Currently, 16 million Australians own over $3.3 trillion in superannuation assets but those holding the most in super, and getting the biggest tax breaks on them, are typically older and wealthier Australians, according to a 650-page report, by former IMF director and senior Treasury bureaucrat Michael Callaghan. More than 11,000 high-income Australians had superannuation balances in excess of $5 million and received annual tax concessions of about $70,000.

What is the goverment proposing?

Super tax concessions represent over $42 billion cost to the federal budget and $22.1 billion relates to earnings tax concessions that largely benefit wealthier retirees.

The government made it clear that the super system was there to support people to build their retirement income, not purely for wealth accumulation.

Ironically, most retirees leave the bulk of the wealth they had at retirement as a bequest to their beneficiaries, they do not spend it themselves. Inheritances are significant, representing the transfer of wealth from one generation to another, as the population ages and passes on this wealth. Australian Prime Minister, Anthony Albanese said in his recent press interview that the government have to take pressure off the age pension. The retirement income review said “71 per cent of people aged 65 and over receive the age pension or other pension payments, with 60 per cent of these receiving the maximum rate”. Government spending on the Age Pension is projected to fall over the next 40 years from 2.5 per cent of GDP today to 2.3 per cent in 2060. Earlier this week Treasurer Jim Chalmers raised concerns about super tax concessions costing more than the age pension by about 2050 which doesn’t make sense.

Treasurer Jim Chalmers ponders next move

When pressed on Wednesday on whether changes to concessions could be implemented in the May budget, Mr Chalmers wouldn’t rule it out. Assistant Treasurer Stephen Jones flagged any changes would be likely targeted at the wealthy.

Are they targeting SMSFs?

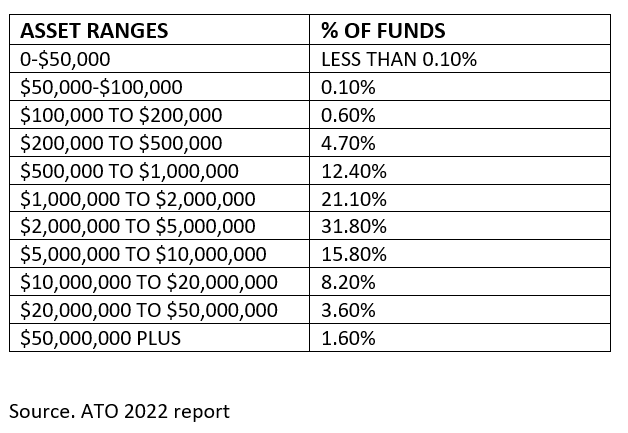

Proportion of assets in size self managed super funds 2021 number of SMSF funds 1,112,102

What is fair and reasonable?

“What we’re thinking about is what is a reasonable amount of money which is consistent with that objective of having savings, tax-assisted savings for retirement income,” Mr Jones said.

“Let me be very clear, this is not about the government saying to people you can’t save more than $5 million, $10 million, $100 million for their retirement.”

Mr Jones argues the money sitting in people’s super accounts that attracts low tax rates means taxpayers are missing out on millions that could be going back to the budget.

Australian Super Funds Association have a strong view

Association of Superannuation Funds of Australia Limited (ASFA) that represents Industry and Retail funds recommended the group of people with more than $5 million in super should not receive the same tax concessions as others.

“Those members aged 65 or older with a total superannuation balance as at 1 July 2023 in excess of $5 million … should be required to withdraw the excess out of superannuation or in the alternative pay tax at the top personal income tax rate on the investment returns attributable to the amount of the superannuation balance over $5 million,” according to the pre-budget submission.

“We have gone through a process with our members and there is general agreement across the sector that amounts above $5 million are no longer appropriate in terms of the long-term equity and sustainability of the system,” the CEO of ASFA Martin Fahy said.

“The projected savings from our modelling suggests about $1.5 billion of savings in tax concessions.”

IMPORTANT NOTICE: You are receiving this email because you have subscribed to our services in the past and you have agreed to the terms and conditions and the privacy statement on our web site. We protect and value your data and continue to send you information that is relevant and valuable. If you are interested in any product described in our newsletters then you need to read a copy of the PDS and determine for yourself if it is appropriate to your needs, circumstances and particular situation.

Anti Hawking Notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

Target Market Determination: We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives, or terms and conditions. You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits. All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.

General Advice Warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services like Financial Choice, Find My Super and selfmanagedsuper.com.au.. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement. Please consult our office to provide you with personal advice if you would like. To make an appointment please click on the link financialchoice.com.au