their retirement.

Conversely, the majority of people presenting as having low retirement confidence typically did not do so.

“One of the key findings in this report is that having a well-documented and detailed financial plan is one of the most effective ways to not only achieve a successful retirement, but to alleviate the emotional burdens and anxieties that Australians can feel towards retiring.” Mr Shrimski says.

How much is enough?

When contemplating their desired yearly income during retirement, working-age Australians who are yet to retire expressed that they would like to have an income of on average $99,000 per annum (assuming today’s dollar value). Those who have already retired said that they desire on average $68,000 (in today’s dollar value) as a yearly income, significantly less than the desired income of current working-age Australians.

IMPORTANT NOTICE: You are receiving this email because you have subscribed to our services in the past and you have agreed to the terms and conditions and the privacy statement on our web site. We protect and value your data and continue to send you information that is relevant and valuable. If you are interested in any product described in our newsletters then you need to read a copy of the PDS and determine for yourself if it is appropriate to your needs, circumstances and particular situation.

Anti Hawking Notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

Target Market Determination: We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives, or terms and conditions. You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits. All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.

General Advice Warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au.. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement. Please consult our office to provide you with personal advice if you would like. To make an appointment please click on the link financialchoice.com.au