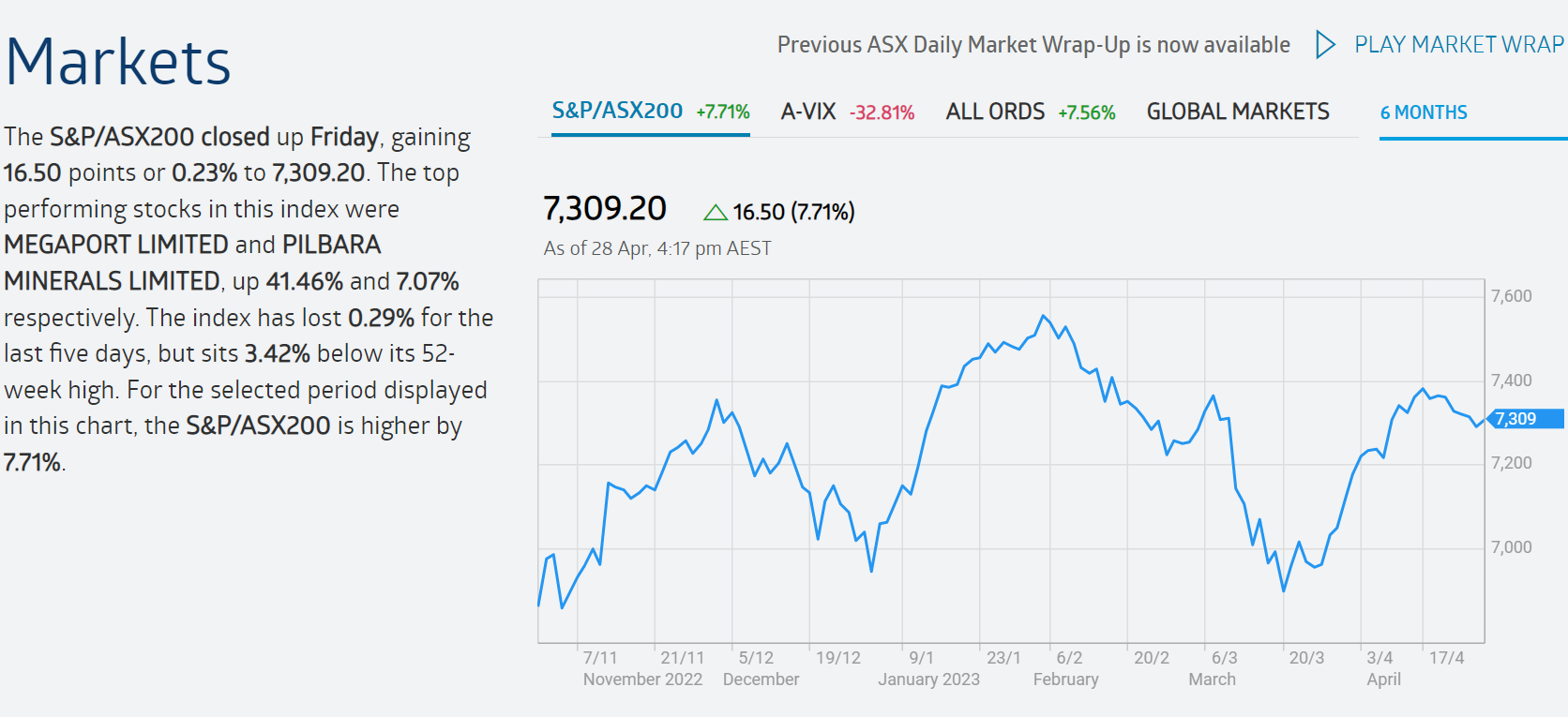

But first, the ASX close today

I have been providing financial advice to clients for over 40 years and the cornerstone of household wealth has been the value of their home. Over my time as a financial planner and author of two books (2004 – Your Super Future; 2008 – Super Rich) I have been curious about the well known 18 year property cycle.

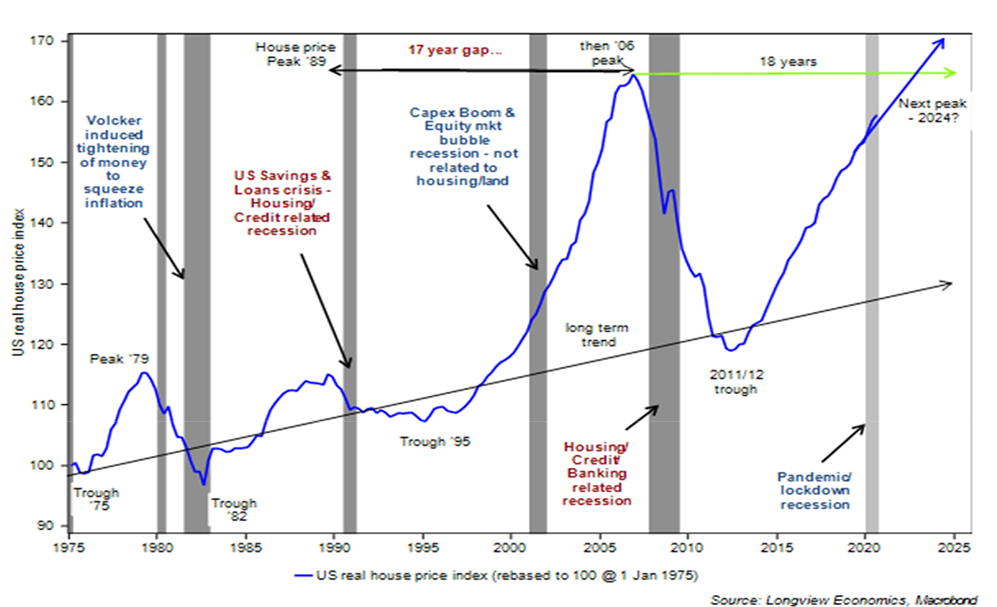

I would regularly refer my clients to a chart dating back to the 1800’s that accurately predicted every boom and bust cycle of land prices. In fact, in the early 2000’s as some of my clients might remember, it was predicting the next boom in 2006. We have described the past US real estate cycles as: 1800 – 1819, to 1837, to 1857, to 1873, to 1893, to 1914 (war interrupted), to 1932 (war interrupted again); then 1955 to 1974, to 1992, and to 2010 (forecast1). We saw that the give-away of the public domain, and the attendant speculation, peaked in 1818, 1836, 1854, 1869, 1888, 1908 and 1926; building activity peaked after that in approximately 1944. There was little real estate speculation during the Second World War, but once the distortions of war were past, real estate speculation peaked in the very early 1970s, in 1987 (S&L), and yet again in 2006. Eighteen years has proved a remarkably consistent pattern.

Our economists in London, Longview Economics, have only this week devoted an issue of their newsletter to this 18 year cycle. You can set your clock to it if you are a property investor.

The 18 Year Land Cycle, a 2024 Peak and a Global Economic Boom

A property cycle is a series of phases a property market goes through in a repeated pattern. Learning how to identify the way Australia’s property cycles move will give you an advantage when it comes to investing.

The 18 year cycle consists of 14 years of rising land (and therefore house) prices, which is then followed by 4 years of falling prices. Those four ‘down years’ of house prices come about because of a tightening in monetary policy (after many years of good gains) which then translates into tight credit conditions, a tightening up of the availability of mortgage credit and, with that, pro cyclical banks’ behaviours (i.e. banks further reducing the availability of credit). That then pushes house and land prices lower as tight credit chokes off demand (and increases housing supply). That pro cyclicality also works through the calculations of the risk weightings of mortgage debt. That is, as house prices fall, banks are required to increase the amount of capital that they assign against that mortgage debt, thereby further reducing balance sheet capacity to lend.

In most western style economies like the UK, US and Canada along with Australia, approximately 75% of domestic loans are to households (with that split 87% mortgages: & 13% consumer credit). The remaining 25% of the loan book is business loans. Approx. 1/3rd of that lending to business is also linked to residential property/construction.

What impact did rising interest rates have on house prices?

Rising interest rates seems to have very little impact on house prices; US mortgage applications (for purchase only), for example, reached a 12 year high (in the past 2 weeks); new home sales moved sharply higher in recent months (now highest since 2006 – FIG 4); Australian building approvals are close to a 10 year high (growth rate); UK loan approvals are at their highest level since 2007; while US median house price growth, according to the National Association of Realtors, is growing at 15% (Y-o-Y), its fastest pace since 2005 (FIG 1). Over and above that, there’s a record shortage of new homes for sale (i.e. at 3.3 months, a 55 year low level of inventory).

Given that the Federal Reserve is likely to leave policy loose for many quarters, and that the banks will increasingly need to put capital to work, a trend higher in house prices through to 2024 is a sensible central working assumption. If that were to occur, it should generate strong consumption growth (supported by the growing ‘cash-out’ momentum) and with that, underpin strong US economic growth, at least until that 2024 peak in housing, land sales & speculation) and potentially for a year or two beyond that, albeit multiple risks to that outlook remain.

In that respect, and if that pattern is followed once again, then the US is moving towards an economic peak in the mid-2020s: The last peak in US building activity/land sales was 2006. The next one, therefore, is due around 2024. If correct that supports an expectation of strong economic growth continuing through to (at least) 2024 – and then recession maybe in 2025/26.

IMPORTANT NOTICE: You are receiving this email because you have subscribed to our services in the past and you have agreed to the terms and conditions and the privacy statement on our web site. We protect and value your data and continue to send you information that is relevant and valuable. If you are interested in any product described in our newsletters then you need to read a copy of the PDS and determine for yourself if it is appropriate to your needs, circumstances and particular situation.

Anti Hawking Notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

Target Market Determination: We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives, or terms and conditions. You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits. All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.

General Advice Warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au.. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement. Please consult our office to provide you with personal advice if you would like. To make an appointment please click on the link financialchoice.com.au