Why financial advice is a valuable commodity

A recent ASIC report noted that 2.6 million Australians are currently paying for financial advice however 10.25 million Australians would like to receive financial advice at some time in the future. Instead of helping you actually beat the market, financial advisors serve more as a coach and counselor, talking you through the tough times and persuading you not to make emotion-based decisions.

Making financial decisions based on emotions rather than rational analysis can lead to poor outcomes. Impulsive spending, chasing investment trends, or letting fear drive investment decisions can hinder financial planning efforts. Most millionaires likely use some type of financial advisor to grow and protect their wealth.

A big shake up by the government

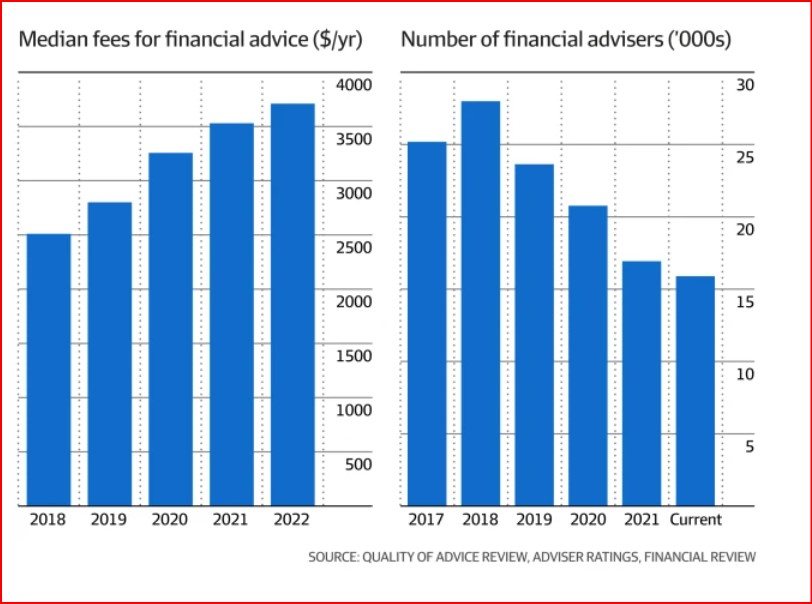

We need to address the exiting of thousands of financial advisers from the Industry because just when they need it most, Australians, amid a cost of living crisis economy and demographic wave in which millions of Baby Boomers, are expected to retire over the next few years.

Many advisers may have left prematurely because they were unwilling or unable to cope with the mountainous red tape ushered in by the damning Royal Commission inquiry. Others would or could not cop the mandatory education standards introduced by the federal government, which included forcing the ageing workforce to obtain a mandatory multi-year tertiary degree.

With so many mature and experienced financial advisers leaving the Industry, the current government has moved quickly to try and reverse the trend and make it easier and more affordable for consumers to get advice.

16% of Australian adults, the equivalent of 3,200,000 people, have a financial adviser helping them navigate the complexities of money management. The Levy review commissioned by the Government of the da, recommends that advisers only be required to keep internal records of advice provided, and hand them to clients only upon request. It also recommends scrapping fee disclosure statements – a separate lengthy document sent to clients at least once a year setting out charges.

Why Australians need financial advice

Wealth Data estimates that the average adviser had about $88 million in client assets under advice in December 2018. This figure more than doubled to about $205 million at the end of 2022. Australians are paying a median annual fee of $3710 for financial advice.

An estimated 5 million Australians are expected to retire between 2021 and 2027. Most of them – especially middle income earners – will retire on a mix of superannuation, personal savings and investments or the equity in their home, rather than fully self-funding or relying on the age pension or government welfare. That means they face difficult decisions such as how to draw down their superannuation savings, whether they should downsize to a smaller home (and take advantage of some government incentives) or adjust the level of risk and mix of assets in their investment portfolio, just to name a few. Those are the kinds of questions qualified financial advisers are best placed to answer.

What is the role of social media

The gap between demand for advice and its availability is believed to be fuelling the emergence of social media influencers who talk about investments and recommend financial products – known as “finfluencers” – without necessarily being qualified to do so. The Federal Court has found social media ‘finfluencer’ Tyson Robert Scholz contravened s911A of the Corporations Act by carrying on a financial service business (between March 2020 and November 2021) without an Australian financial services licence.

Mr Scholz’s business to paying subscribers included:

- subscription/membership fees of $500, $1,000 or $1,500

- offers of various levels of share trading training, referred to as ‘Stage 1’, and ‘Stage 3’ packages, which were marketed as introductory or advanced seminars

- offers of individual one-off share trading suggestions, or tips for a fee

- the Stage 2 package providing one year’s access to a private chat site, named ‘Black Wolf Pit’, using the online communications platform Discord.

ASIC Deputy Chair Sarah Court said, ‘ASIC has warned those who discuss financial products and services on social media that they could be the subject of enforcement action if they are carrying on a business of providing financial services without a licence.

‘Financial services laws exist to protect investors if something goes wrong. The individuals who paid Mr Scholz for his tips, to attend seminars or access private online forums, as well as those individuals who purchased shares based on his recommendations or statements of opinion, did not have the benefit of these protections.’

Final point

The benefits of paying for advice and the net gains have been well documented. I personally think the future is very bright for the Wealth Management Industry and the affordability of making compliance and alternative ways to deliver advice like Robo advice of scaled advice will benefit everyone.

Anti Hawking Notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

Target Market Determination: We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives, or terms and conditions. You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits. All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.

General Advice Warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au.. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement. Please consult our office to provide you with personal advice if you would like. To make an appointment please click on the link financialchoice.com.au5 million Aussies in last 4 months have gone overseas. Should you invest overseas as well?