You should be feeling better about your Super returns

The latest Super fund returns have just been released; how do they compare against your fund?

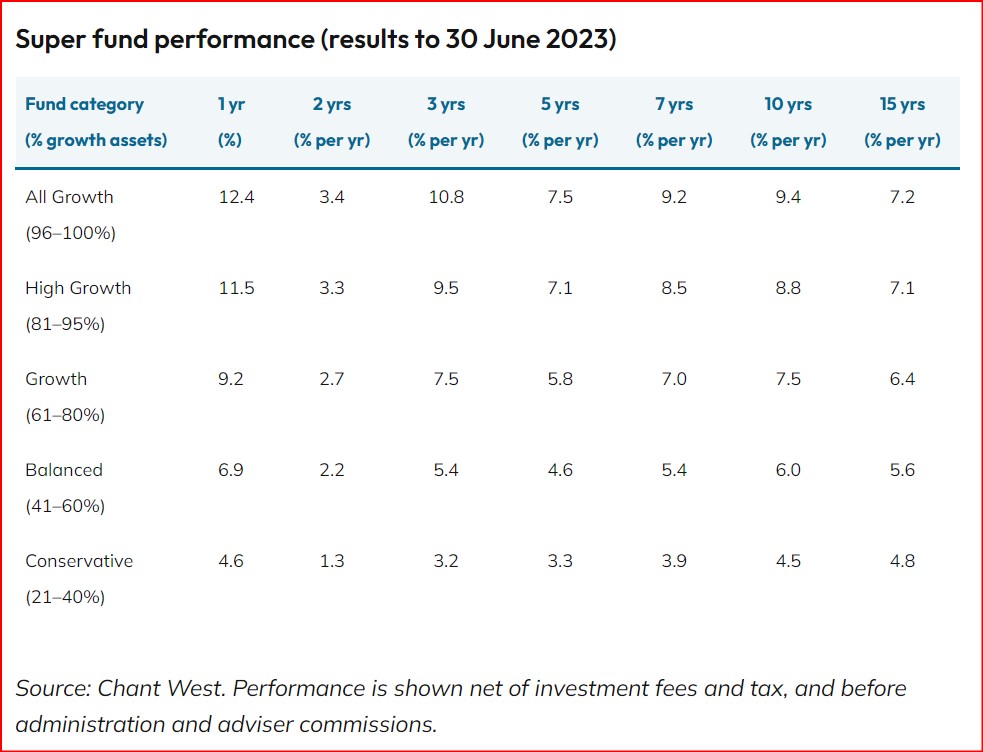

Super funds surpassed expectations in the financial year to June 2023. Against a backdrop of challenging economic conditions and high market volatility, the median Growth fund returned 9.2%, more than making up for the 3.3% fall the previous financial year.

The main drivers of the remarkable result were Australian and international shares, which returned 14.4% and 18.3% respectively over the year to June.

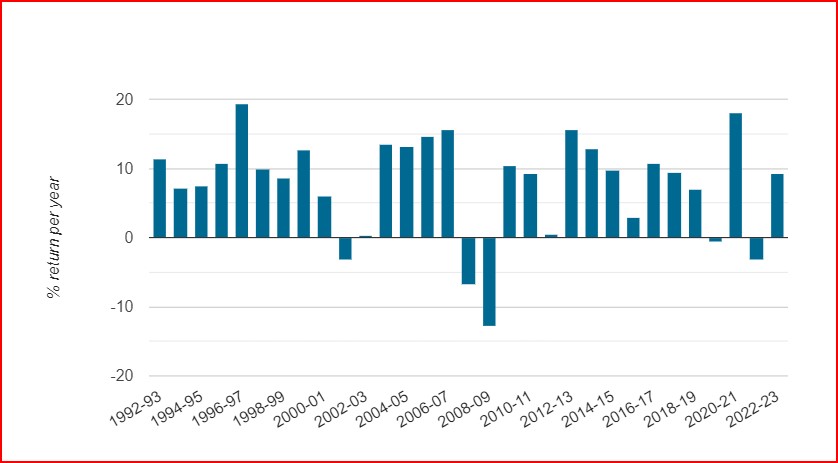

31 years of Super performance

In the year to June 2023, the median Growth returned 9.2%, the 12th positive return in 14 years and well ahead of the typical long-term objective of around 6% per year. Growth funds typically aim to post no more than one negative return every five years, which translates to six negative years over the past 31. As it happens, they have had only five, that is why your investment selection based on your investment profile is so important.

The opportunity cost of selecting a conservative portfolio over the longer term can cost your dearly.

Close to 70% of Australians with super in one of the major funds are invested in their fund’s MySuper option, the default option for employees who don’t wish to choose another super fund. Around 40% of the 69 MySuper products registered with the Australian Prudential Regulation Authority (APRA) in August 2022 were lifecycle products. This means that your investment selection becomes more conservative as you get older.

If you can whether the storm, then the outcome can be worth it

Take a look at the chart above and compare the compound return for a growth investor against a conservative investor over a 10 year period. If you were to put those figures into your compound interest calculator, you would be astounded.

Risk profiling is a process Advisers use to help determine the optimal levels of investment risk for clients. It aims to identify the risk required to meet your investment objectives, your risk capacity, and your tolerance to risk. We are currently sending out to our clients the annual risk assessment questionnaire to make sure that you are invested in the correct profile which will have a big financial impact to your long term plans.

The ability to take risks is evaluated through a review of an individual’s assets and liabilities. An individual with many assets and few liabilities has a high ability to take on risk. Conversely, an individual with few assets and high liabilities has a low ability to take on risk. For example, an individual with a well-funded superannuation account, sufficient emergency savings and insurance coverage, and additional savings and investments (with no mortgage or personal loans) likely has a high ability to take on risk.

Anti Hawking Notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

Target Market Determination: We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives, or terms and conditions. You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits. All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.

General Advice Warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au.. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement. Please consult our office to provide you with personal advice if you would like. To make an appointment please click on the link financialchoice.com.au5 million Aussies in last 4 months have gone overseas. Should you invest overseas as well?