The “sell in May” proverb is said to have originated centuries ago in England when merchants, bankers and other interested parties in London’s financial district noticed that investment returns generally did worse in the northern summer.

There is some evidence that the stock market, on average, tends to underperform in the six-month period between May and October. However, analysts, market timers and academics who have studied the phenomenon extensively can’t settle the matter conclusively one way or the other.

Sam Stovall, chief investment strategist at CFRA Research, sums up the “Should I sell in May?” conundrum facing investors in 2021 this way:

“Some say yes, in anticipation of a long overdue digestion of recent gains triggered by lofty valuations. Others say no, since valuations are justified by a projected second-half surge in gross domestic product and earnings per share growth, due to pent-up consumer demand, the expenditure of recent stimulus checks, and the anticipated passage of an infrastructure package.”

Stovall adds that the “strongest six months of the year,” as popularized in The Stock Trader’s Almanac, tells us that the price return for the S&P 500 from November through April has recorded the highest average price change of any rolling six-month period.

“Conversely, the ‘sell in May’ adage reminds investors that average May-through-October price returns have historically been anaemic,” Stovall writes.

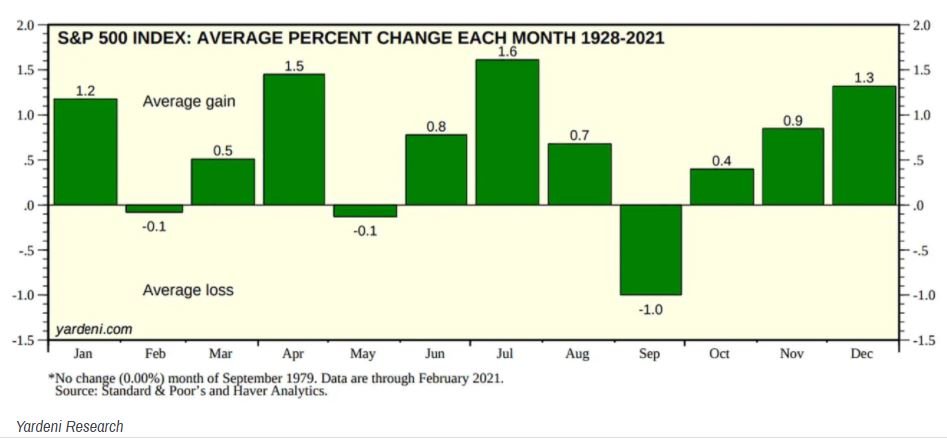

For the record, thanks to Dr. Ed Yardeni of Yardeni Research, we do know unequivocally that the worst individual months for average stock market performance are not found exclusively in the post-May period.

In fact the worst month is not May but September as the chart below shows.

Most of Us Should Just Stay Where They Are

The great bulk of retail investors are likely best served by simply leaving their allocations alone.

The pros get judged on every basis point of return they can squeeze out of their holdings. But for us regular investors, portfolio churning – even in the age of low commission-free trades – it can still take its toll, be it in the form of opportunity cost or emotional stress.

Like most Wall Street sayings that encourage clients to trade, long-term investors would do well to ignore the “sell in May” chatter. Leave the tactical moves to the tacticians and trust your long term plan that your adviser has put in place for you.

Something tells us Warren Buffett isn’t sweating “sell in May” right now.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources.