Making advice

accessible and

affordable to

all Australians

Making advice

accessible and

affordable to all

Australians

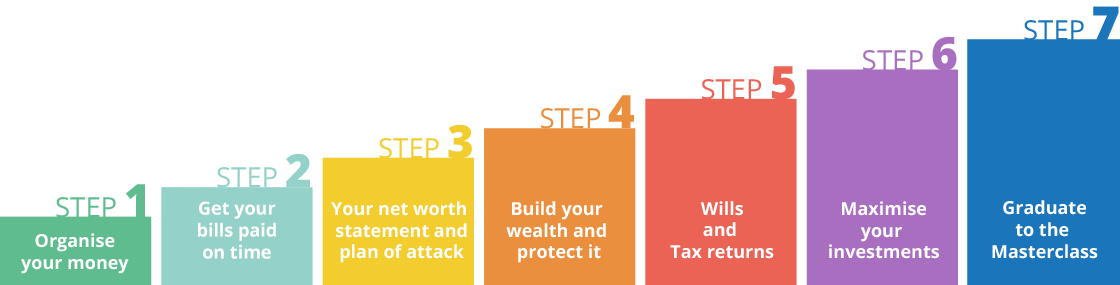

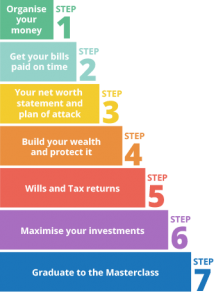

Financial Choice’s 7 Step Plan

The 7 steps below are the building blocks to get you started. Scroll down through the page below to read more about each progressive step on the way to better financial advice.

Financial Choice’s 7 Step Plan

The 7 steps below are the building blocks to get you started. You can click on an individual step to go straight to that step, or scroll down through the page below to read through each progressive step on the way to better advice.

Step 1. Organise Your Money

Financial Choice will provide you with the essential components to start building a better view of your financial life so you can get better advice. By setting up your budgeting and savings goals in Step one you are now able to start to work with your financial planning expert to really make sure that you make the changes that will get you on track with your money. After you have sorted out your financial world and started to budget effectively we can now introduce you to a financial planner who will set in place the building blocks that will relieve you of the financial stresses that you experienced before you were introduced to Financial Choice.

This rule has been the building blocks for sound financial management for many years. It goes like this:

Life’s Essentials

No more than 50% of your take home pay should go to life’s essential items like shelter, food, heating and transportation.

In your budget these are itemised categories and are set up by your planner.

Financial Essentials

This is the 20% of your take home money you set aside to pay back debt, make additional contributions to your savings and retirement and credit card debt.

Lifestyle Essentials

Life is meant to be enjoyed so we can channel 30% of your take home pay into the Lifestyle part of your plan. This is stuff like your mobile phone, gym fees, kid’s parties, holidays, restaurants, shopping and other fun stuff.

Step 2. Get your bills paid on time

Your Financial Choice planner will set up a bill paying account or debit card to manage all your recurring bills and expenditure. This will make it easier to plan ahead and not worry about overlooking those bills if you are away from home.

Personal Budgeting and Bill paying service

Pay my bills – we will pair you with your trained money manager that will help you set up your budget and assist you in the difficult task of making sure that all your bills are paid on time and you stick to your budget. Your personal money manager will track all your bills, set up all your payment reminders, contact your Creditors if needed and negotiate difficult situations on your behalf.

Your wages get paid into an account in your name set up by Financial Choice. Your living expenses are transferred to your bank account that you currently use for everyday living.

Step 3. Your Net Worth

To really start to build a plan we need to understand what your Net worth really is. We can get an instant valuation of your family home and other properties that you have, your share portfolio, your managed funds, your superannuation funds and your bank accounts. We will also get the updated balance of your loans and debts to arrive at a current one page Assets and Liabilities summary.

This is now the beginning of your plan. We know your total financial picture of cash flow and assets.

Step 4. Build and Protect

Once you know where you are going you need to protect against potentially rough weather and obstacles that come up on the horizon that could steer you off course. Insurance to protect your income, life insurance to protect loved ones and general insurance to cover those assets. This is the critical step you need to take before you then move to accelerate your wealth. One big mistake could sink your plans for building real wealth.

Step 5. Integrated Electronic Tax Returns

Financial Choice will help you prepare your tax return. Your transactions automatically feed into your tax return so that you don’t have to keep a shoe box of receipts. We are also able to better predict how much your refund will be so that we can add it to your investments or help reduce debt. The tax return link is very important to enable you to keep up to date without any unpleasant surprises from the Tax man.

Our online Will service will help you get that part of your life organised so that your Estate Planning is complete. We also update the beneficiary details of your Superannuation fund.

Step 6. Maximise Your Investments

You new Financial Life is now taking shape and you can concentrate on making sure that both your strategy and the choice of investment and lending vehicles are matched to your long term aspirations. Advice on self-managed super to get greater control of your wealth is also provided here. We compare the cost of your current superannuation plan against the best fund available that offers low fees and better long term performance.

We compare in detail the fees you are paying on your managed funds, home loans, credit cards and make sure you are fully invested in the correct asset allocation to match your time frame and stage in life.

Step 7. Graduate to the Masterclass

Investing like the Ultra wealthy is more about getting the simple things right. How do the top 20 wealthiest individuals in the world invest? What’s their secret? How did they start? The answers might surprise you.

When you graduate to “Investing like a Pro”- you will follow the same investing principles that the top investors follow. It starts with having a global perspective on asset allocation, taking into account currency fluctuations, relative taxation structures and keeping to the plan no matter what.

This is where you need to enlist the services of the best in the business and have access to a panel of international experts that are at the top of their game.

This is where we tailor an investment portfolio to suit your risk profile and stage of life.