Recent research suggests that the number of SMSF’s are increasing and Women are outnumbering Men

The latest available ATO figures indicate there were 597,900 SMSFs in Australia in June, 2021. This resumed the steady growth of the sector after a brief dip in numbers during the early phase of market disruption due to COVID. The number of new funds established increased while wind-ups fell sharply in the year to June 2021, as markets rebounded strongly from their March 2020 lows. As a result, net establishments were the strongest in many years.

How much should you have in super before you even consider a self managed super fund?

The SMSF Association wrote to ASIC last month in relation to research that was released by the University of Adelaide’s International Centre for Financial Services (ICFS). “Understanding self managed super fund performance” the research examines the investment performance of the SMSF sector over the period 2017-2019.

The research establishes a lower threshold at which an SMSF becomes competitive with APRA regulated funds, being $200,000. The research also shows for suitable individuals, an SMSF can be a viable option for individuals with lower superannuation balances than previously thought. The trend shows that partners are pooling their super together to get economies of scale and getting very involved in managing their future retirement.

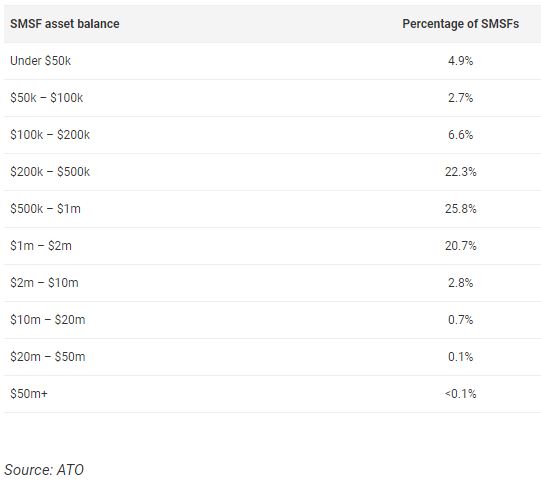

The vast majority (86%) of SMSFs in Australia had balances greater than $200,000 in June 2020, as indicated in the table below. This is consistent with the generally held view that it is not cost effective to set up and run an SMSF with less than $200,000.

The vast majority (86%) of SMSFs in Australia had balances greater than $200,000 in June 2020, as indicated in the table below. This is consistent with the generally held view that it is not cost effective to set up and run an SMSF with less than $200,000.

597 SMSF funds have more than $20 million in assets.

What do SMSF’s invest in?

Listed shares are the most popular asset class, with 26.35% of all SMSF assets in this asset class. That is followed closely by cash and term deposits at 18.98%, unlisted trusts at 12.6% and non-residential real property at 10.54%.

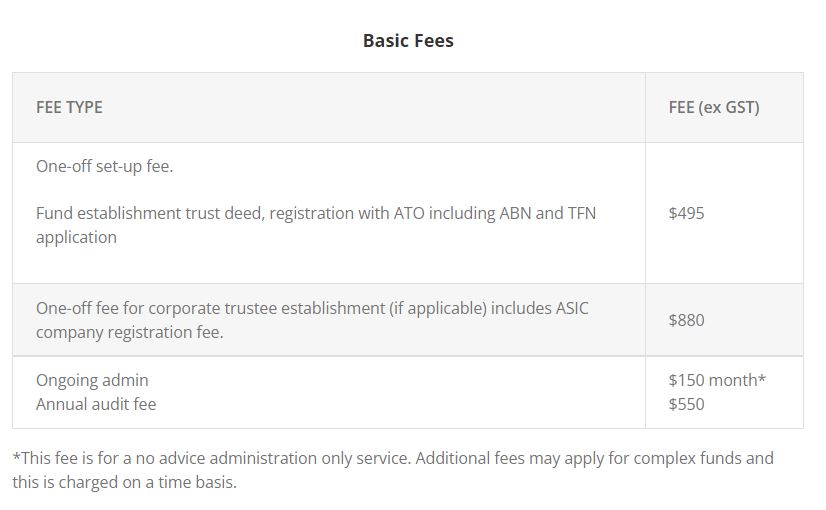

What does it cost to set up a SMSF?

Self-managed super funds are now firmly entrenched in the Australian superannuation landscape. The number of SMSFs continues to rise despite the market uncertainty in recent years, along with individual member and overall fund balances. Most SMSFs have corporate trustees, with this structure becoming increasingly popular. SMSFs typically have two members, with more women getting on board.

OK, so what is the next step?

Go to selfmanagedsuper.com.au You will be able to complete the engagement form and submit it by email to support@selfmanagedsuper.com.au and arrange an obligation free assessment of your options.

Anti hawking notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au. The above images are promotional images of models and are not real people.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L