SOCIALLY RESPONSIBLE INVESTING IS NO LONGER JUST A FAD. IT IS A SERIOUS MEGATREND.

Investing may look a bit different in 2021 as the year starts with cautious optimism and global vaccine rollouts. The investment winners in the year of the pandemic were technology companies, but what investment opportunities should you look for?

Portfolios will be guided by five trends this year:

- Economic drivers such as the recovery from COVID-19 and the dispensing of the vaccine.

- Low global interest rates

- Trends like the movement to value investing

- Thematic investing like socially responsible investing

- Leverage investing, borrowing short and investing long

There is also a resurgence in setting up self managed super funds to take advantage of these trends. No other superannuation option offers complete control.

“The self managed super fund sector is the largest part of the Australian retirement landscape because it gives you choice and freedom to invest the way you want to invest and in alignment with your values”.

Recently, there has been a global movement to invest in Green and Sustainable industries and the product development created by fund managers who have responded to this trend, are launching new exchange traded funds (ETF’s) to allow investors to choose their investments, rather than a fund manager via a public offer fund, making that choice for them.

Not only are they becoming popular as an investment choice, the recent performance has been nothing short of exceptional.

Investors have been increasingly interested in the themes of the future in recent years and being able to invest accordingly to their views and values. This trend is likely to continue in 2021. Dynamics in the coming year, such as vaccine rollout or a renewed focus on climate change, are likely to see biotechnology and climate change related investments appeal in 2021. Investors interested in healthcare may take a thematic or sub-sector approach such as healthcare biotechnology.

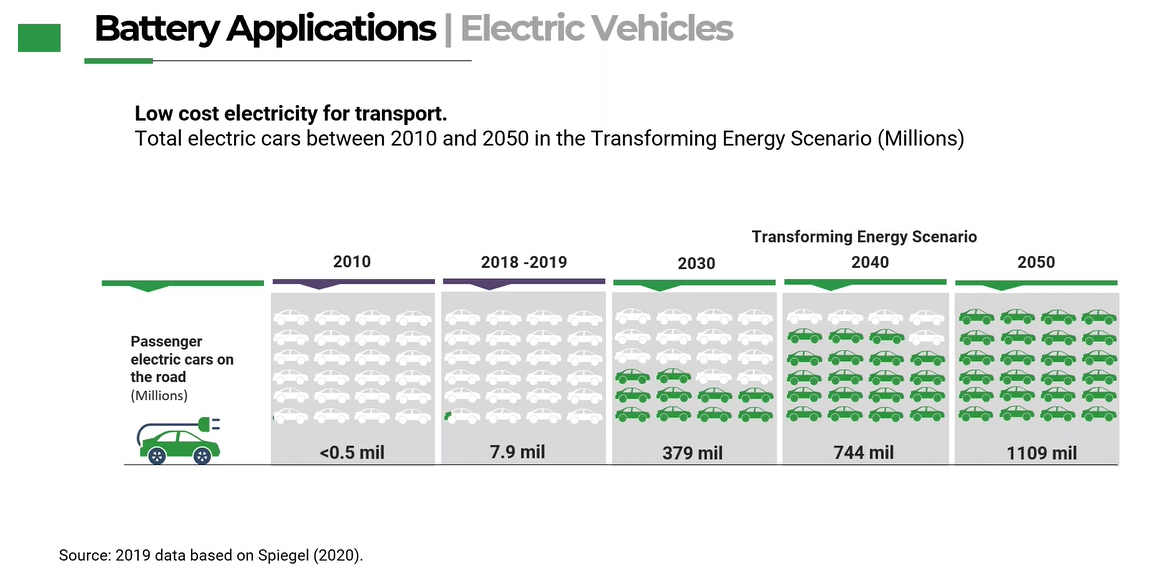

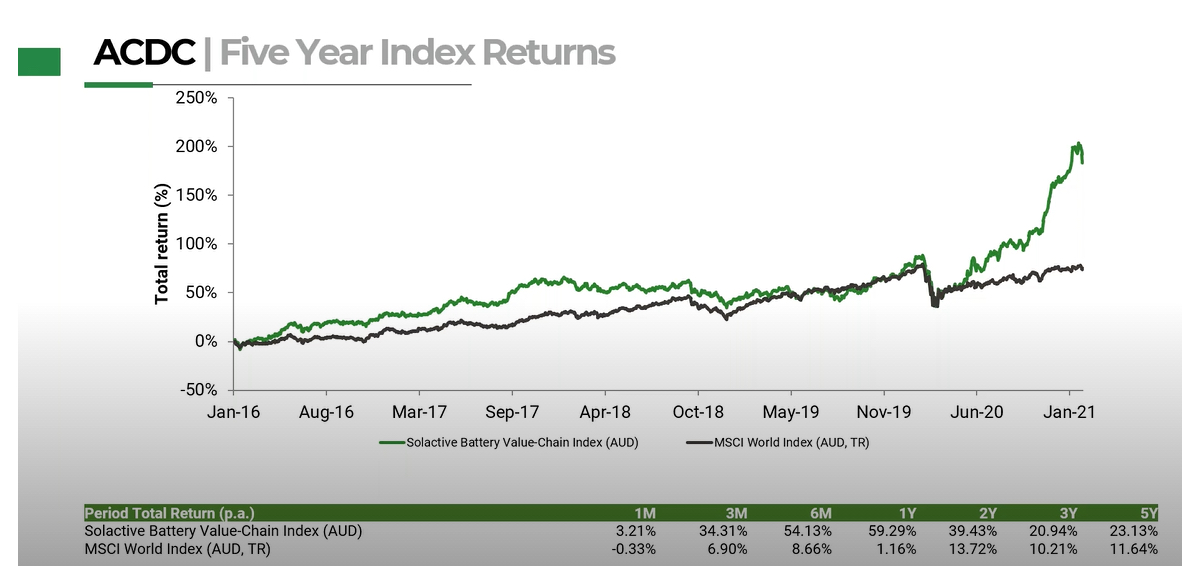

One recent addition that has caught the attention of the investment industry has been the ETFS Battery Tech & Lithium ETF (ASX Code: ACDC). This ETF offers investors exposure to the energy storage and production megatrend, including companies involved in the supply chain and production for battery technology and lithium mining. Demand for energy storage is being driven by the movement towards emissions reduction and renewable energy, such as solar and wind.

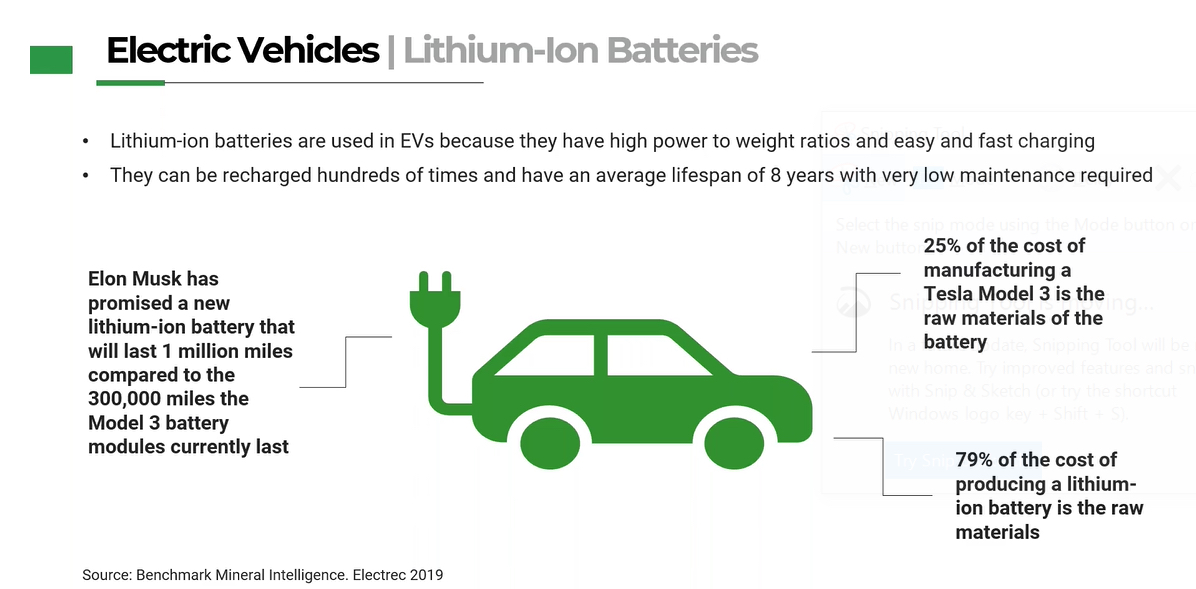

What powers Electric Vehicles

Why invest in battery technology?

Battery technology is central to the growth of renewable energy and electric vehicle usage, so investors may consider this as an investment in environmental sustainability. It is an established technology with continued innovation and is expected to aid the global transition to clean energy.

Battery technology represents a growth investment for many investors given the projected demand for storage in the coming years off the back of growth in renewables use and the electric vehicle industry.

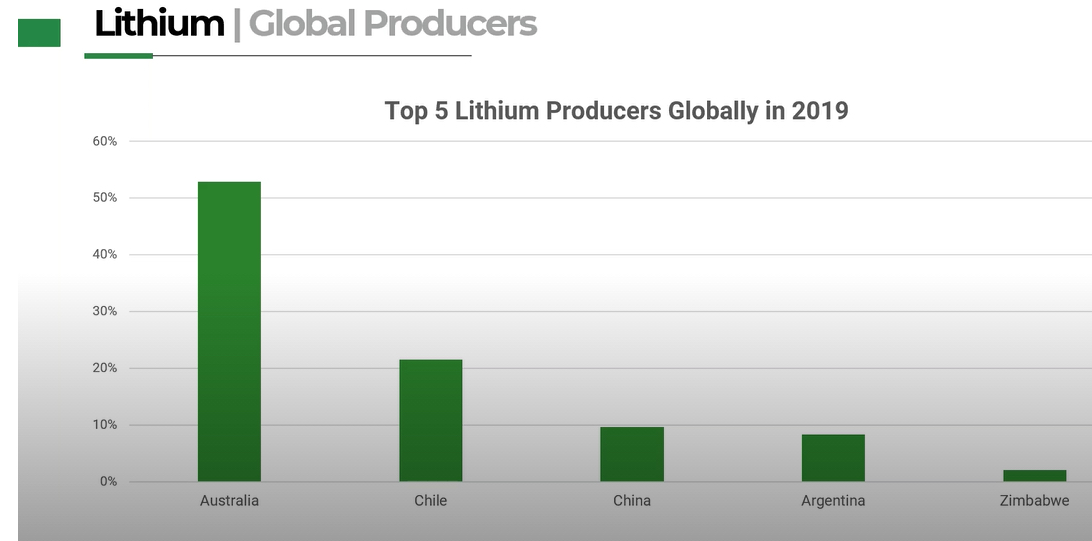

The value chain for battery technology ranges from mining companies mining for metals like lithium, to manufacturers of battery storage and storage technology providers. All are potential beneficiaries of the anticipated growth in this industry. Ethical and responsible investing has gathered momentum recently and has shown over the last 10 years how its investment results have topped those of traditional investment pool.

What about the performance of this investment class?

Who are the major producers of lithium globally?

How to build your own tailored portfolio using green ETF’s

You can select “Green” investments from some public offer superannuation fund menu’s but if you want total control over your investment choices, then the only way you can achieve that goal is by setting up a “Green” self managed super fund.

Our self managed super division is a leading administrator and has won several awards for administration and advice excellence by the Smart Money magazine from the Australian Financial Review.

If you are a self directed and educated investor then a self managed super fund would be ideal to get full advantage of this global Mega Trend. go to www.selfmanagedsuper.com.au to take that next step. Contact our office on 02 9887 1700 for further details or email support@selfmanagedsuper.com.au

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources.