Are you eligible?

You may be eligible for the scheme if:

- you’ve never owned property or land in Australia

- intend on purchasing a property for residential purposes (for example, it can’t be a houseboat, motor home or investment property)

- intend on living in the property for at least six of the first 12 months you own the property, and

- you’ve not previously withdrawn funds as part of the scheme.

How does it work?

Any voluntary contributions you’ve made into your super from 1 July 2017 could be eligible savings as part of the scheme – there’s no need to open a separate account.

Any before-tax contributions (for example, salary sacrifice) will be taxed at 15% on the way in, and any investment earnings on these contributions will also be taxed at 15%.

From 1 July 2018, you’ll be able to withdraw these funds by applying to the Australian Taxation Office (ATO). Once determining you’re eligible, the ATO will arrange for your money to be paid to you from your super fund.

Benefits of the scheme

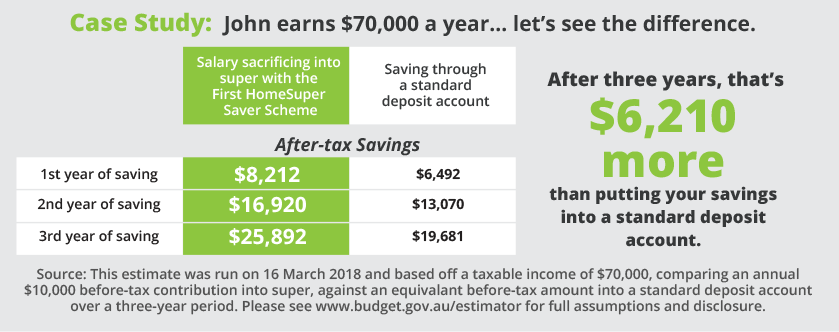

Tax savings. Before-tax contributions into super (for example, through salary sacrificing) will be taxed at 15%. For most people, this will be less than their marginal tax rate – which could be up to 45% plus the Medicare levy.

Potentially higher earnings on your savings. You might earn a higher return on your savings if the deemed rate (determined by the ATO) is higher than what you’d get in your regular savings account or term deposit. The deemed rate for the quarter ending March 2018 is 4.72%. See the ATO’s website for the current deemed rate, also known as the shortfall interest charge.