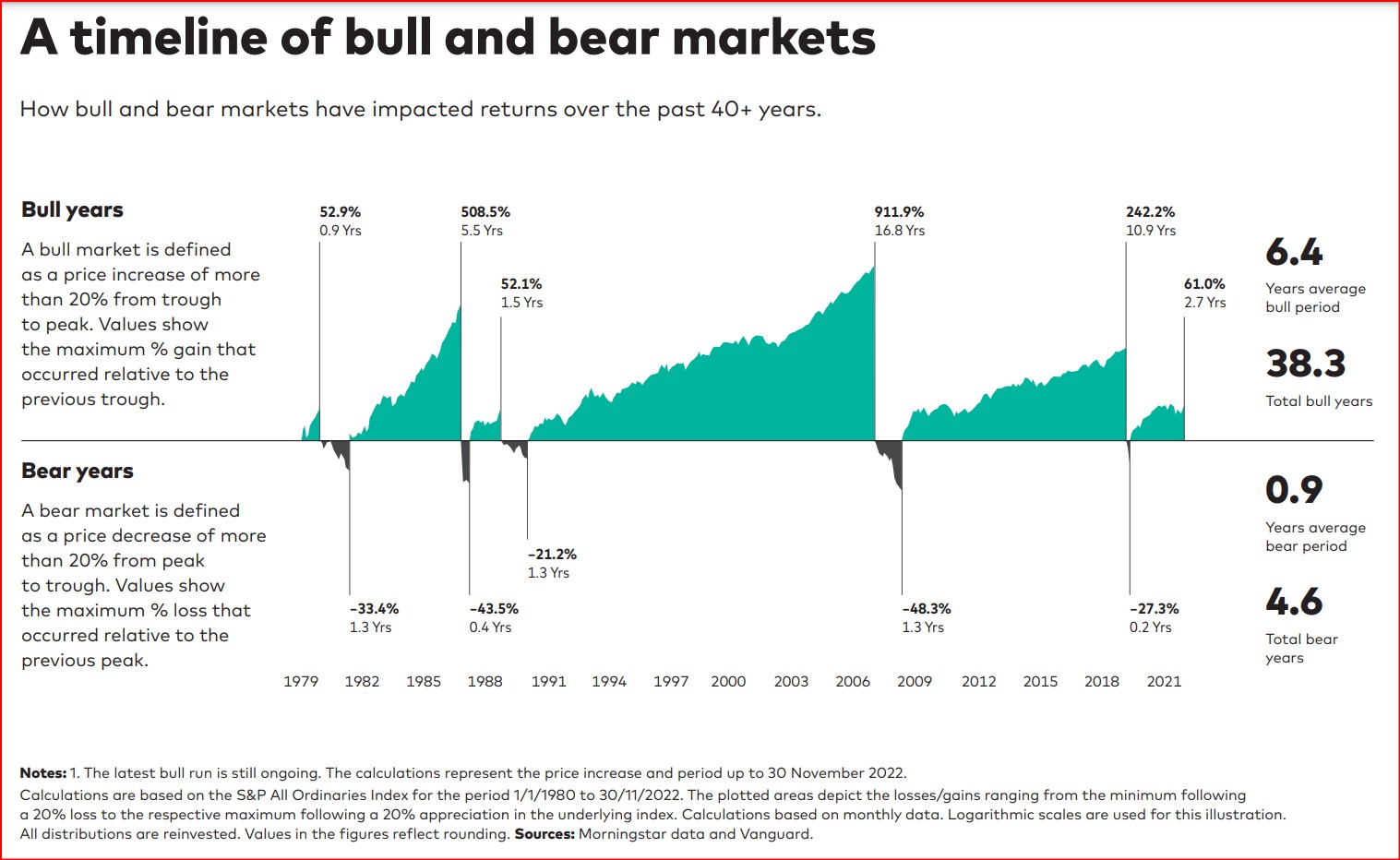

It’s hard to determine whether the Australian market is heading for a Bull market, or retreating to a Bear market, at the moment. You can see from today’s performance and the last 12 months that it seems we are only treading water with a positive 12 month return of 1.46%. Hardly exciting!

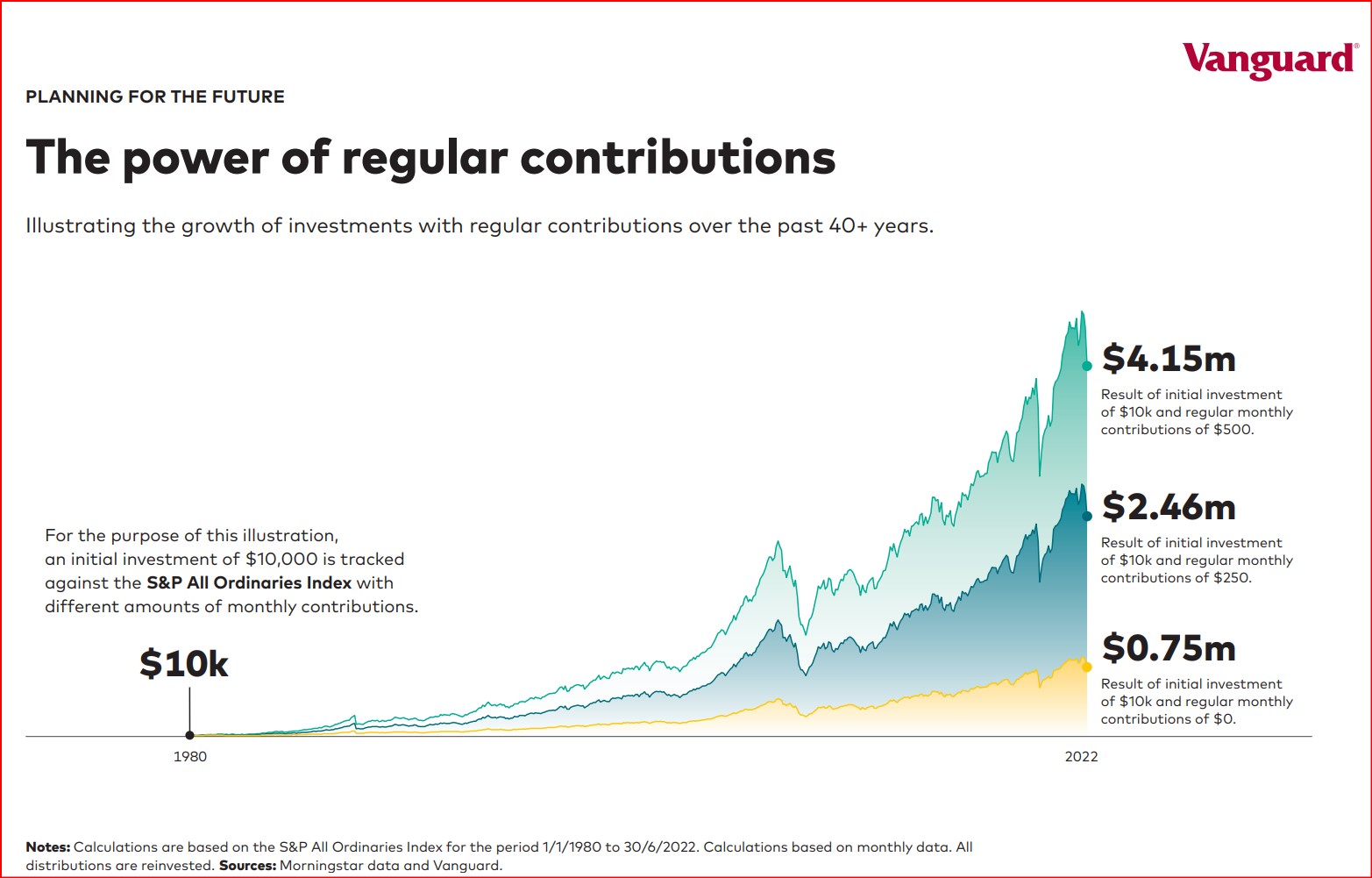

Forget about whether we are in a Bull or Bear market. All you need to do is regularly contribute over the longer term.

Seems so simple so why don’t we all do it?

Index investing first became broadly available to U.S. investors with the launch of the first indexed mutual fund in 1976. Since then, low-cost index investing has proven to be a successful strategy over the long term, outperforming the majority of active managers across markets and asset styles (S&P Dow Jones Indices, 2015). In part because of this long-term outperformance, index investing has grown exponentially, particularly in the United States, and especially since the global financial crisis of 2007‒2009. In recent years, governmental regulatory changes, the introduction of indexed ETFs, and a growing awareness of the benefits of low-cost investing in many world markets have made index investing a global trend.

Financial Choice has led the market in adopting Index investing with ETF’s since 2008.

One of the simplest ways for investors to gain market exposure with minimal costs is through a low-cost index fund or ETF. Index funds seek to provide exposure to a broad market or market segment through varying degrees of index replication, ranging from full (in which every security in the index is held) to synthetic (in which index exposure is obtained through derivatives).

We expect the case for low-cost index fund investing to hold over the long term. Like any investment strategy, however, the real-world application can be more complex than the theory would suggest. This is especially true when attempting to measure indexing’s track record versus that of active management.

The most important part is time and how we use it

Time is an important factor in investing. Transient forces such as market cycles and simple luck can significantly affect a funds returns over shorter time periods. These short-term effects can mask the relative benefits of low-cost index funds versus active funds in two main respects: the performance advantage conferred on index funds over the longer term by their generally lower costs, and the lack of persistent outperformance among actively managed funds.

What difference can a professional financial manager or adviser make?

Understanding the importance of selecting index funds or ETF’s in a particular sector or region is critical in delivering exceptional performance over a long term. The assistance of an asset allocation expert and financial adviser who can match your risk profile to certain markets to reduce the volatility is critical in portfolio construction.

IMPORTANT NOTICE: You are receiving this email because you have subscribed to our services in the past and you have agreed to the terms and conditions and the privacy statement on our web site. We protect and value your data and continue to send you information that is relevant and valuable. If you are interested in any product described in our newsletters then you need to read a copy of the PDS and determine for yourself if it is appropriate to your needs, circumstances and particular situation.

Anti Hawking Notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

Target Market Determination: We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives, or terms and conditions. You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits. All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.

General Advice Warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au.. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement. Please consult our office to provide you with personal advice if you would like. To make an appointment please click on the link financialchoice.com.au5 million Aussies in last 4 months have gone overseas. Should you invest overseas as well?