What were incomes and houses in 1975?

Many investors think that when it comes to investing in Australia you can’t go past the old residential property market. Everything seems to be tilted in it’s favour. At the moment, with the interest rate cliff looming and talk from state governments to put restrictions on rental increases and increasing stamp duty, the market is in a state of flux. One thing everyone can agree on though, and that is there are not enough houses to accommodate our growing population. Should investors continue to invest in this asset class or are there better options elsewhere?

It helps if we take a look back to 1975 when interest rates were double digits and income was rising to accommodate inflation.

In 1975, the median employee earned $6448 per year. In the 47 years since then, wages have grown by about 5 per cent annually, taking median employee income to where it is today. The median Australian employee earned $65,000 in 2022, according to the Australian Bureau of Statistics. This figure captures both full-time workers and part-time workers.

So while earnings have gone up by almost tenfold since 1975, house prices have gone up by more than thirty fold in that same period of time.

Turn the clock forward to 2019 and according to CoreLogic the average price of houses were;

- Sydney: $866,524

- Melbourne: $709,092

- Brisbane: $533,133

- Adelaide: $465,266

- Perth: $458,137

- Canberra: $656,943

- Hobart: $484,716

- Darwin: $461,033

How very different is the world of 2023

According to the Australian Bureau of Statistics (ABS), Victoria saw a 73.92% increase in house values over ten years, with an annual percent change of 5.86% up to June 2022.

Australia has a well-known love affair with property and many Australians hold a firm belief that its value never goes down. However, not everyone has the minimum amount needed to place a deposit on a property and secure a mortgage. This has many people wondering if it makes more sense to invest in the sharemarket or dive into property? Despite the modern dynamics, this is an age-old debate.

Potential for growth

Both investments offer the potential to grow in value over time.

A 2015 research paper from the Federal Reserve of San Francisco titled The Rate of Return on Everything looked at nearly 150 years of data to uncover very long term returns across a range of asset classes and geographies. Australian housing returned 6.37% p.a. in real terms over the full sample of data, while equities returned 7.81% p.a. Looking at just the data since 1950, housing performed better, returning 8.29% p.a. vs 7.57% p.a. for equities. However, looking at just the more modern series since 1980, the pendulum swung back the other way with equities returning 8.78% p.a. vs 7.16% p.a. for housing.

Comparisons have their limitations, of course. Returns can vary according to the timeframe selected and you can break property down into different regions, or equities into various sectors. It’s important to keep in mind there have been periods of boom and bust for both asset classes. Returns change further once gearing and costs are introduced into the equation. Also, it’s important to keep in mind past performance is not indicative of future performance.

Regardless of how you cut the data though, it’s clear that both equities and property have produced attractive long-term returns.

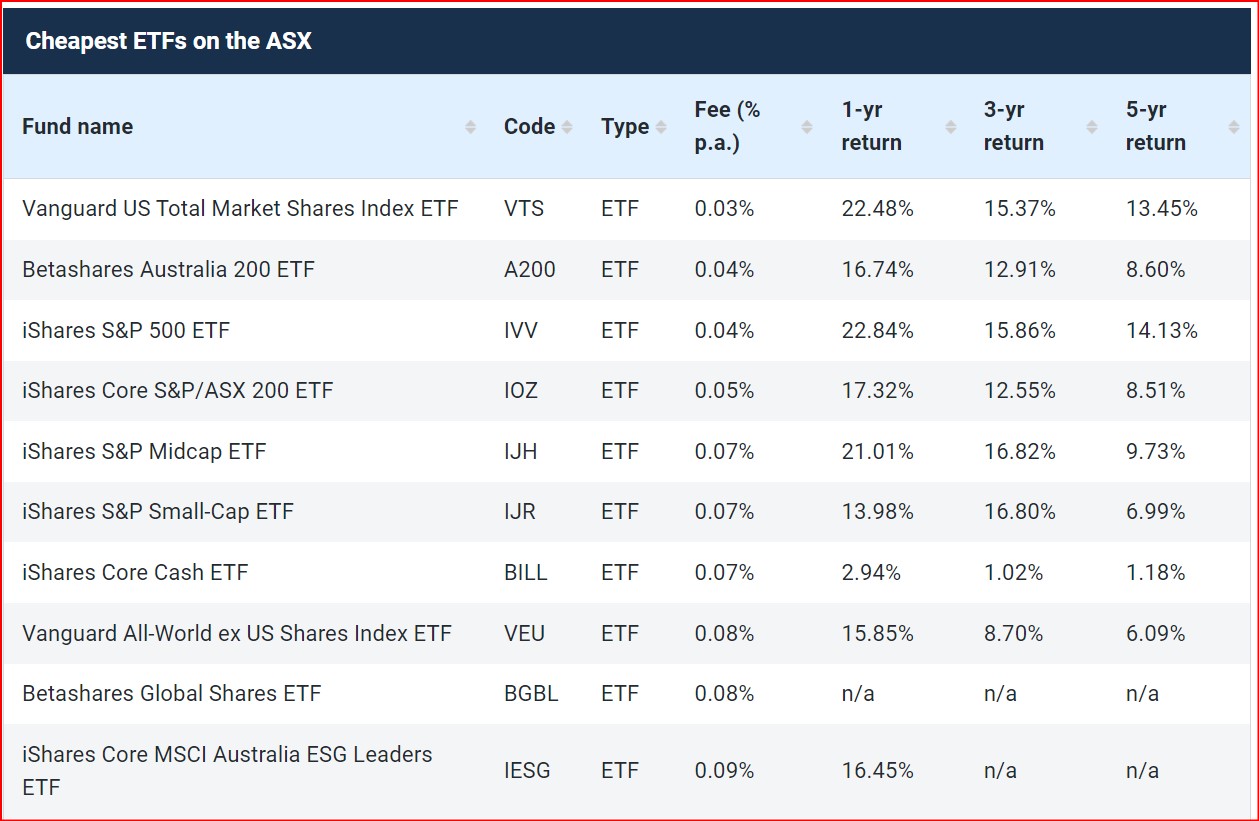

The 10 lowest cost ETF’s in Australia

How can I get access to these low cost investment products?

You can access these low cost ETF’s via your self managed super fund with help from a licensed financial planner. Remember a tailored portfolio is best if you want to even out the volatility.

Anti Hawking Notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

Target Market Determination: We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives, or terms and conditions. You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits. All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.

General Advice Warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au.. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement. Please consult our office to provide you with personal advice if you would like. To make an appointment please click on the link financialchoice.com.au5 million Aussies in last 4 months have gone overseas. Should you invest overseas as well?