What is an index fund? We use exchange traded funds-ETF’s- to give us global exposure to all share market indexes.

An index fund tracks an index, and an index is simply a representation of a part of a market (e.g. the stock market, bond market, real estate market, etc.). For example, one of the most well-known indexes is the S&P 500, which includes the stocks of the 500 largest US companies. There are many different indexes that track many different parts of many different markets.

I have just finished listening to a video from Jack Bogle, the founder of Vanguard, who manage over $6.2 trillion U.S in investors money. That is almost 3 times the size of the whole Australian Superannuation Industry. He is the pioneer of index investing and has some very useful insights.

His words of wisdom still ring true today as they did in 1975 when he set up the mutual company that specialised in low cost index investing.

He said “keep the fees that you pay an investment manager to a minimum and always keep your Index funds as the cornerstone of your portfolio. Never Sell”.

When we develop our investment portfolio’s for clients, the front and centre of every portfolio are two things:

- An index fund that takes in the whole U.S stock market and;

- An index fund that captures the whole of the Australian stock market.

We change our allocations based on long term investment trends and economic fundamentals. This would usually make up to 70% of our clients allocation and the rest would be tilted toward other index funds that focus on regions or a particular Industry or a certain trend i.e. Alternative energy companies.

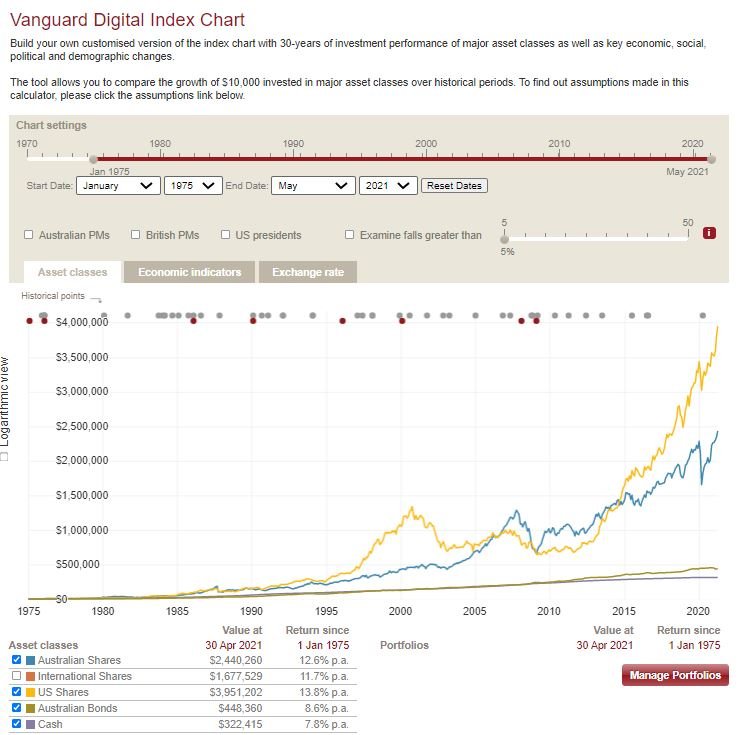

Look at this real life example to illustrate the power of long term indexing.

Imagine you start investing in 1975 and you have $10,000 in your pocket. You could put $10,000 into the U.S stock market index or you could invest the whole lot into the Australian stock market index. (Let’s disregard tax and buying and selling charges for the time being as both will be minimal because you will hold and never sell thereby not triggering capital gains tax).

Let’s compound the return on your money at 13.8% p.a. which is the actual return of the U.S stock market since 1975.

Let’s also compare that against the return of the Australian stock market over the same time which was 12.6% p.a.

If you left your money in the bank over that period, you would have earned an average interest rate of 7.8%.

What would your $10,000 invested in 1975 be worth in 2021?

U.S Index – $3,951,202

Australian Index – $2,440,260

Australian cash – $322,415

Comparison in returns – U.S versus Australia since 1975

The simple power of compound interest at work; the difference of 1.2% each year makes a difference of over 60% in the final benefit. Imagine if you just left it there?

It is clear now that cash is not a good place to keep your money other than to use it to spend on goods and services.

How does advice increase your return?

An investment advisory can help add extra performance to an existing low cost index investment portfolio strategy by adopting active asset allocation to the portfolio. Our strategy is to identify ETF opportunities that can enhance this long term return. We pay a hefty fee to a global consulting firm to give us investment intelligence that identifies small tilts towards emerging markets or trends like renewables and infrastructure.

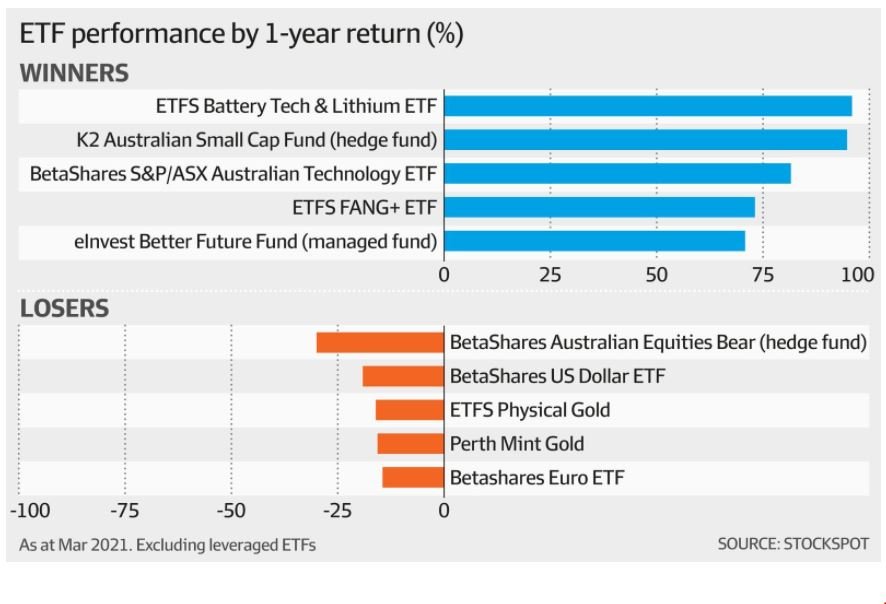

We identified 3 of the top 5 ETF’s below and they are in our model portfolios for clients that are getting advice and this has made a huge difference to our returns.

What are the top 5 ETF’s for 2020

Be careful of the Hype of the newcomers

Chris Brycki from Stockspot has alerted us to the fact that 63 per cent of ETF money is flowing into new products launched in the last five years. This means that most investors are failing the asset allocation test of filling up the core with U.S Indexes and allocating up to 30% to other specialist sector plays. This is what has helped Financial Choice portfolios deliver superior long term performance (10 years plus) over the competitors.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources.