Check out where the money is going. Australian investors are still pouring their savings into International ETF’s

Despite ongoing global economic and geopolitical uncertainty, flows into equities and bonds continued to increase in Q3 2020 according to the latest figures released by the Australian Securities Exchange (ASX) and Vanguard.

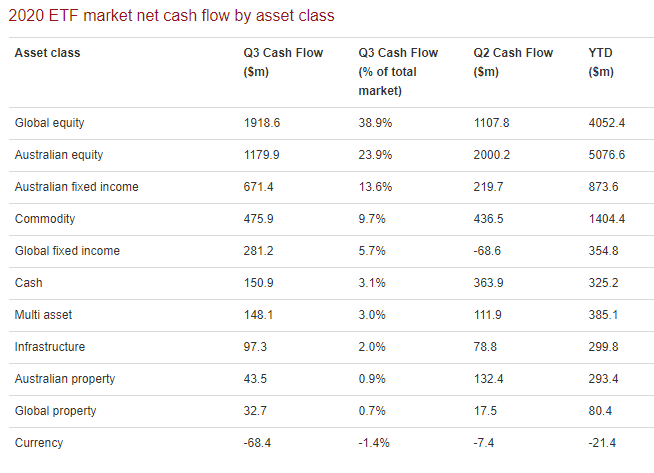

A$1.9b flowed into international equities compared to A$1.18b into domestic equities in the September quarter, reversing the home-preference trend evident in the June quarter.

“Even with the uncertainty surrounding global events such as the US Election, cash is seeing less inflows than earlier in the year while international equities is seeing more. It’s possible that many Australian investors are seeing this window as an opportunity to further diversify their portfolios and capture any increased returns,” said Minh Tieu, Head of Capital Markets for Asia-Pacific.

The Australian ETF industry also surpassed A$71b in assets under management (AUM), with A$4.9b in new inflows between July to September.

Domestic bonds drew A$671m in inflow, A$390m more than international bonds in Q3, and triple the flow seen in Q2. This indicates a strengthening of the local bond market as investors continue to build up their conservative allocation.

Diversified ETFs also maintained steady growth in Q3 with inflows of A$148m, up from A$112m in Q2 and A$125m in Q1.

“Investors see diversified ETFs as an efficient way to gain exposure to multiple asset classes in a single trade, and a simple way to mitigate market risks by ensuring their portfolios are broadly diversified,” said Mr Tieu.

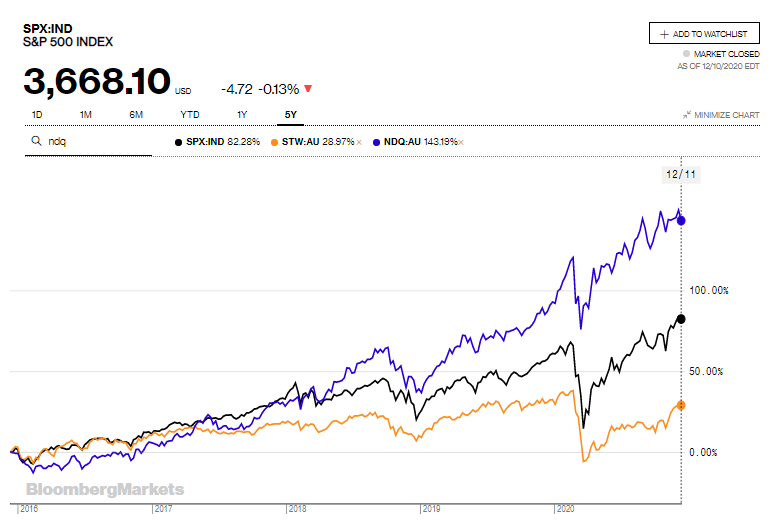

The long term return of the S&P 500 ETF and the Nasdaq ETF against the A200 index

As you can see the Australian ETF that invests in the top 200 companies has continued to struggle against the S&P 500 Index in the U.S.

If we were to add in the Nasdaq ETF you could see that the difference is amazing.

In constructing our portfolios for clients we have been focused on these two indexes for the last 10 years as the dominant component of our models.

The ETF funds Flow for 2020. Where has the money gone?

General Advice warning: The content of this newsletter is for the clients of Best Interest Advice and it’s other related services. The content is general advice only and has not considered your personal situation or objectives and cannot be relied upon. Please consult a financial adviser to provide you with personal advice. We cannot guarantee the accuracy of this information as it is sourced from third parties and general media. All attempts to verify its contents have been made and we only rely on reputable sources.