Australian consumer prices surged at the fastest annual pace in two decades last quarter as petrol, home building and food costs all climbed, fueling speculation interest rates could rise from record lows as soon as next week.

Markets also quickly narrowed the odds on a rise to 0.25% next week, though many still favour a June hike given such a sudden move would cause political ripples so near to the election on May 21.

Futures also shifted to price in rates of 0.5% by June, whether in one hike or two.

We need a plan to combat higher than normal inflation …

With the election around the corner, both sides of politics should have a plan on how to boost the supply side of the economy.

“This reflected the broad-based nature of price rises, as the impacts of supply disruptions, rising shipping costs and other global and domestic inflationary factors flowed through the economy,” said Michelle Marquardt, the head of price statistics at the Australian Bureau of Statistics.

It appears from the table below that the biggest increases came from transport and housing, reflecting the pressure on supplies for building and renovations. New dwelling prices have recorded their largest rise since September 2000, following the introduction of the GST. Price rises were driven by high levels of building construction activity, combined with ongoing shortages of materials and labour. Fewer payments of government construction grants compared to the previous quarter also contributed to the rise. These grants have the effect of reducing out of pocket expenses for new dwelling purchases.

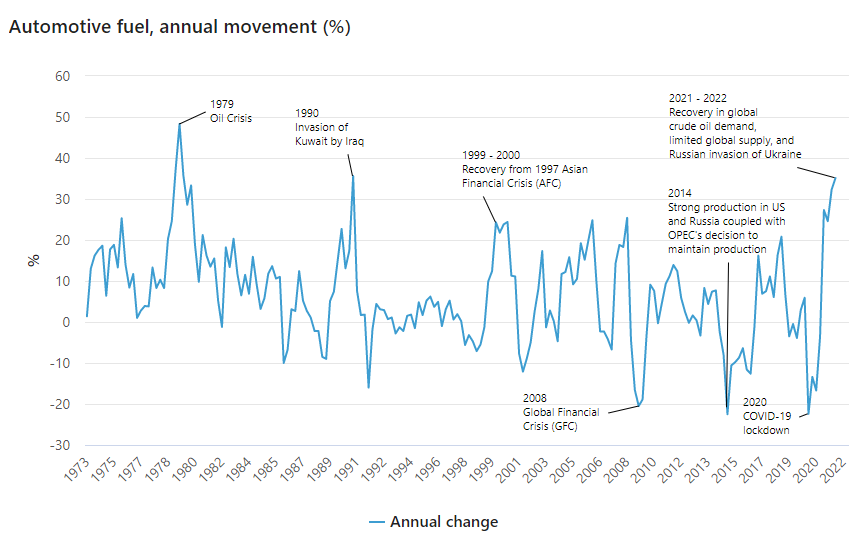

Will the price of fuel continue rising?

Will wages blowout?

Extremely low unemployment rates have proved to be more costly than valuable because an economy operating at near full employment will cause two important things to happen:

- Aggregate demand for goods and services will increase faster than supply, causing prices to rise.

- Companies will have to raise wages as a result of the tight labour market. This increase usually is passed on to consumers in the form of higher prices as the company looks to maximize profits.

Let’s now wait and see what happens next Tuesday. Will interest rates increase?

The RBA will soon begin raising interest rates, either next week or in early June, and keep raising the cash rate in the months ahead. It is a welcome development that the cash rate will finally be lifted from an emergency low of near-zero. The economy, with a low 4 per cent unemployment rate, has rebounded from the pandemic due to $314 billion of Federal Government stimulus.

Anti hawking notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement.

Target Market Determination. We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives.” or terms and conditions, You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.