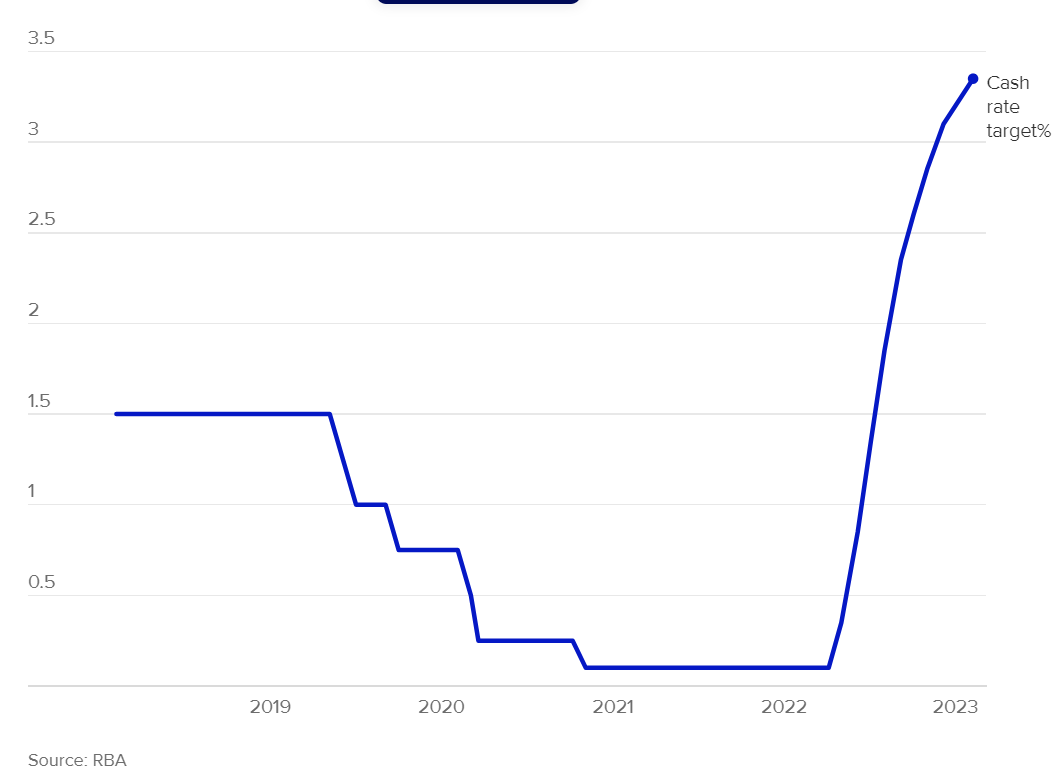

Australia’s central bank has slugged borrowers with another increase in interest rates, extending the record run of hikes to nine meetings in a row as it tries to cut inflation, and indicating there are “further increases” to come. Bill Evans, chief economists from Westpac, expects another three consecutive rate increases over the next quarter.

During it’s first board meeting of 2023 on Tuesday, The Reserve Bank raised its cash rate 25 basis points to 3.35%, its highest level in just over a decade. Most economists had predicted such an increase. “Global inflation remains very high” RBA governor Philip Lowe said in the Reserve Bank Statement.

“It is, however, moderating in response to lower energy prices, the resolution of supply-chain problems and the tightening of monetary policy,” Lowe said. “It will be some time, though, before inflation is back to target rates” of 2%-3% over time.

So what does it mean for borrowers and investors?

Firstly, it appears not all banks are putting up their interest rates for investors but they are quick to increase the rates for borrowers. All of the big four banks have now passed on the Reserve Bank of Australia’s ninth-consecutive interest rate.

Since April 2022, when interest rates were just 0.10 per cent, repayments on a $500,000 loan have increased by $969 a month or $11,628 a year.

BORROWERS

What are some strategies you can use?

The 7 tips to get through mortgage stress

1. Factor in another two rate rises into your mortgage

You should have a plan in place that you can follow if rates continue to increase. This will help you manage your budget to cover higher mortgage repayments. If you are in the early stages of taking out a mortgage, you should ask your lender or mortgage broker to help you risk-proof your home loan.

2. Ask for a rate review and see a mortgage broker

Once the rate hike is confirmed, you should contact your lender or broker and request a rate review. Lenders are still in tight competition, so you’ll likely get rate reductions if you submit a reassessment.

3. Don’t switch from variable to fixed rates just yet

Another way to protect yourself from the sudden increase is to consider fixed-rate mortgage loans. This option will lock in your repayments for a specific period to help you better manage your cash flow. With interest rates going up for the remainder of 2023, many experts are expecting rate cuts in 2024 and 2025 as inflation comes under control. It may be best to try and ride out this cycle and wait for interest rates to get back to 2019 levels

4. Find a part-time job

With the rise of the gig economy, there are many opportunities to work even in the comforts of your home. Many Australians are now earning through online work such as writing, digital marketing, graphics design, translation, language tutorials, arts and crafts, and many more.

5. Use your home as a source of income

Check if you can use your home to generate some income. Maybe you can rent a room to a Uni student or offer your storage space for rent. Some homeowners also use online platforms like Airbnb to rent out their spare bedrooms to travelers.

6. Don’t panic

While a higher mortgage repayment can strain your budget and certainly cause concern, it’s not an endgame. Make sure you consult the experts to help you set up a new plan.

7. Fix your cash flow

You’ll surely feel the effects of rising rates if your finances are in a mess. Use this uncontrollable event as a wake-up call to reassess your budget. Are you earning enough to cover your expenses? Are you spending too much above your means? Taking time to review how you earn and spend money can help you avoid mortgage default.

INVESTORS

When interest rates are rising, there are some clever strategies investors can use. This provides opportunity for investors to seek asset classes that do well during a hiking cycle.

1. Floating rate notes: As an income investment, Floating rate notes pay a coupon (interest payment) above a noted benchmark, like the Bank Bill Swap Rate (BBSW), which is an independent reference rate highly correlated to the RBA cash rate. For example, a floating note paying a coupon of BBSW+200 basis points (bps) means that the interest payment is 2% higher than the reference rate. If the RBA raises interest rates, it will be reflected in the interest payments your floating notes receive.

As the income of floating notes improve during rising interest rate cycles, it means the price of floating notes on the secondary market tend to be more stable relative to fixed bonds. Floating rate notes are available in both investment grade bonds and hybrid securities.

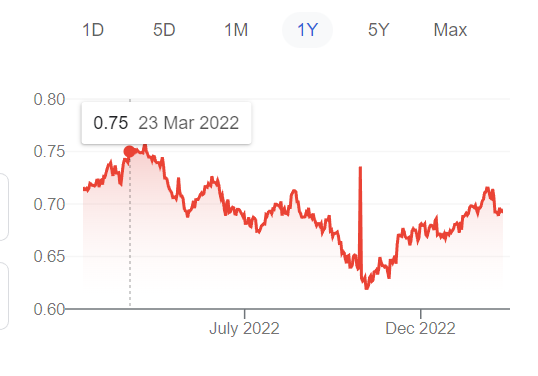

2. FX investments: Currencies generally reflect the economic and inflationary outlook for the host country, and the variation between the economic drivers of two countries can create differentials in how markets perceive the value of those currencies. For instance, if the US Federal Reserve (Fed) has a higher cash rate relative to the RBA, it generally causes the US dollar to rise in value against the Australian dollar. Currently, we are seeing the Fed hike rates more aggressively than the RBA, which is why the Australian dollar has been falling this year. For investors who believe the Fed is likely to continue to raise rates more aggressively, they can consider diversifying their currency exposure into USD.

Cash is king: Before the interest rate hiking cycle that started this year, cash was an unattractive asset to hold. This is because when rates are near zero, other investment options like shares outperform as traditional fixed income instruments like term deposits and savings accounts offering minimal return.

However, rates are moving higher, and equity markets are volatile, making fixed income an increasingly attractive asset class to hold.

For the investor, one of the key benefits of cash is that it allows you to keep some ‘powder dry’ to take advantage of opportunities that arise when growth orientated markets start trending upwards again.

Consumer warning: All investments carry a level of risk. You should consult a financial professional to determine if an investment is suitable. The above examples are for educated investors and wholesale investors.

IMPORTANT NOTICE: You are receiving this email because you have subscribed to our services in the past and you have agreed to the terms and conditions and the privacy statement on our web site. We protect and value your data and continue to send you information that is relevant and valuable. If you are interested in any product described in our newsletters then you need to read a copy of the PDS and determine for yourself if it is appropriate to your needs, circumstances and particular situation.

Anti Hawking Notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

Target Market Determination: We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives, or terms and conditions. You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits. All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.

General Advice Warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au.. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement. Please consult our office to provide you with personal advice if you would like. To make an appointment please click on the link financialchoice.com.au