What is the brief history of April Fools day and can you remember the prank that involved Big Ben?

The origin of April Fools day goes way back to Chaucer’s’ Canterbury Tales in 1392. Over the years, pranks have been performed around the world on this day and probably the one that received most attention was in 1980 when the BBC announced that Big Ben’s clock face was going digital and whoever got in touch with the BBC first could win the clock hands as a memento.

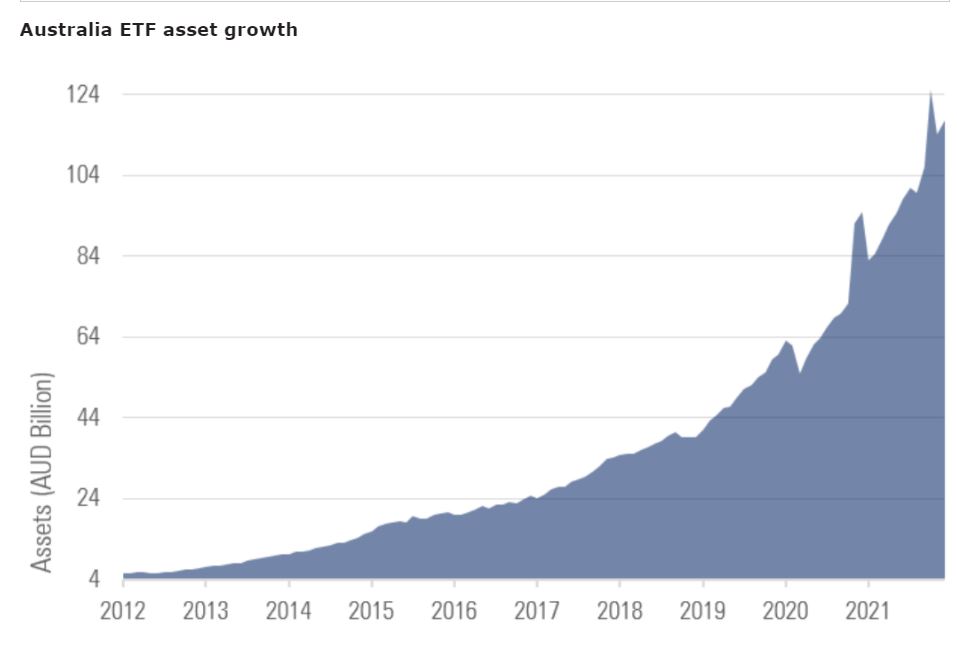

The EFT industry continues to attract investors money at a record rate

That saying about “change being the only constant in life” never felt truer than during these times. Just as we changed our behavior to help guard against the spread of Covid-19, we can also take steps to protect our financial lives from future turmoil. Looking forward, rapid industry growth has opened up multiple avenues for investors to invest according to their style, philosophy and outlook. But the surge in ETF demand has led to product proliferation. To stay relevant and address investors’ ever-changing preferences, product innovation has been directed toward the niche and narrow segments of the market. The global trend of ESG-focused investing continues to be embraced locally. This enthusiasm was reflected in the doubling of 2020’s net inflows with $2.8 billion going into the sustainable ETF cohort in 2021. This was 13.5% of all net flows into the Australia-domiciled ETFs. BetaShares and Vanguard were at the forefront of investors’ surging demand for ESG strategies. BetaShares Global Sustainability Leaders ETF, BetaShares Australian Sustainability Leaders ETF, and Vanguard Ethically Conscious International Shares ETF received the highest inflows among the sustainable ETFs currently in the market according to Morningstar.

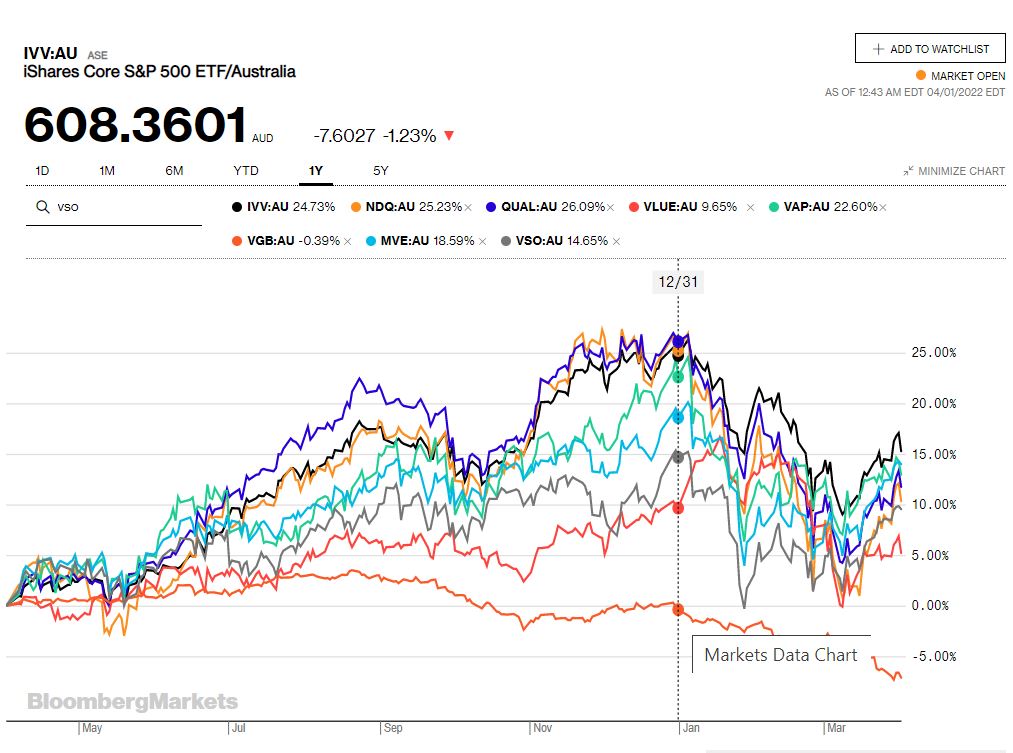

It’s been a bit bumpy over the past 12 months

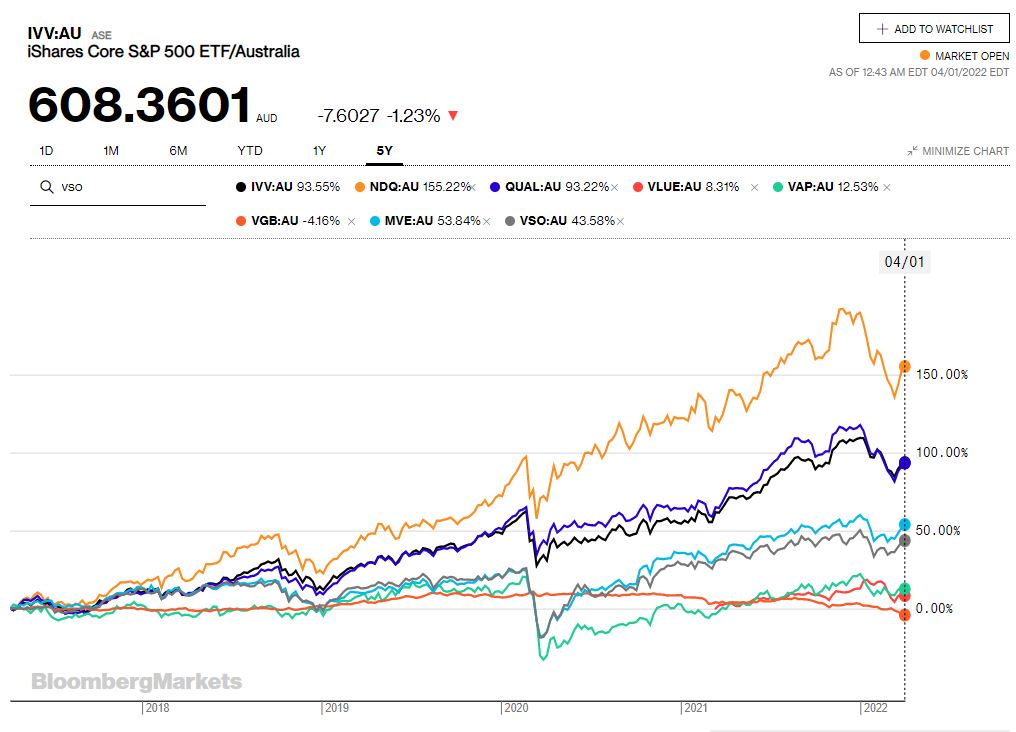

What about the longer term

Over five years, an investment in the Nasdaq (ASX code NDQ) would have returned 155.22% growth. Both the S&P 500 (ASX code IVV) and MSCI Quality (ASX code QUAL) returned investors an identical result of 93% over five years.

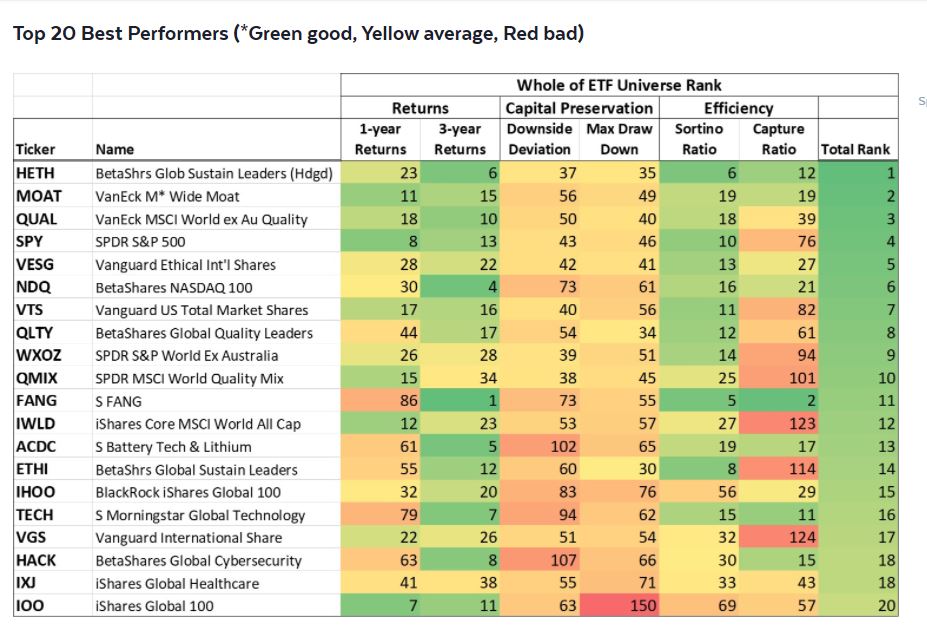

The top ETF’s

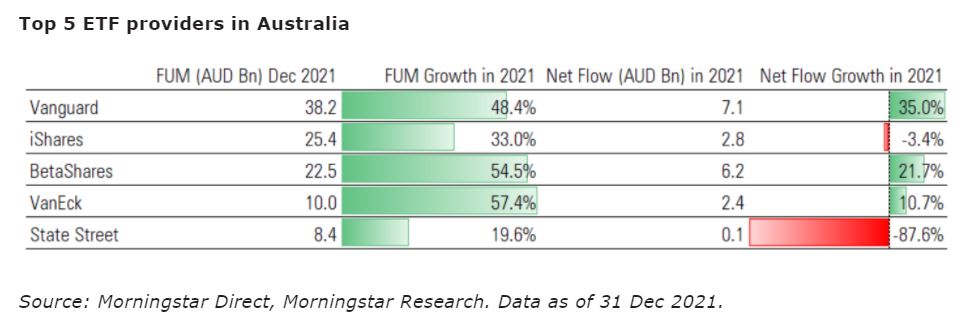

Historically, the local ETF industry has been concentrated with a handful of larger players managing the lion’s share of the assets. There was no change in that trend in 2021. Vanguard, iShares, and BetaShares continued to occupy the top three positions in terms of funds under management (FUM). As of 31 Dec 2021, the trio together managed close to two-thirds (73.6%) of the total ETF assets in Australia.

Vanguard retained its market leadership across the board with a 48.4% jump in FUM relative to 2020. The firm attracted the highest net inflows in 2021. As of 31 Dec 2021, Vanguard managed 32.7% of the total ETF FUM in Australia, followed by iShares (21.7%) and BetaShares (19.2%).

Anti hawking notice. You are receiving this newsletter bulletin because you have subscribed to our services in the past. You have subscribed to our online portal findmysuper.com.au or you were a member of a superannuation or retirement fund that Financial Choice provided advice to it’s members. You may also have registered with selfmanagedsuper.com.au.

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources. Best Interest Advice AFSL 292925. Financial Choice is a business name registered to Best Interest Advice P/L. Any advice and information is provided by Best Interest Advice Pty Ltd AFSL No. 292925 and is general in nature. It hasn’t taken your financial or personal circumstances into account. It’s important to consider your particular circumstances and read the relevant product disclosure statement .

Target Market Determination. We always advise clients to carefully consider the appropriateness of the product given their own knowledge of their financial situation, needs and objectives.

Terms and Conditions. You can read our Financial Services Guide on our website for information about our services, including the fees and other benefits. All information on our website is subject to change without notice. Please consult professional advice before you act on any of this general information.