At the age of 43, Tom Brady believes time shapes who he is and what he does.

Tom Brady is the most successful American football player of all time. At the age when most players are into their tenth year of retirement, Tom is playing arguably the best football of his life.

Time is his most precious commodity along with the love of his family. Ironically, he is a swiss watch makers brand ambassador. It has taken Tom 20 years to refine his skills. He has always believed that time will deliver the results, you just have to have faith and belief.

He has more time behind him than he has in font of him (in both Football and life) so he always sharpens his focus on the next game to never waste an opportunity.

“There were times when I was younger and had a lot more free or disposable time that I could focus my time and energy on things that probably weren’t as relevant as the things I am doing today, and now I don’t feel like I have that much free time at all. I have to find the time to rebalance and refocus and make concerted efforts to do that because there are a lot of requests for my time. I am hyper-focused on taking care of my body because in the end, for my sport, my body is my asset, taking care of it is what my profession is, and the better I do that, the better career I’m going to have. It’s hard to balance time.”

What is the connection between Tom Brady and investing?

First and foremost, Tom Brady is still working at a time when most people in his line of work have well and truly retired.

In my experience as a financial adviser for 38 years, a lot of my colleagues have retired and sold their businesses to lead a very laid back and stress free existence. That only lasts a few years and you can’t keep playing golf everyday. In fact, I reflect on a number of clients who have taken early retirement only to age overnight. So rule number one is look after your health and work as long as your mind and body allow you to. Tom Brady is renowned for looking after his body and sticks to a strict dietary plan; just like following a great long term savings plan.

The next big lesson is that the star performer or number one draft pick quite often fails the consistency test. They enjoy their time in the sun but are very soon the forgotten star. This is like trying to pick the best investment. If it is shooting out the lights now then it will probably fizzle pretty quickly in a couple of years.

Before Index Funds and ETF’s became fashionable, most advisers would pick last years best performer and move money into that investment. In a short period of time, the returns would fail to impress and both the adviser and their clients money would start to walk out the door in search of another number one draft pick.

How can you achieve consistent performance year in, year out just like Tom Brady?

Like Tom, you wait until you get selected in the middle of the pack and become dependable and predictable just like the draft sheet says – deliver what you said you would!

Index investing will not deliver the best performance each year but it will deliver predictable performance over a long time.

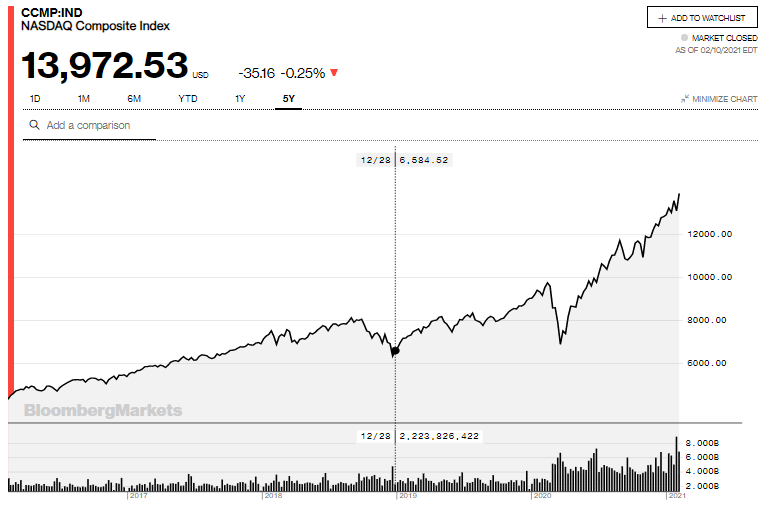

Vanguard Investments invested heavily in research to help nervous investors. They found that if you held your investments for 5 years or more, you would in (a majority of cases) eliminate all negative results from your portfolio.

If you have a look at the Nasdaq Index, it tells that story.

This is the return over the last month.

This is the return over 5 years. Almost a straight line.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources.