In 2020 a new and dangerous era of natural disaster was ushered in, ravaging Australia, Brazil, Siberia and the US.

It’s been called many things. A “once-in-100-year flood”, “unprecedented” and “chaotic”.

On Wednesday night, the Hawkesbury River at Windsor peaked at 12.9m above sea level, the highest level in 60 years. While some have labelled it a one-in-100-year flood, Dr. Johnson a hydrologist from the water research centre at UNSW said that does not mean the next one will be in 100 years. We can all remember the last time the Hawkesbury river broke it banks. It seems to occur every 10 to 12 years.

The cost of extreme weather disasters in Australia has more than doubled since the 1970s, reaching $35 billion for the decade to 2019. The trajectory of climate change impacts and sea level rise could eventually cost the Australian economy $100 billion every year, a new report from the Climate Council says.

Australians are five times more likely to be displaced by a climate-fuelled disaster than someone living in Europe. Our Asia-Pacific region seems to be the most disaster-prone on the planet, being bit by around 40 per cent of the 335 disasters recorded worldwide in 2017 and suffered almost 60 per cent of disaster-related deaths.

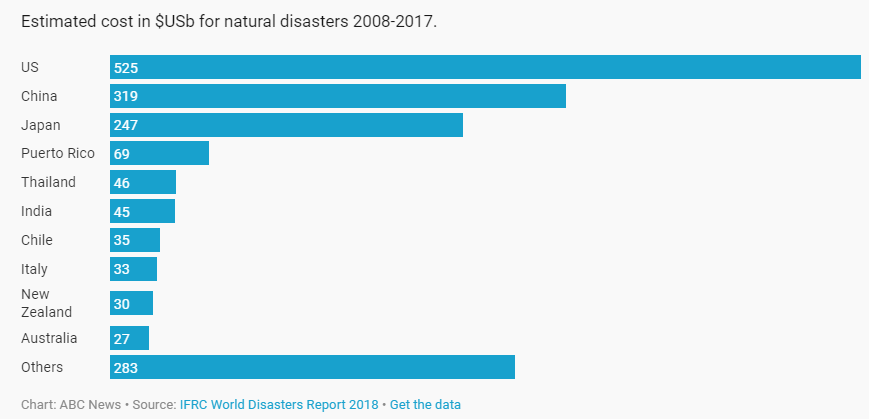

Australian is ranked 10th in terms of the cost of natural disasters, but still a fair way behind the big three disaster zones: the US, China and Japan which together account for about two-thirds of the total financial cost. as the chart below shows.

So should you be selling your QBE shares as a result of an expected increase in insurance claims?

More than 22,000 claims have been lodged so far.

Due to high premiums many people have opted out of getting cover for flood insurance. Premiums have increased by more than 178 per cent over the last decade in flood-prone areas. This is why the cost of these floods will exceed anything seen before. According to Allianz, one of the nation’s biggest insurers, 95 per cent of its customers in New South Wales have decided not to take out flood cover.

Consumer watchdog the Australian Competition and Consumer Commission (ACCC) has had its eye on the affordability of insurance. It found in cyclone- and flood-prone areas of northern Australia, premiums had increased 178 per cent over the past 10 years. Among the recommendations was more investment to reduce the risk of disasters.

Andrew Hall from the Insurance Council of Australia said more mitigation work, such as building dams and levees, was key to reducing premiums. “Over the last three years, insurers have paid out around $7 billion in claims in natural disasters — and in the last calendar year, insurers across the nation made only $35 million in profit. With the excessive cost of flood insurance many residents will be forced to sell up and possibly relocate to regional areas that are not prone to floods. This latest series of natural disasters is going to have a material affect on the valuations of properties in these areas.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources.