The RBA’s decision to lift the cash rate by another 25 basis points to 4.35% will hurt small businesses relying on consumers to spend up big in the lead-up to Christmas and tip many borrowers over the edge, experts are warning.

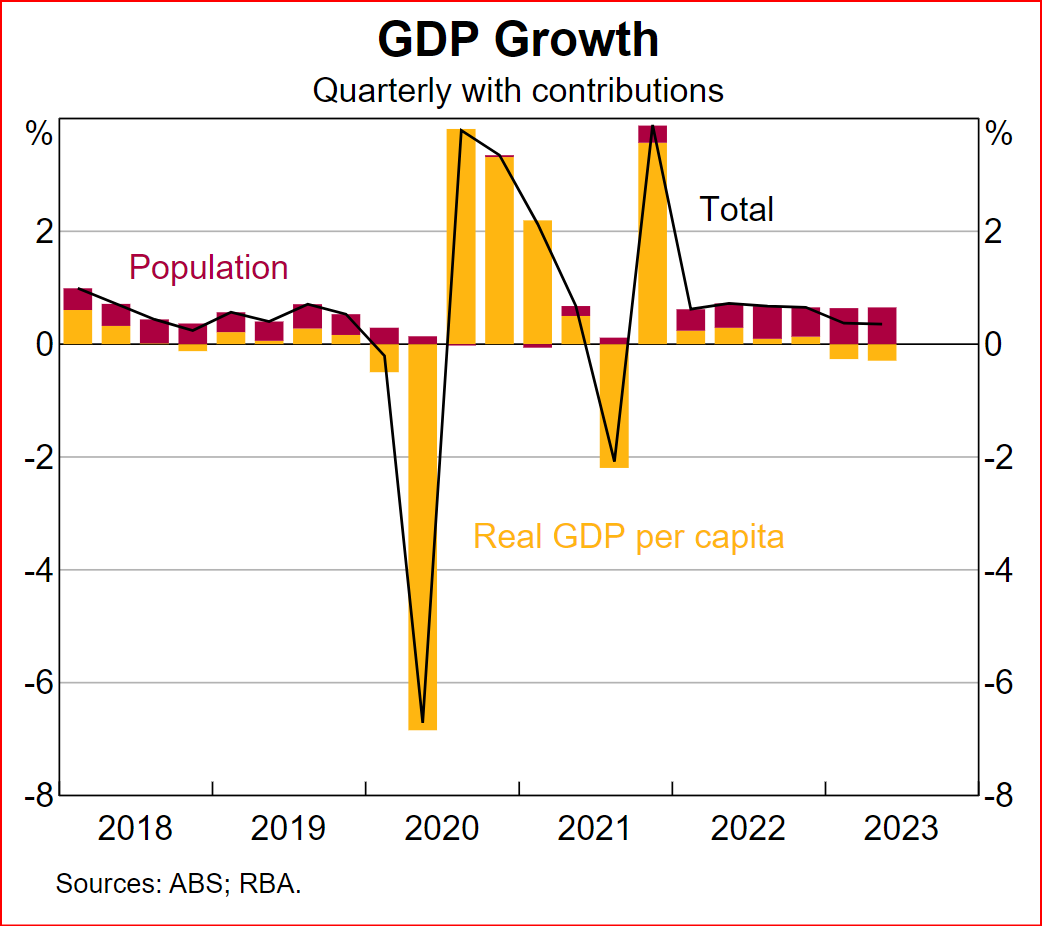

The economy is experiencing a period of below-trend growth and GDP per capita has declined further. High inflation and the significant rise in interest rates are weighing on people’s real incomes and household consumption growth is subdued, as is dwelling investment. At the same time, the ongoing rebound in international student and tourist numbers is supporting demand conditions for Australian businesses. Strong growth in public and private investment has also supported domestic activity, reflecting a large pipeline of work and an easing in supply constraints.

Business is in pretty good shape

Growth in non-mining business investment over the first half of 2023 was the strongest outcome since 2007, aside from the pandemic rebound. Investment in machinery and equipment as a share of GDP has risen to its highest level in a decade, partly reflecting the boost to vehicle sales from an unwinding of supply chain disruptions. Non-residential construction has also increased strongly; very low vacancy rates and a large increase in rents for industrial property have led to a strong pick-up in industrial building activity.

Australia’s economic growth is slowing.

Growth in the Australian economy has slowed over the first half of 2023 and GDP per capita has declined. It has been less pronounced than a few months ago.

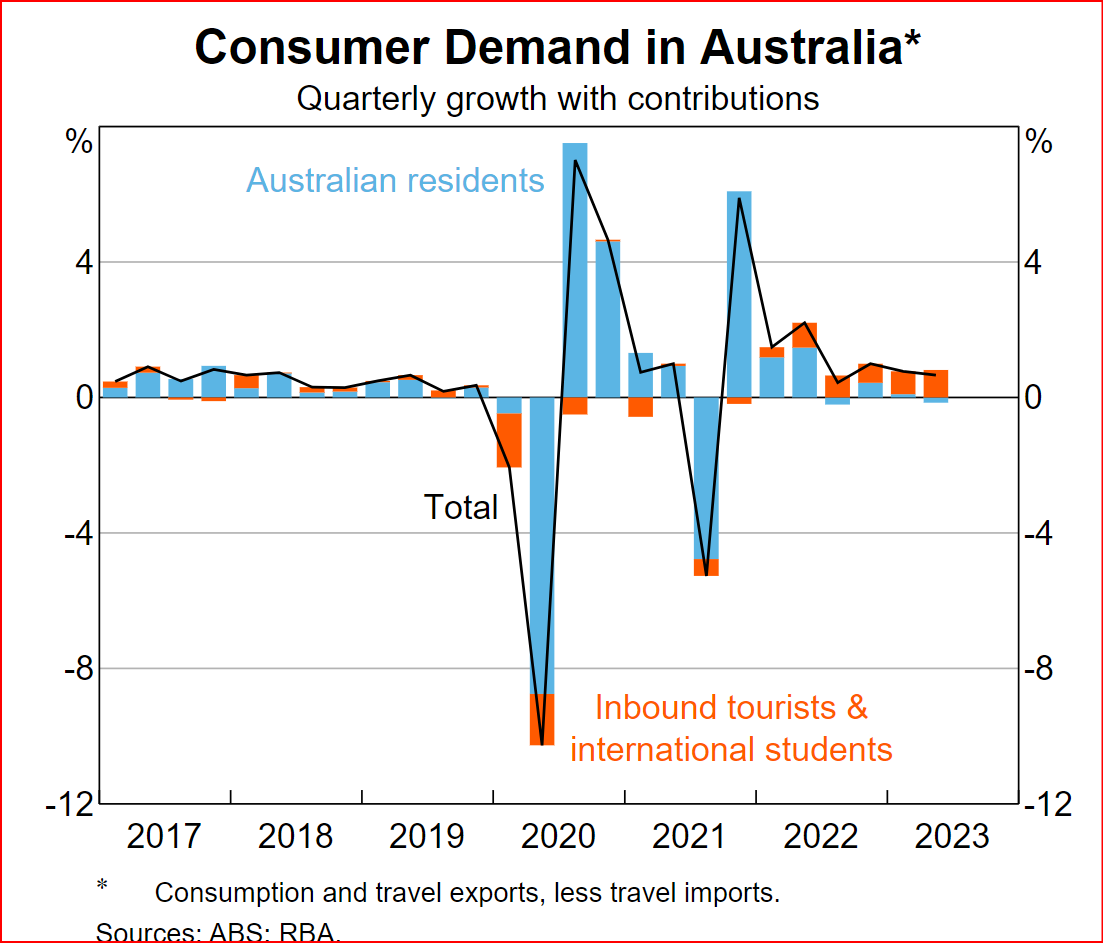

Household consumption growth has been subdued in recent quarters and per capita consumption has declined slightly. The slowdown in growth has been driven by discretionary categories, while growth in the consumption of essential goods and services has remained steady. Sales of new cars have continued to grow strongly, supported by the delivery of orders that were placed several months earlier as supply constraints have eased. Retail sales and other timely indicators suggest that household consumption growth remained subdued in the September quarter, although growth is expected to have picked up compared with the June quarter.

Are we heading for a soft landing?

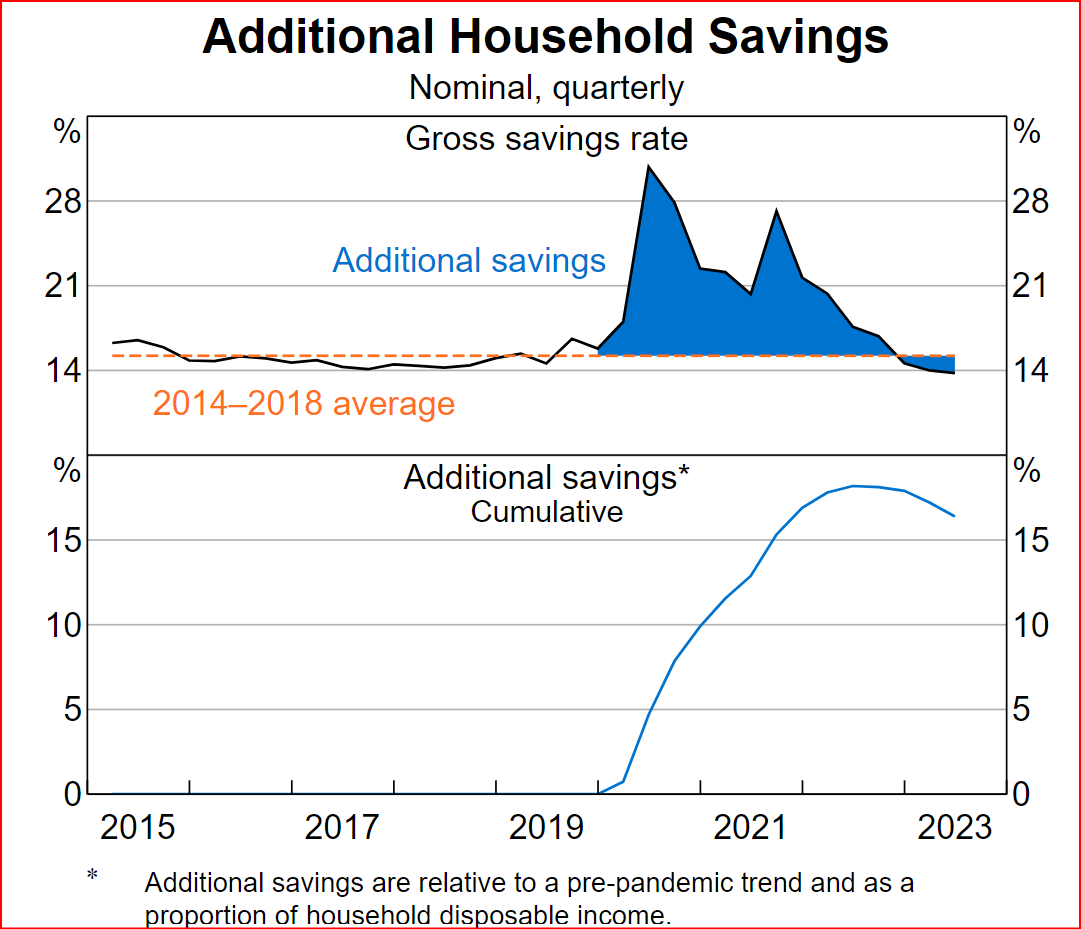

The pressure on household budgets has seen the household saving ratio decline further below pre-pandemic levels. For households with a mortgage, extra mortgage payments (beyond scheduled payments) in recent quarters have been slightly lower than the pre-pandemic average. The savings amounts held by Australians is slowly getting used to bridge the gap between price rises and stagnant incomes.

More broadly, there has been a small drawing down of the additional savings accumulated during the pandemic in recent quarters, as measured by the deviation of the savings rate from its pre-pandemic average (Graph 2.10). The extent to which households draw down on their savings to smooth consumption remains a key uncertainty for the consumption outlook.

Thank goodness for students!!

While the growth of consumption by permanent residents has been weak, growth of total consumer spending in Australia – which includes spending by temporary residents – remains around its pre-pandemic average. This has supported demand conditions for Australian businesses. In particular, total spending has been supported by strong growth in international students and tourists over the past year. This includes a large contribution from Chinese tourists and students since the start of 2023, despite a slowing economic recovery in China.

Total spending, rather than consumption, determines the demand conditions that feed into the price-setting behaviour of consumer-facing firms. However, an increase in international students also supports the supply side of the economy as many students participate in the labour force.

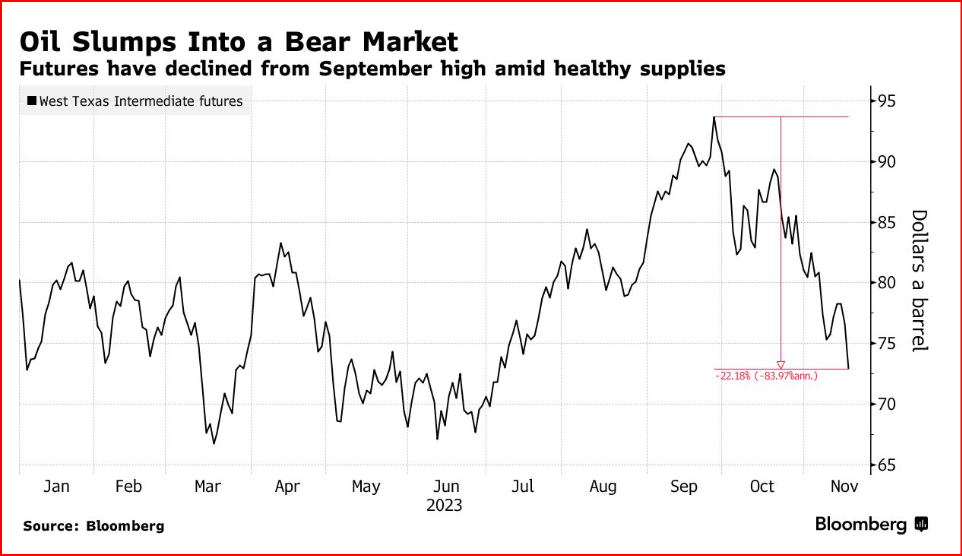

Oil. A key part of inflation

Oil headed for a fourth weekly loss after sinking into a bear market as signs of healthy supplies and rising stockpiles offset attempts by OPEC+ leaders Saudi Arabia and Russia to keep declines in check.

There have also been some clouds on the demand horizon. Figures from China, the world’s largest importer of crude, showed that refiners of oil cut daily processing rates in October as trending oil production fell from a month earlier. Meanwhile, US unemployment benefits rose to the highest level in almost two years, signaling a slowdown in the world’s biggest crude consumer.

The final point-house prices

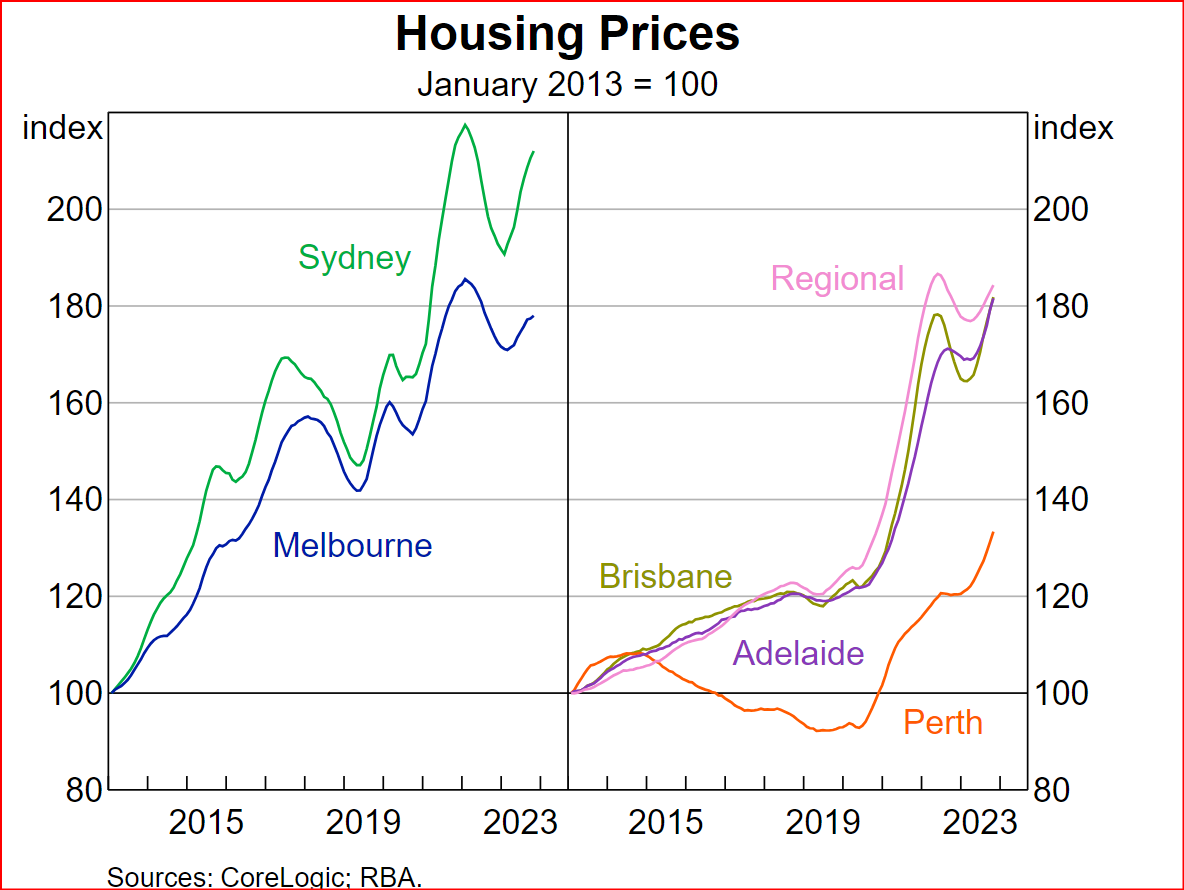

In amongst all the doom and gloom, house prices have recovered despite interest rate increases. National housing prices have increased strongly over the past six months to be around their April 2022 peak. Recent increases have been broadly based across capital cities and regional areas and have underpinned a rebound in household wealth. The rebound in housing prices reflects a combination of stronger demand for established housing, partly due to strong population growth, and ongoing limited supply of dwellings. Housing turnover and overall residential listings remain below long-run average levels.

What about Renters

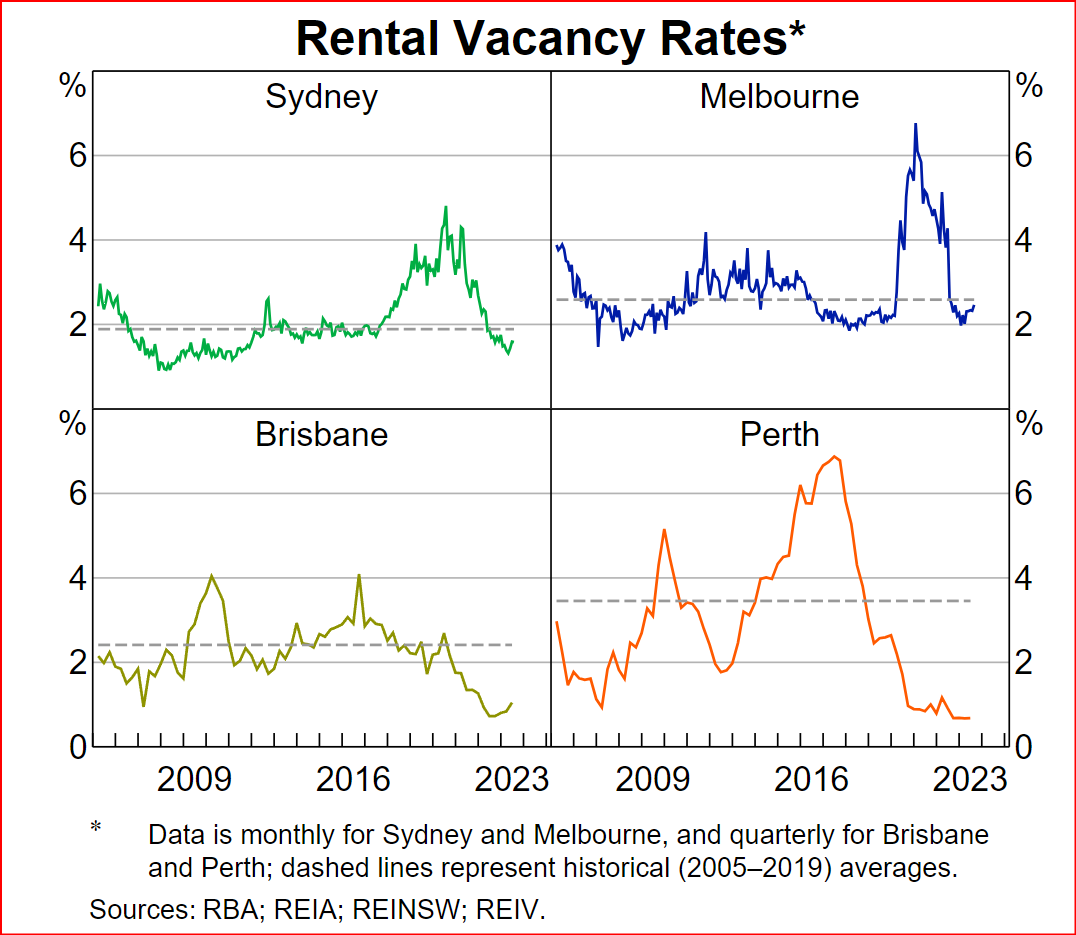

Rental vacancy rates remain very low, particularly in smaller capital cities. Advertised rents (for new leases) are 30 per cent higher than pre-pandemic levels, but the pace of growth in advertised rents has slowed, particularly in regional areas.

Despite the easing in advertised rents growth, inflation for the stock of rentals captured in the CPI (which covers capital cities but not regional areas) increased by almost 8 per cent over the year to September and is expected to increase further.

Rents on new leases flow through to rent inflation in the CPI with a lag because only a small share of the stock of rental properties update leases in a given month.

Anti Hawking Notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

Target Market Determination: We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives, or terms and conditions. You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits. All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.

General Advice Warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au.. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement. Please consult our office to provide you with personal advice if you would like. To make an appointment please click on the link financialchoice.com.au5 million Aussies in last 4 months have gone overseas. Should you invest overseas as well?