Employment is cooling and so is where you work

Work is now a thing we do, not a place we go. Offices play a role, but not the central one they’ve held for decades.

Can employers force you to return to the office? The hybrid model seems to be the future

Zoom, the videoconferencing company whose fortunes soared with the pandemic-driven shift to working from home, has reportedly told its staff to get back to the office — for at least two days a week, if the commute is no more than 80 kilometres.

It’s part of a trend of employers winding back the work-from-home flexibility that enabled most to keep operating through the pandemic in 2020 and 2021.

In Australia, close to 90 per cent of employers have implemented mandatory in-office days, according to a survey of 300 hiring managers commissioned by recruitment agency Robert Half.

Particularly for parents and younger workers, working from home is not something they will readily give up.

More than half of business leaders in multiple countries surveyed by McKinsey & Co. expect remote work to increase in the future, and when given the option to work remotely, most Americans take it.

A direction to return to the workplace will be lawful and reasonable except in extreme cases — for example, where it is contrary to a government directive or another law.

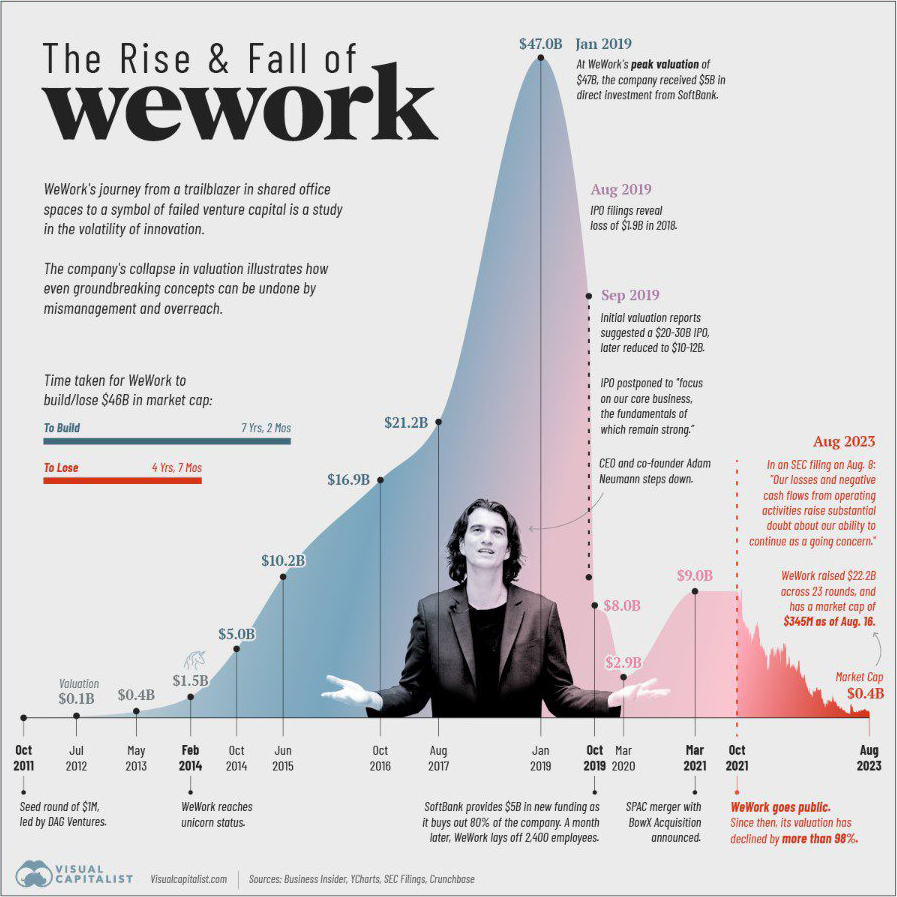

We Work – what happened

Office-leasing leviathan We Work told investors last week that it had “substantial doubt” it could remain in business as customers continued to bail. The once buzzy biz said it lost nearly $400M last quarter, and the stock’s plunged 99%. It’s a far cry from 2019, when We Work was valued at $47B and occupied more office space in Manhattan and London than any other company. If We Work stops paying its landlords, they might struggle to pay their debts.

This is not just a We Work problem. The flow on to Commercial Property

A US and global commercial real estate crisis is brewing. Over seventy percent of US employers are hybrid, (working at least in part from home) and surveys suggest flexible work is here to stay. Now some analysts predict a 35% drop in office values by up to 2025. This will have a profound impact on retirement savings and unlisted assets that are in superannuation funds.

Already, in the US forced sales of commercial properties spiked in the first quarter of 2023 (owners couldn’t make mortgage payments), and office-loan delinquencies hit 5%. The one-two punch of lower occupancy plus higher interest payments could bring about even more trouble. Morgan Stanley estimated that $1.5Trillion US in commercial real estate debt will come due in the next two years. That is an alarming statistic.

If you work from home don’t forget the tax deductions

To claim working from home expenses, you must:

- be working from home to fulfil your employment duties, not just carrying out minimal tasks, such as occasionally checking emails or taking calls

- incur additional running expenses as a result of working from home

- have records that show you incur these expenses

- Where you incur running expenses for both private and work purposes, you need to apportion your deduction. You can only claim the work-related portion as a deduction. Running expenses relate to the use of facilities within your home. These expenses are generally considered private and domestic expenses. You can claim a deduction for additional running expenses you incur as a direct result of working from home.

Additional running expenses may include:

- electricity or gas (energy expenses) for heating or cooling and lighting

- home and mobile internet or data expenses

- mobile and home phone expenses

- stationery and office supplies

- the decline in value of depreciating assets you use for work – for example:

– office furniture such as chairs and desks

– equipment such as computers, laptops and software - the repairs and maintenance to depreciating assets.

In limited circumstances where you have a dedicated home office, you may also be able to claim:

- occupancy expenses (such as mortgage interest or rent)

- cleaning expenses.

What you can’t claim

You can’t claim a deduction for:

- coffee, tea, milk and other general household items, even if your employer may provide these at work

- costs that relate to your children’s education, such as equipment you buy – for example, iPads and desks, subscriptions for online learning

- items your employer provides – for example, a laptop or a mobile phone

- expenses where your employer reimburses you for the cost.

Source ATO web site https://www.ato.gov.au/individuals/income-deductions-offsets-and-records/deductions-you-can-claim/working-from-home-expenses/

Anti Hawking Notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

Target Market Determination: We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives, or terms and conditions. You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits. All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.

General Advice Warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au.. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement. Please consult our office to provide you with personal advice if you would like. To make an appointment please click on the link financialchoice.com.au5 million Aussies in last 4 months have gone overseas. Should you invest overseas as well?