It’s Russell Medcraft here and welcome to another edition of our weekly newsletter. This week is very special because we are launching our new Financial Choice Direct Portfolios website and platform to make it easier and cheaper for investors to access our tailored portfolios of ETF’s.

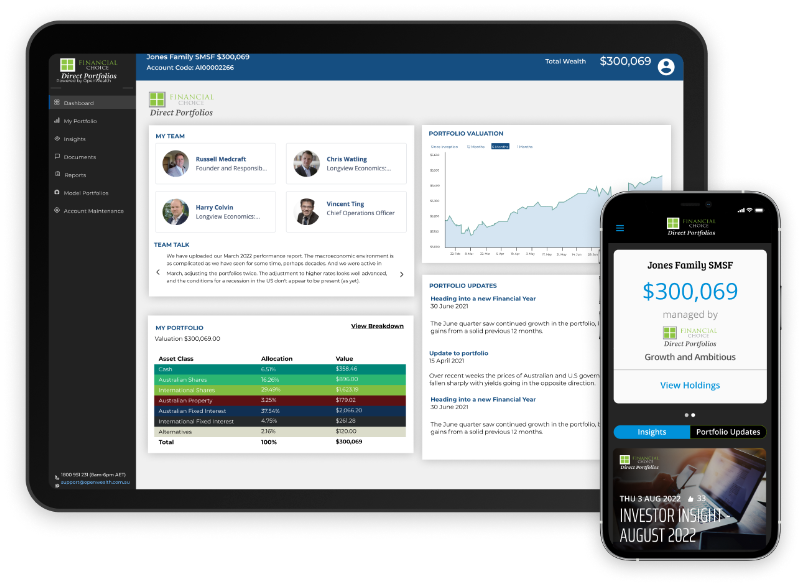

Our new online investing solution, designed specifically for people wanting an easy-to-use and low-cost way to access our suite of Investment Portfolios, offers some real benefits like fully researched ETF’s by Morningstar, no brokerage fees for the buys and sells and an App that helps you track your portfolio. Start with as little as $10,000 and add to your portfolio on a monthly basis. This is a real cost effective way to save.

For active investors and SMSF’s we have reduced fees for all portfolios over $1,000,000.

Simply visit our website, select one of our 5 ready-made investment portfolios, and complete the short account-opening process.

How simple is that!

Benefits of Financial Choice Direct

- Open an account directly from our website in 5 minutes

- Invest from as little as $10,000

- Choose from 5 portfolios, all diversified across different asset classes and covering a range of investment outcomes

- Track your portfolio 24/7 via your Investor Portal or Mobile App

- Stay fully informed with regular portfolio and market updates from our Investment Team

- Ideal for those not requiring personal financial advice but wishing to set up a hassle-free investment portfolio

- All for a low 0.75% Management Fee with zero brokerage. ( For further information about our portfolios and fees, please read the Investment Menu)

Watch our short 2-minute video to find out more.

Please visit our website financialchoicedirect.com.au for further information or contact us on 1300 664 118.

Anti Hawking Notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

Target Market Determination: We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives, or terms and conditions. You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits. All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.

General Advice Warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au.. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement. Please consult our office to provide you with personal advice if you would like. To make an appointment please click on the link financialchoice.com.au5 million Aussies in last 4 months have gone overseas. Should you invest overseas as well?