I had a Zoom meeting late last night with our asset consultant and economist in London, Chris Watling, the founder and chief strategist from Longview Economics. Chris is highly respected around the world as an economics commentator and is a member of our policy committee which provides us with strategic asset allocation advice in the construction of our client model portfolios.

This is an overview of all that he considers important to determine whether the U.S and the world will fall into a recession as a result of what’s happening to Interest rates, inflation and the energy crisis due to the war in Ukraine.

US Recession or Mid-Cycle Slowdown?

The debate about the US economy is deeply divided; on one side of the debate, the bears are pointing to a number of factors/indicators which suggest that there is a high likelihood of a recession (i.e. in the next 3 – 12 months).

They highlight, for example, the collapse in business and consumer confidence. The yield curve inversion and oil price spike, the squeeze on corporate earnings and real incomes from higher inflation, as well as the tightening of US federal policy from higher interest rates and quantitative tightening.

On the other side, many are pointing to the U.S economy in the middle of a mid-cycle soft patch. This is centered around a) some soft manufacturing data and drawdown of stockpiled inventory from 2021 and b) softening of housing activity bought about by higher interest rates. In other words, having grown rapidly in 2021, the U.S economy is (unsurprisingly) slowing and is now in a classic mid-cycle slowdown similar to that of 2012 and 2015. How inflation behaves in Q2 will be critical and last Friday’s higher than expected number sent the market into a tailspin.

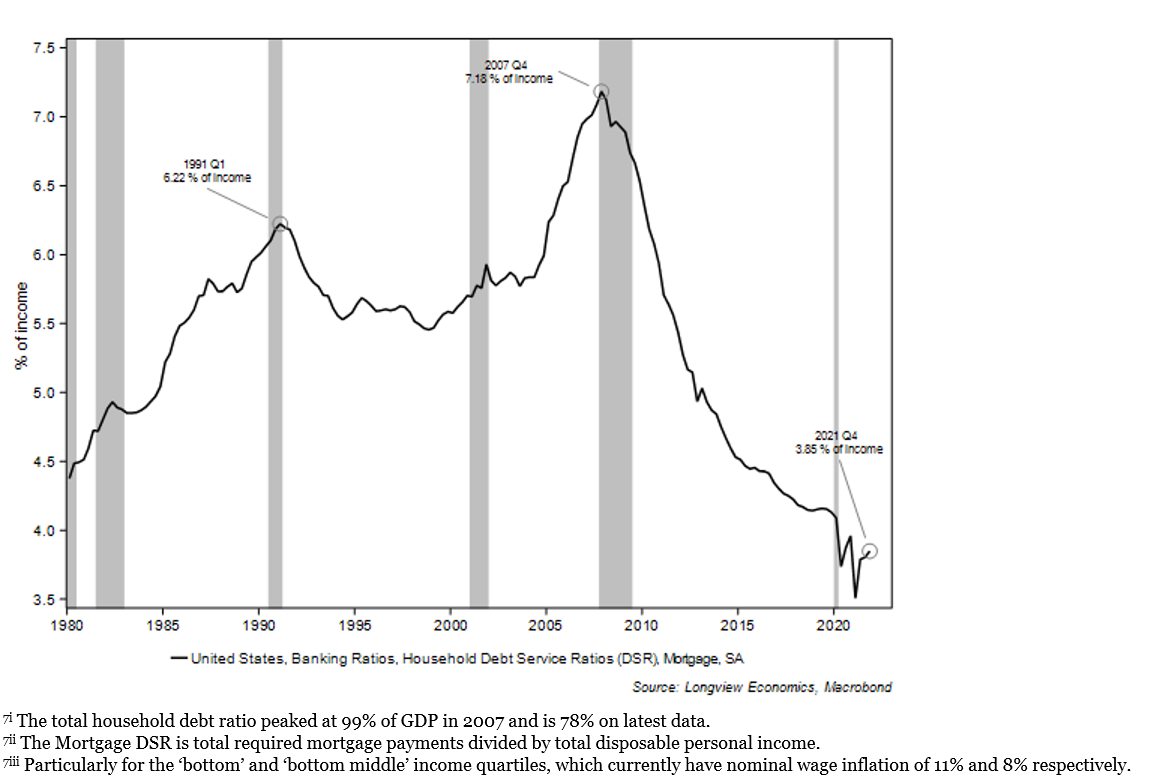

In fact the signs are early but an easing of inflation and money supply is easing which which typically signals falls in inflation readings. Also, the mortgage serviceability rates are able to absorb the increases in interest rates and the wealth affect of higher house prices and low unemployment globally, meaning households will still have an appetite to borrow and spend well into the next year.

Household debt service ratio for mortgages (% of income)

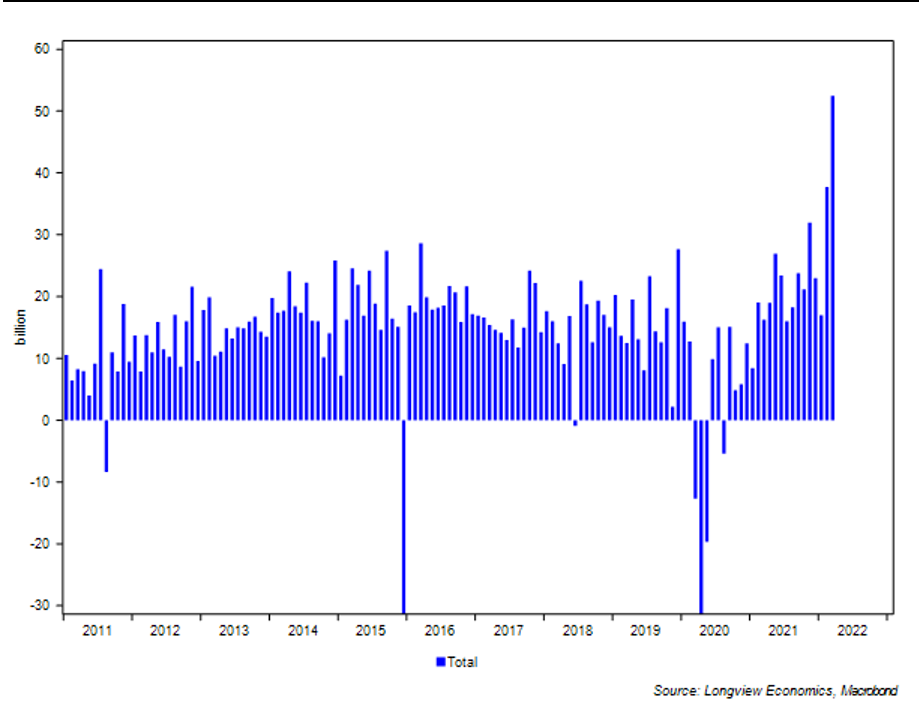

Commercial banks and credit conditions are healthy

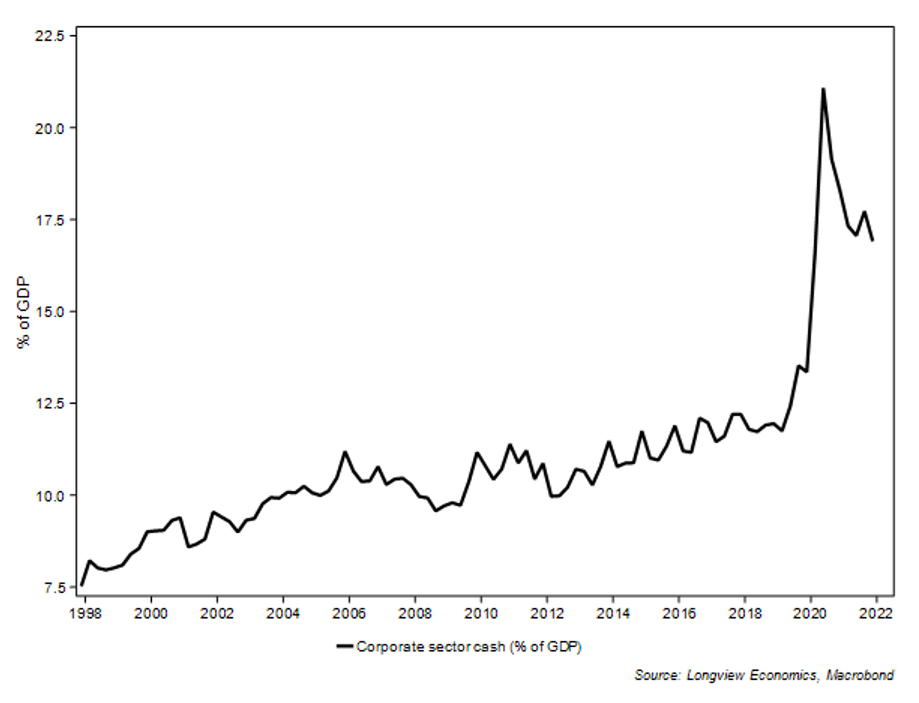

U.S corporate cash levels and cash flow is in good health.

Overall the recession risk is still low as indicated by Longview economics warning signs.

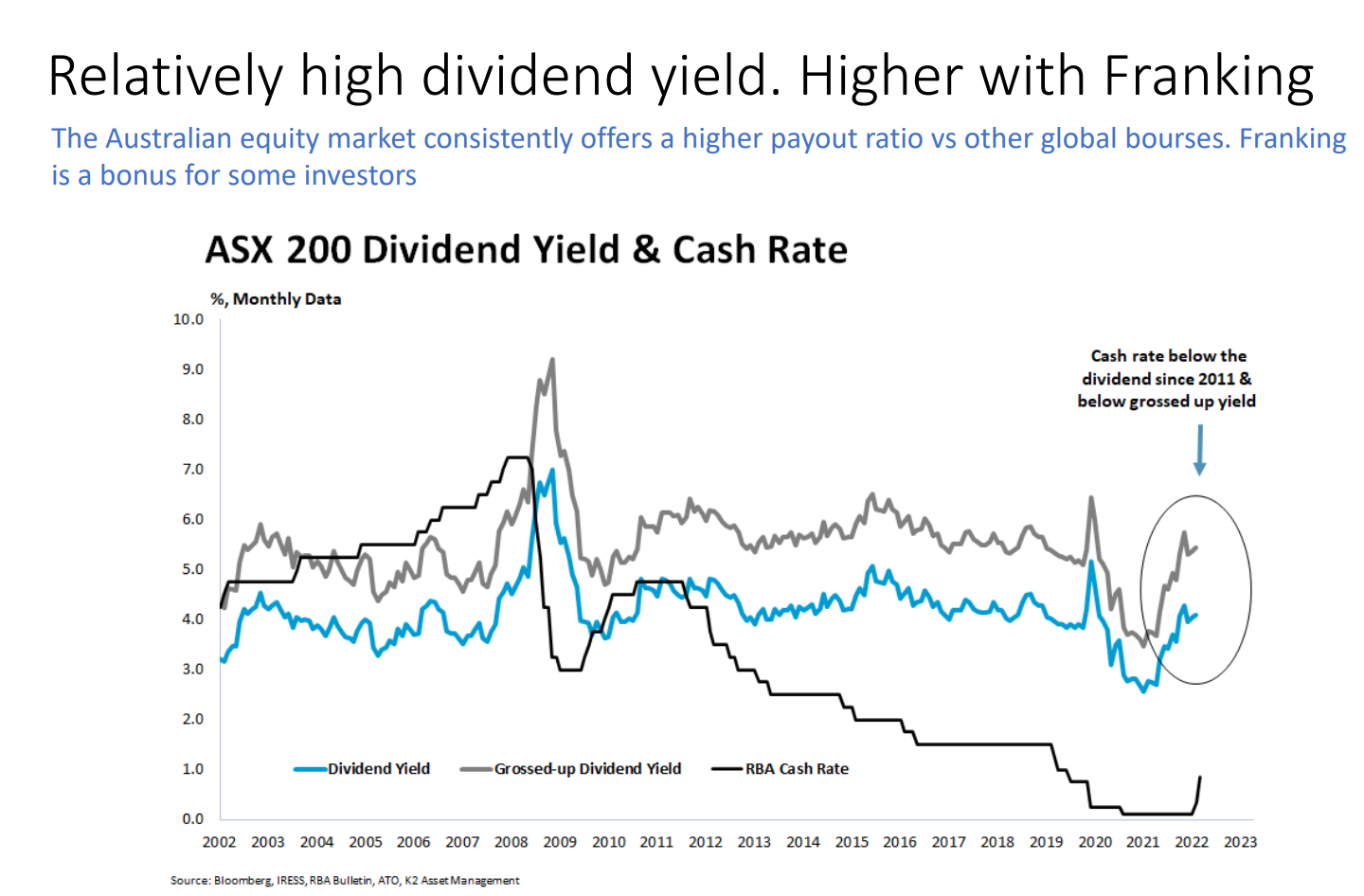

What about Australia and the opportunities

Australia is set for a record dividend payout ratio as a result of share price weakness and will certainly go toward helping investors recover in the near term. Longview Economics expect a short term rally in share prices which will make the combination of share price increases and dividend payments an attractive incentive to stay invested.

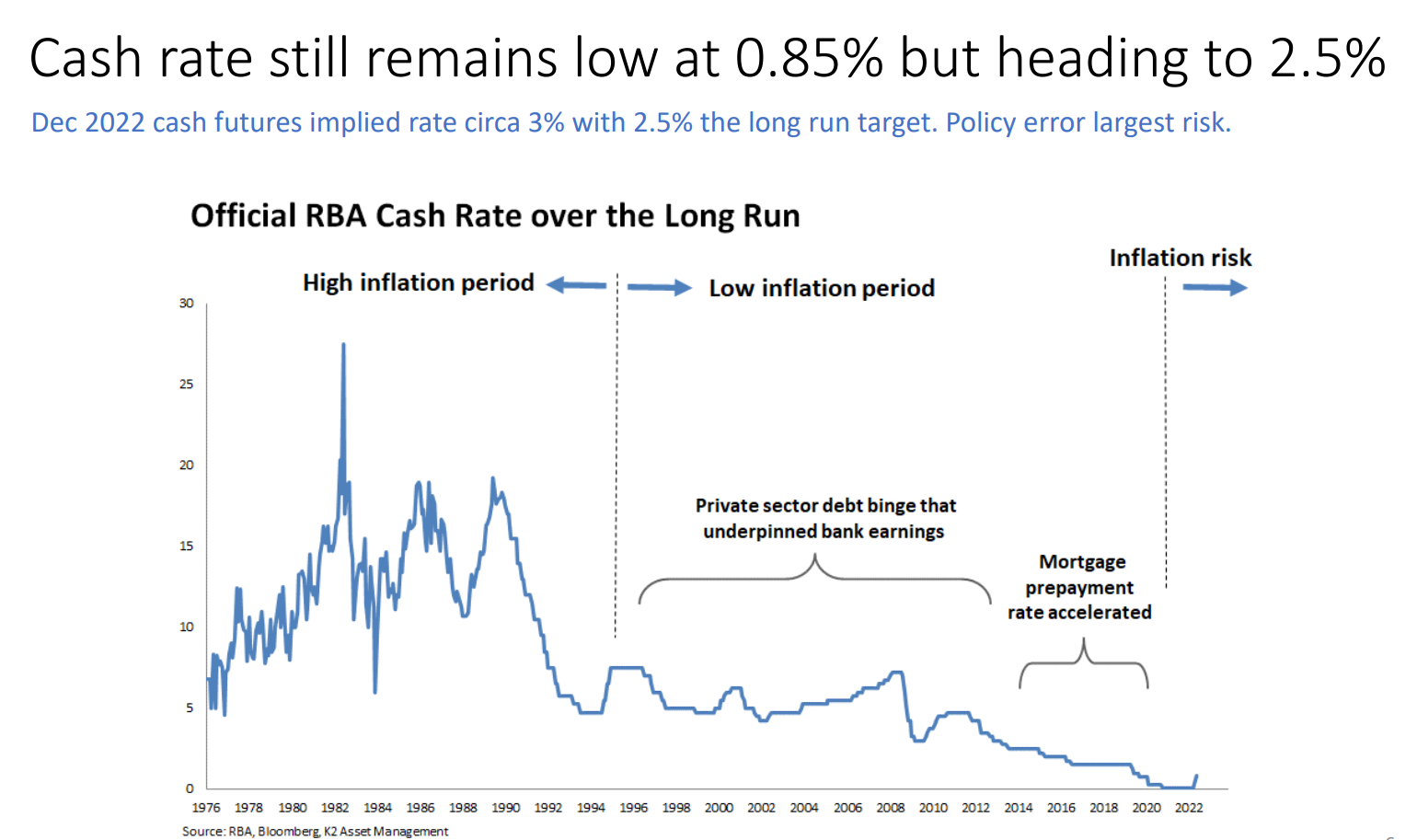

What about interest rates. How far will the RBA go?

George Boubouras, from K2 Asset Management, is confident that there will be some interest rate cuts once inflation increases are curtailed. At present, from the above graph, you can see that many homeowners prepaid their mortgage when interest rates were being cut and will not have any problem with meeting the interest rate increases if they remain at the same repayments as 2018.

What is a good plan to adopt when the next crash occurs

PART 1. Always be prepared for another correction/crash

The biggest gains from market dislocations are born before the crash even begins, but that doesn’t mean you should try to predict recessions and sell in advance. At this stage, you should be putting together a plan for what you’ll do when (not if) there is another market crash. This can be either setting up a buying plan of cheap oversold shares or ETF’s, or taking the opportunity of changing your risk profile.

PART 2. Don’t sell at or near the bottom

When markets do begin to crash, emotions will quickly become elevated. The first thing to do is STAY CALM. What seemed like a good idea in the calm of a bull market, might suddenly seem folly when markets are in freefall. Now is the time to pull out those watch lists of shares or ETF’s that you were considering before the crash. Have a good look at everything on your list and prioritise after considering any recent developments in that thematic, e.g. Lithium Green, Geography U.S, Europe, Asia or Asset Class, Property, Infrastructure, Bonds.

PART 3. The long road back

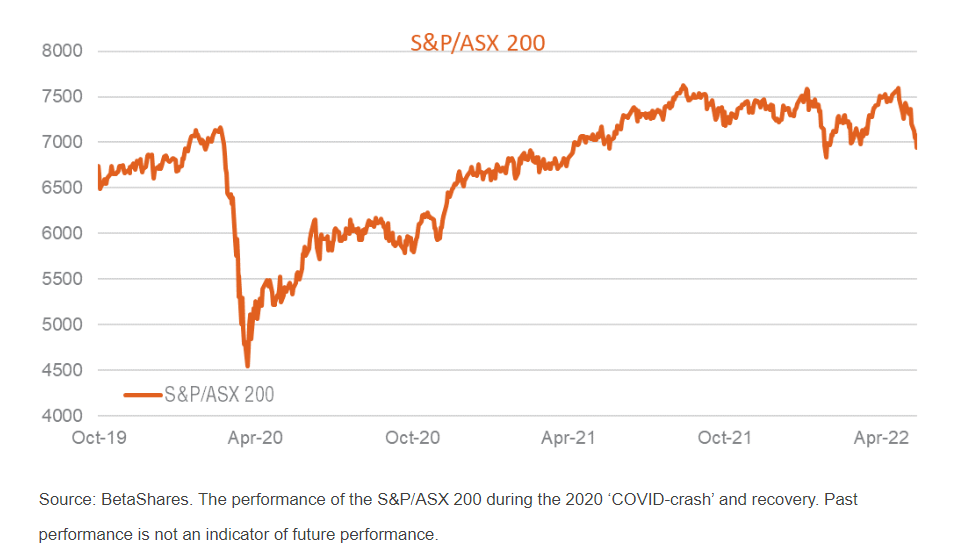

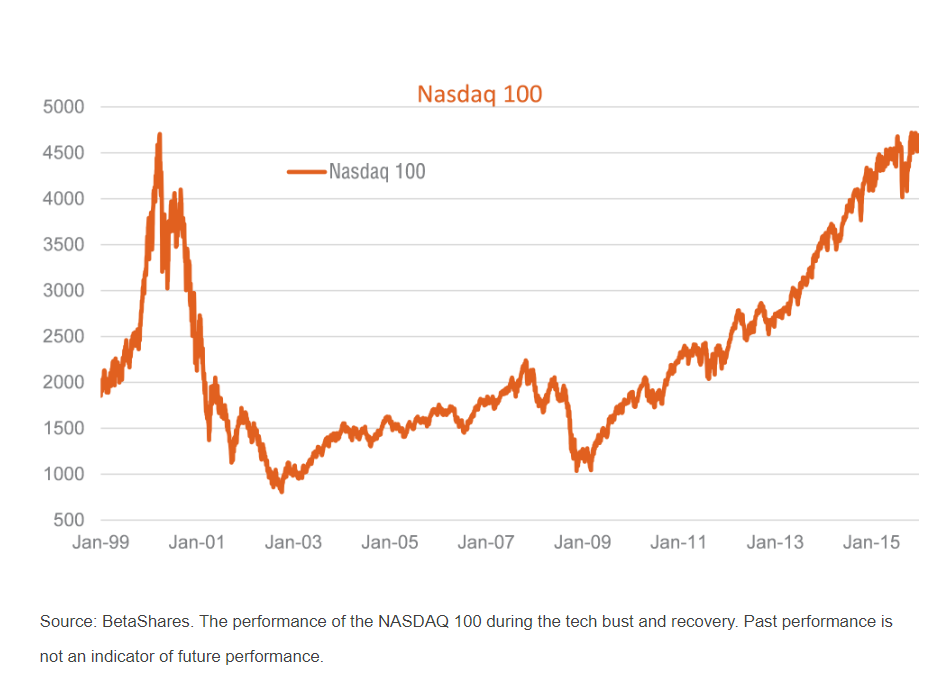

Now this is the hard part; you might want to try to ‘pick the bottom’. As tempting as it may seem, it’s almost impossible to do so successfully. Markets generally fall very quickly, bounce around, haver false starts before recovering slowly. Let’s have a look at some of the most recent falls and how they have bounced back.

Covid 19 crash and recovery

The global financial crisis 2008

The dot com boom and bust

Here are some of the main points

- Uncertainty = volatility (worst start in 50 years for US equities)

- Desynchronisation of global monetary settings and interest rates

- Geopolitical – Cold War 2.0. Elevated tensions with different trading block

- China is in transition – Corporate credit conditions improving, household wealth, labour market and inventory build up which equates to lower future prices and inflation weakening, compelling stock valuations.

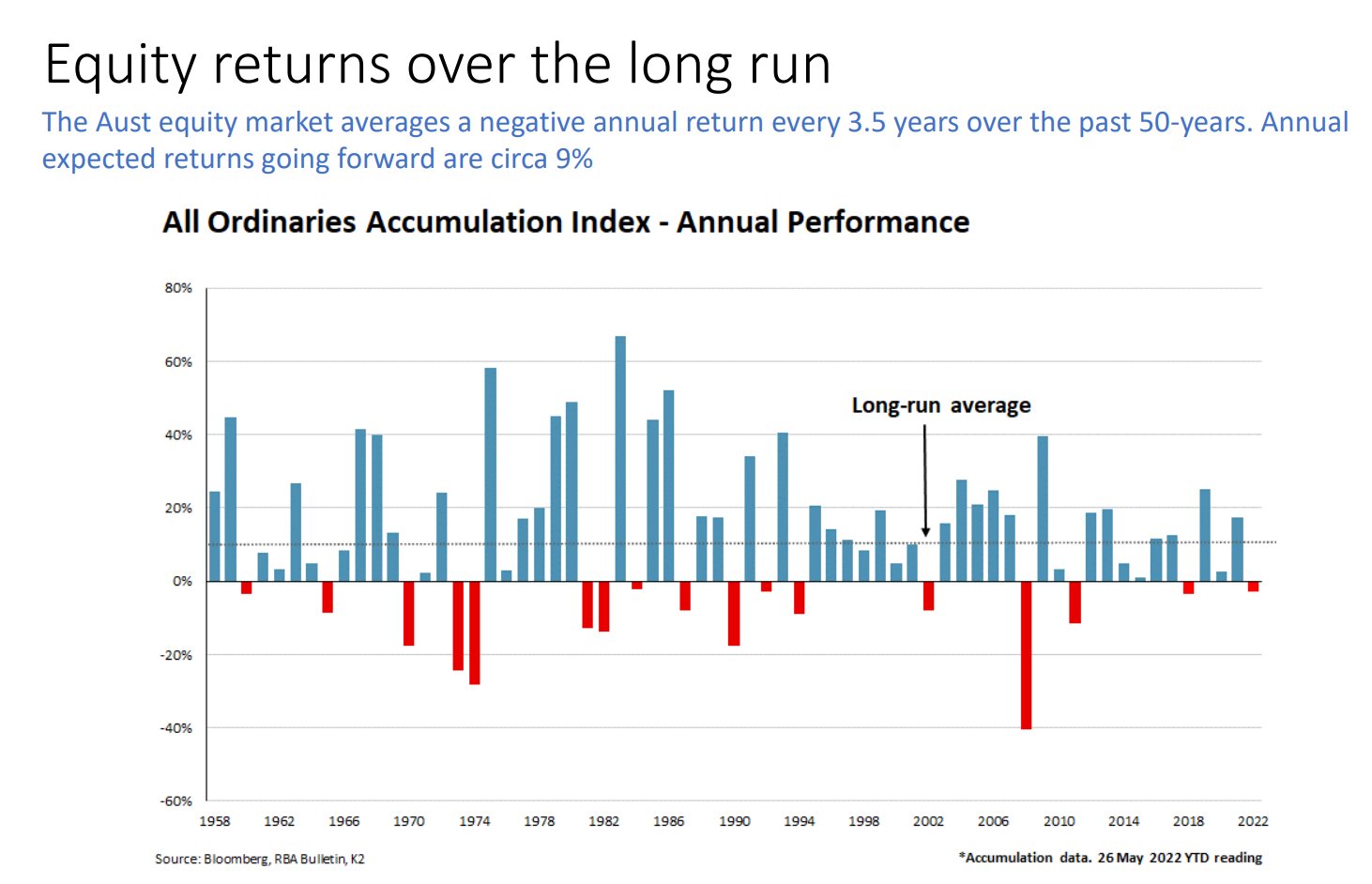

Putting it all in perspective-some charts to highlight the positives always outnumber the negative years of stock market returns

The Australian share market over 64 years

The US market over 95 years

Anti hawking notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement.

Target Market Determination. We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives.” or terms and conditions, You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.