To make ends meet means “to pay for the things that you need to live when you have little money.“

With the inflation genie still out of the bottle, how are Aussie families going to make ends meet?

What was the latest monthly figure on inflation?

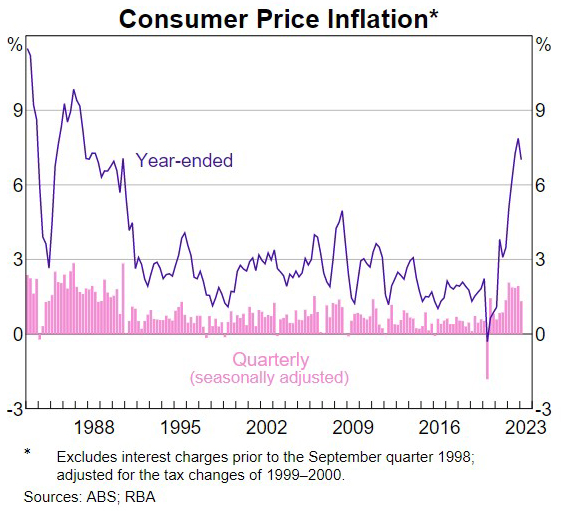

The monthly CPI indicator annual movement rose 6.8% in April, up from 6.3% in March. The annual movement for the monthly CPI, excluding volatile items and holiday travel, rose 6.5% in April, down from 6.9% in March. This series excludes fruit & vegetables, automotive fuel and holiday travel and accommodation.

Fuel, Food and mortgage payments will the breaking points.

Compared to April last year, borrowers are paying an extra $1133 in monthly mortgage payments, or a whopping 54 per cent more. The latest figures are suggesting a further increase is on the cards when the reserve bank next meets.

- An estimated 867,000 Australians were working multiple jobs in the December quarter

- The Australian Bureau of Statistics says it was the highest number of people working more than one job since it began keeping such records in 1994, according to a report by the ABC.

What are we likely to face over the next 12 months around the world?

US Economy – Under Pressure, slowing growth

According to the International Monetary Fund (IMF), the baseline forecast is for growth to fall from 3.4 percent in 2022 to 2.8 percent in 2023, before settling at 3.0 percent in 2024. Advanced economies are expected to see an especially pronounced growth slowdown, from 2.7 percent in 2022 to 1.3 percent in 2023. In a plausible alternative scenario with further financial sector stress, global growth declines to about 2.5 percent in 2023, with advanced economy growth falling below 1 percent. Global headline inflation in the baseline is set to fall from 8.7 percent in 2022 to 7.0 percent in 2023 on the back of lower commodity prices but underlying (core) inflation is likely to decline more slowly. Inflation’s return to target is unlikely before 2025 in most cases.

Interest rates globally

Overall, authorities suggest that once the current inflationary episode has passed, interest rates are likely to revert toward pre-pandemic levels in advanced economies. How close interest rates get to those levels will depend on whether alternative scenarios involving persistently higher government debt and deficit or financial fragmentation materialize.

Soaring Public Debt

With the recent headlines surrounding the fiscal dilemma facing Victoria, soaring public debt is a real issue all around the world. Public debt, as a ratio to GDP, soared across the world during COVID-19 and is expected to remain elevated, posing a growing challenge for policymakers, particularly as real interest rates are still rising across the world.

When a country is in debt distress, a comprehensive approach that combines significant debt restructuring — renegotiation of terms of servicing of existing debt — fiscal consolidation, and policies to support economic growth can have a significant and long-lasting impact on reducing debt ratios.

Finally, economic growth and inflation have historically contributed to reducing debt ratios.

Supply chain fragmentation

Supply-chain disruptions and rising geopolitical tensions have brought the risks and potential benefits and costs of geoeconomics fragmentation to the center of the policy debate. Foreign direct investment (FDI) multilateral efforts to preserve global integration are the best way to reduce the large and widespread economic costs of FDI fragmentation.

IMPORTANT NOTICE: You are receiving this email because you have subscribed to our services in the past and you have agreed to the terms and conditions and the privacy statement on our web site. We protect and value your data and continue to send you information that is relevant and valuable. If you are interested in any product described in our newsletters then you need to read a copy of the PDS and determine for yourself if it is appropriate to your needs, circumstances and particular situation.

Anti Hawking Notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

Target Market Determination: We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives, or terms and conditions. You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits. All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.

General Advice Warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au.. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement. Please consult our office to provide you with personal advice if you would like. To make an appointment please click on the link financialchoice.com.au5 million Aussies in last 4 months have gone overseas. Should you invest overseas as well?